The EUR/USD pair remains on the bids as the latest China trade data reinforced risk-aversion across the financial markets with the Asian equities accelerating losses and thus supporting the demand for the safe-haven in the euro.

However, the gains are restricted in the major as markets now await the ZEW figures from Germany and the Eurozone later this session. Besides, the main currency pair will also track the sentiment on the European indices.

Gold added almost $9 to reach 1164.80 trading well over its support levels on the US holiday. There are several Federal Reserve speakers due today, as traders try to figure out what and when the Fed will act.

The UK will release inflation data for September later on this morning and just as the Bank of England warned last week, we’re expecting no change in prices compared to the same month last year.

Trading quote of the day:

The easiest thing to do is prepare. If you don’t, on behalf of the other market participants, we thank you.

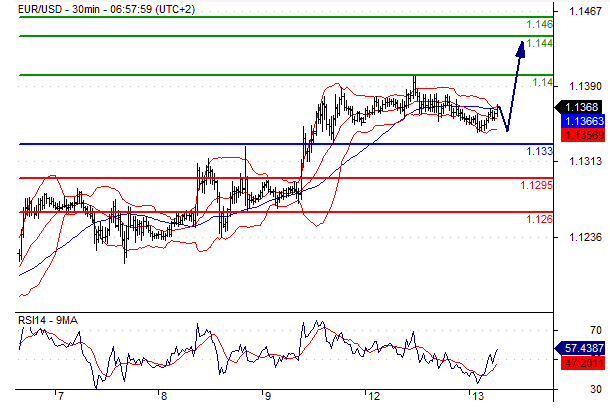

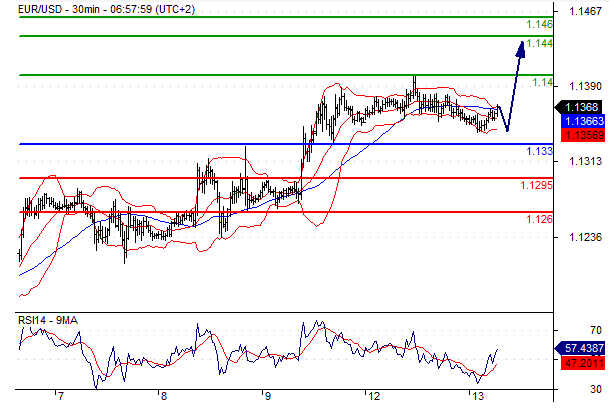

EURUSD

Pivot: 1.133

Likely scenario: Long positions above 1.133 with targets @ 1.14 & 1.144 in extension.

Alternative scenario: Below 1.133 look for further downside with 1.1295 & 1.126 as targets.

Comment: The RSI is mixed to bullish.

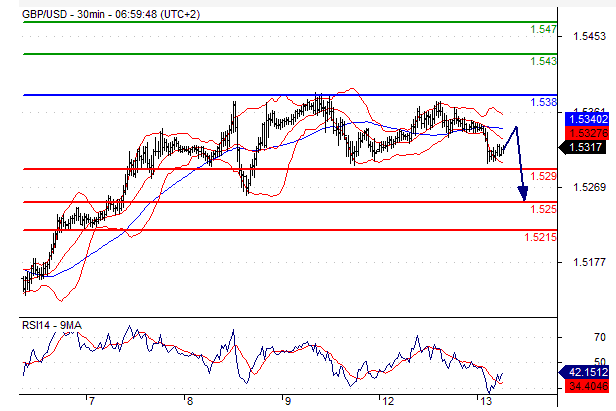

GBPUSD

Pivot: 1.538

Likely scenario: Short positions below 1.538 with targets @ 1.529 & 1.525 in extension.

Alternative scenario: Above 1.538 look for further upside with 1.543 & 1.547 as targets.

Comment: As long as the resistance at 1.538 is not surpassed, the risk of the break below 1.529 remains high.

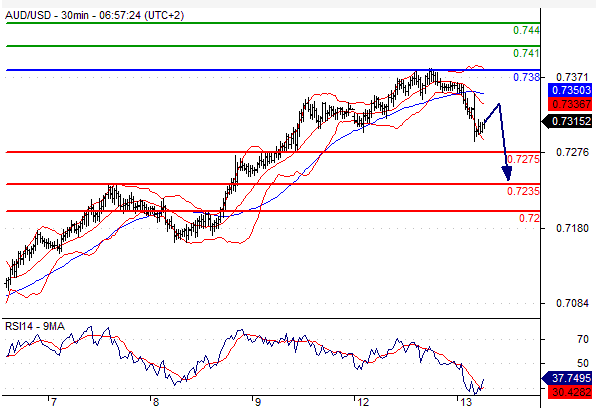

AUDUSD

Pivot: 0.738

Likely scenario: Short positions below 0.738 with targets @ 0.7275 & 0.7235 in extension.

Alternative scenario: Above 0.738 look for further upside with 0.741 & 0.744 as targets.

Comment: The RSI is badly directed.

USDJPY

Pivot: 120.35

Likely scenario: Short positions below 120.35 with targets @ 119.65 & 119.45 in extension.

Alternative scenario: Above 120.35 look for further upside with 120.6 & 120.9 as targets.

Comment: The RSI is badly directed.

Leave A Comment