It is a very busy week in economic announcements for the market as there are 3 central bank meetings. It all starts with Australia on Tuesday, Canada on Wednesday and the ECB on Thursday together with plenty of economic data with focus on EU inflation on Wednesday and US non-farm payrolls on Friday. On top of this, we have a series of Fed speeches with key focus on Yellen’s speech on Thursday and an OPEC meeting on Friday.

USD is generally very strong with the USD index trading firmly above 100. Overall, the USD is still trading in a tight range as can be seen from EURUSD which has been trading between 1.06 and 1.0570. GOLD staged an impressive drop on Friday, with the shiny metal reaching new 6 year lows at 1052. The next support is at 1042. Market announcements this week will set the tone for the rest of the month.

Trading Quote of the Day: The trend is your friend.

Green lines are resistance, Red lines are support.

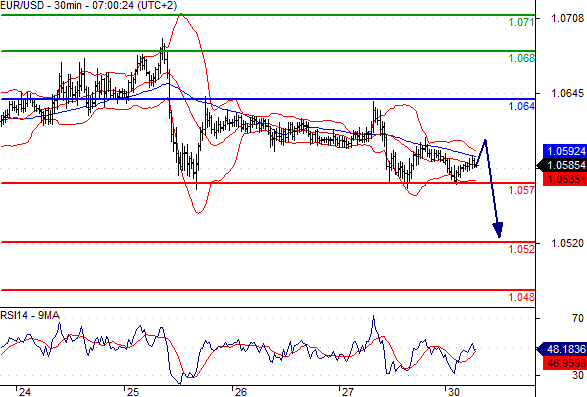

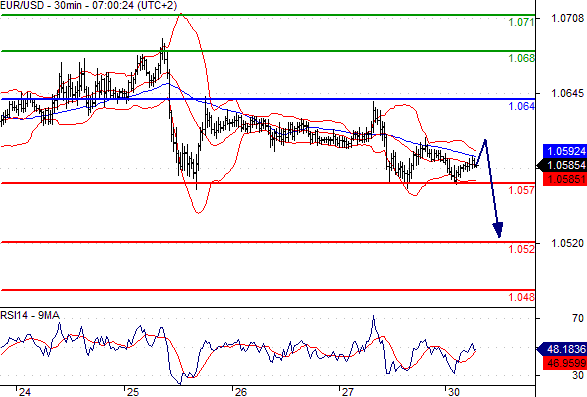

EUR/USD

Pivot: 1.064

Likely scenario: Short positions below 1.064 with targets @ 1.057 & 1.052 in extension.

Alternative scenario: Above 1.064 look for further upside with 1.068 & 1.071 as targets.

Comment: A break below 1.057 would trigger a drop towards 1.052.

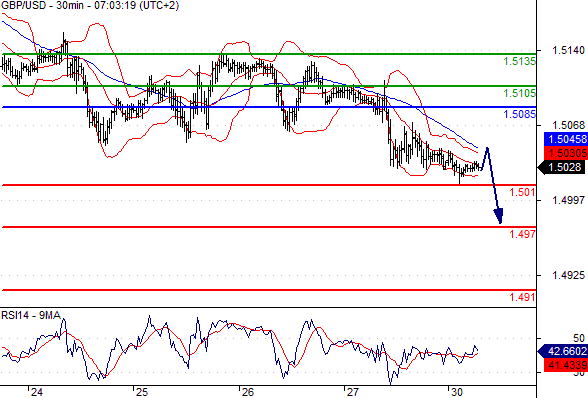

GBP/USD

Pivot: 1.5085

Likely scenario: Short positions below 1.5085 with targets @ 1.501 & 1.497 in extension.

Alternative scenario: Above 1.5085 look for further upside with 1.5105 & 1.5135 as targets.

Comment: The RSI is mixed to bearish.

AUD/USD

Pivot: 0.721

Likely scenario: Short positions below 0.721 with targets @ 0.715 & 0.7135 in extension.

Alternative scenario: Above 0.721 look for further upside with 0.724 & 0.726 as targets.

Comment: As long as 0.721 is resistance, look for choppy price action with a bearish bias.

USD/JPY

Pivot: 122.5

Likely scenario: Long positions above 122.5 with targets @ 122.95 & 123.05 in extension.

Alternative scenario: Below 122.5 look for further downside with 122.25 & 122 as targets.

Comment: Even though a continuation of the consolidation cannot be ruled out, its extent should be limited.

Leave A Comment