The oil price continues to slide to 7 year lows as markets fully digest OPEC’s decision on Friday to essentially drop production quota by retaining production at current levels. Noteworthy loser is Brent oil which has shed 9% of its value since the ECB meeting on Thursday. As a result, commodity currencies (CAD, NOK and AUD) where hit hard since then. Overnight, AUD/USD traded weaker despite strong business survey results last month and the JPY held stronger on Tuesday in Asia despite disappointing third quarter growth figures. AUD/USD previously hit a 3.5 month high at 0.7386 before collapsing to 0.7210 levels. Asian Stocks hit 3 week lows as oil prices knocked energy company shares lower. EUR/USD is marginally higher today, testing 1.0860 area. Traders minds will remain on central bank activities including RBNZ, SNB and BoE this week. And more importantly, Fed is generally expected to hike interest rate next week.

Trading quote of the day:

“To be a good trader, you need to trade with your eyes open, recognize real trends and turns, and not waste time or energy on regrets and wishful thinking.”

– Alexander Elder

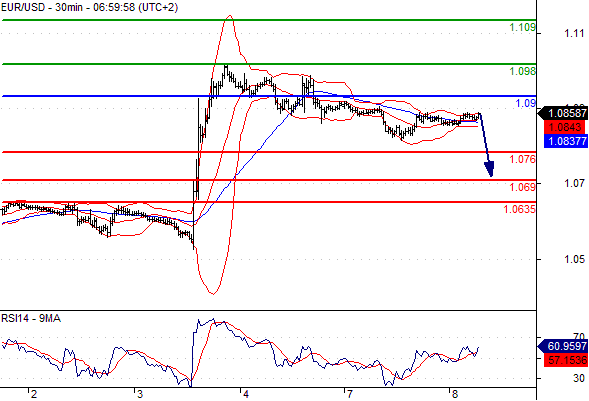

Green lines are resistance, Red lines are support.

EUR/USD

Pivot: 1.09

Likely scenario: short positions below 1.09 with targets @ 1.076 & 1.069 in extension.

Alternative scenario: above 1.09 look for further upside with 1.098 & 1.109 as targets.

Comment: as long as 1.09 is resistance, likely decline to 1.076.

GBP/USD

Pivot: 1.509

Likely scenario: short positions below 1.509 with targets @ 1.5 & 1.4955 in extension.

Alternative scenario: above 1.509 look for further upside with 1.5115 & 1.5155 as targets.

Comment: the RSI is mixed to bearish.

AUD/USD

Pivot: 0.7285

Likely scenario: short positions below 0.7285 with targets @ 0.719 & 0.7165 in extension.

Alternative scenario: above 0.7285 look for further upside with 0.732 & 0.735 as targets.

Comment: the RSI has broken down its 30 level.

Leave A Comment