The day today and last night is dominated by USD bulls. EUR/USD posed new 7 month lows at 1.0660 while oil briefly touched $40 – also a 2, 5 month low. AUD/USD painted a different picture though, since RBA minutes helped the pair recover briefly above 0.71 before sending the pair back to 0.7085. Risk Sentiment returned after the Paris attacks in what seemed like a short lived shock – at least on the financial markets.

Gold, while initially jumping to 1098 from 1083 after the Paris attacks, was sold off in the last two days with the yellow metal at 1077 at time of writing. This is the last level of support and a break will signify the lowest price since 6 years.

Ahead today, we have UK CPI Report and ZEW economic survey in the EU. On the monetary policy front, the market will listen to what ECB’s Lautenschlager and Fed’s Tarullo have to say about what may be in store at the upcoming ECB and Fed meetings in December.

Quote of the day:

“Success consists of going from failure to failure without loss of enthusiasm.”

– Winston Churchill

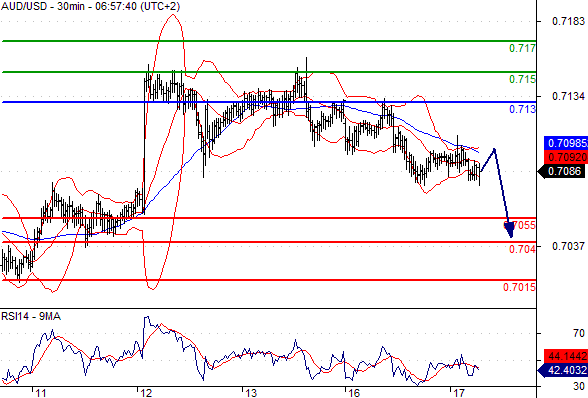

Green lines are resistance, Red lines are support.

EUR/USD

Pivot: 1.0725

Likely scenario: Short positions below 1.0725 with targets @ 1.0625 & 1.06 in extension.

Alternative scenario: Above 1.0725 look for further upside with 1.077 & 1.083 as targets.

Comment: The RSI is mixed to bearish.

GBP/USD

Pivot: 1.524

Likely scenario: Short positions below 1.524 with targets @ 1.514 & 1.5095 in extension.

Alternative scenario: Above 1.524 look for further upside with 1.5275 & 1.531 as targets.

Comment: The RSI is badly directed.

AUD/USD

Pivot: 0.713

Likely scenario: Short positions below 0.713 with targets @ 0.7055 & 0.704 in extension.

Alternative scenario: Above 0.713 look for further upside with 0.715 & 0.717 as targets.

Comment: The RSI is badly directed.

USD/JPY

Pivot: 122.9

Likely scenario: Long positions above 122.9 with targets @ 123.6 & 124 in extension.

Alternative scenario: Below 122.9 look for further downside with 122.6 & 122.35 as targets.

Comment: The RSI is bullish and calls for further upside.

Leave A Comment