EU Session Bullet Report

EURUSD has recovered from the recent USD strength and has tested 1.12 during the late US session. There is s significant resistance at 1.1215 followed by 1.1245. Markets will await fresh clues from the German Ifo Business climate and GFK consumer sentiment releases later in the day.

USDCAD posted a new high after Canadian Retail Sales came up at 0.5% versus 0.7% expected. USDCAD reached 1.3360 – levels not seen since 2004. GBPUSD is struggling following the break of key 1.5330 support. The Old lady has fallen as low as 1.5215, with 1.5160 now very possible.

Although we have a strong USD overall, USDJPY was sold off and broke 120.00 after Tokyo markets opened following a 3 day holiday. The last anti-hero was AUDUSD which is on its course to meet 0.6905 – this year’s low after the pair broke the psychological support of 0.70

From US, jobless claims, durable goods and new home sales will be released later in the afternoon.

Trading quote of the day:

“In this business if you’re good, you’re right six times out of ten. You’re never going to be right nine times out of ten.” – Peter Lynch

EURUSD

Pivot: 1.1105

Likely scenario: Long positions above 1.1105 with targets @ 1.1255 & 1.132 in extension.

Alternative scenario: Below 1.1105 look for further downside with 1.102 & 1.097 as targets.

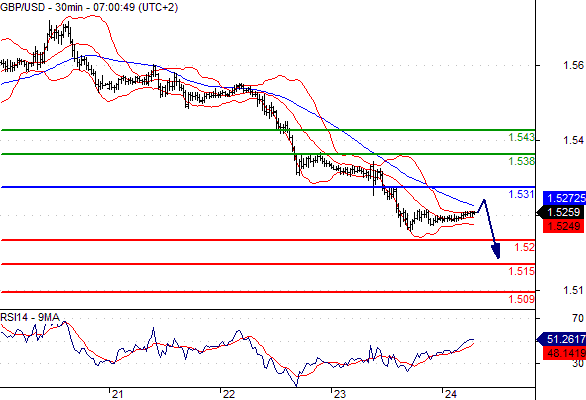

GBPUSD

Pivot: 1.531

Likely scenario: Short positions below 1.531 with targets @ 1.52 & 1.515 in extension.

Alternative scenario: Above 1.531 look for further upside with 1.538 & 1.543 as targets.

Comment: As long as 1.531 is resistance, look for choppy price action with a bearish bias.

AUDUSD

Pivot: 0.706

Likely scenario: Short positions below 0.706 with targets @ 0.697 & 0.694 in extension.

Alternative scenario: Above 0.706 look for further upside with 0.709 & 0.712 as targets.

Comment: The RSI is bearish and calls for further downside.

Leave A Comment