EU Session Bullet Report

Global stock markets closed the day lower yesterday as anticipation over a December rate hike in the US gathers pace. The prospect of higher borrowing costs and slower economic growth led investors away from riskier assets resulting in a selloff

Currency markets traded in a range with the USD stabalizing following last weeks strong gains. Gold remains under pressure and remains below 1100 whilst crude oil hovers around the $44 mark. Today we have another quiet economic calendar so we can expect more range bound trading driven by technicals.

Trading quote of the day:

If you want to have a better performance than the crowd, you must do things differently from the crowd.

Sir John Templeton

Green lines are resistance, Red lines are support.

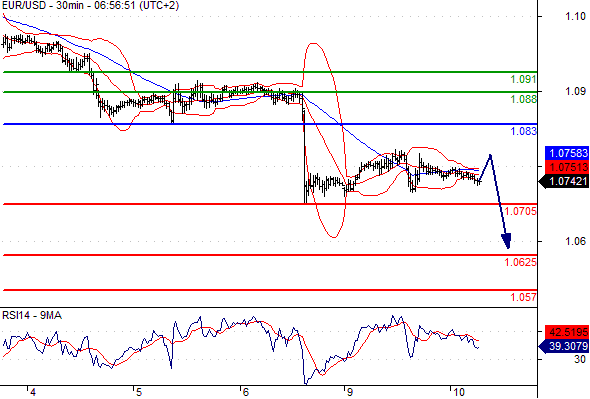

EUR/USD

Pivot: 1.083

Likely scenario: Short positions below 1.083 with targets @ 1.0705 & 1.0625 in extension.

Alternative scenario: Above 1.083 look for further upside with 1.088 & 1.091 as targets.

Comment: As long as 1.083 is resistance, likely decline to 1.0705.

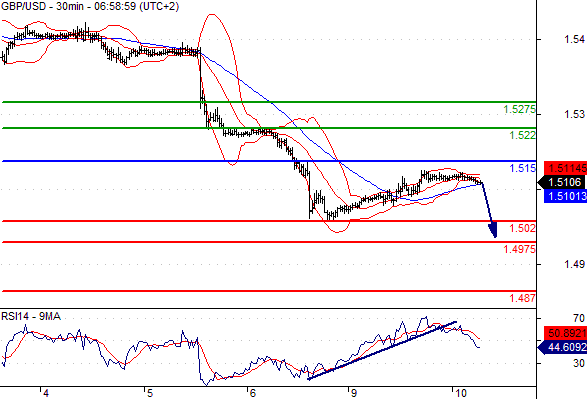

GBP/USD

Pivot: 1.515

Likely scenario: Short positions below 1.515 with targets @ 1.502 & 1.4975 in extension.

Alternative scenario: Above 1.515 look for further upside with 1.522 & 1.5275 as targets.

Comment: The RSI broke below a rising trend line.

AUD/USD

Pivot: 0.709

Likely scenario: Short positions below 0.709 with targets @ 0.702 & 0.6975 in extension.

Alternative scenario: Above 0.709 look for further upside with 0.712 & 0.7175 as targets.

Comment: A break below 0.702 would trigger a drop towards 0.6975.

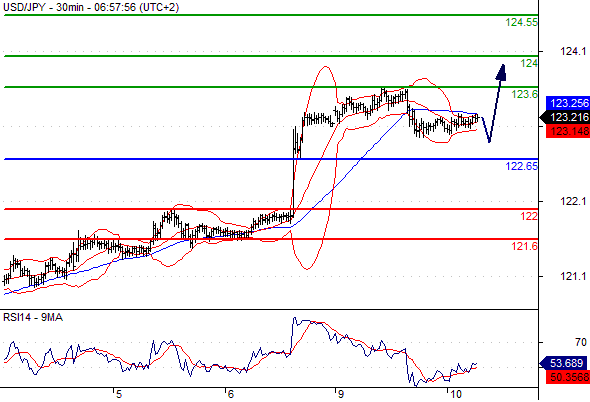

USD/JPY

Pivot: 122.65

Likely scenario: Long positions above 122.65 with targets @ 123.6 & 124 in extension.

Alternative scenario: Below 122.65 look for further downside with 122 & 121.6 as targets.

Comment: Even though a continuation of the consolidation cannot be ruled out, its extent should be limited.

USD/CAD

Pivot: 1.3225

Likely scenario: Long positions above 1.3225 with targets @ 1.332 & 1.3355 in extension.

Alternative scenario: Below 1.3225 look for further downside with 1.318 & 1.3135 as targets.

Comment: Even though a continuation of the consolidation cannot be ruled out, its extent should be limited.

Leave A Comment