EU Session Bullet Report

USD is trading stable against all pairs ahead of the long awaited NFP report today. Last week, Janet Yellen said that “if the incoming information supports that expectation then our statement indicates that December would be a live possibility” in regards to raising interest rates for the first time in a decade. NFP data should support the view or not. Currently there is a 58% probability that the FED will raise rates in December but that can all change depending on the news this afternoon.

Economists expect the report to show 180k jobs created in the US in October, up from last month’s 142k. Prior employment data this week, suggest for a strong report today.

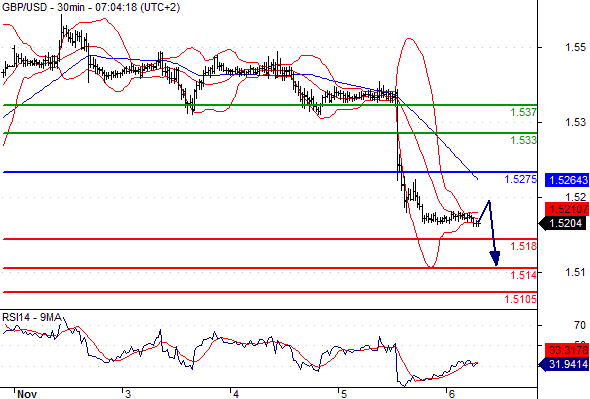

Yesterday the GBPUSD was the weakest currency, and is currently posting new lows at 1.5188. BoE forecasted a lower growth and inflation target, despite upbeat economic data lately in the UK.

On the data front, Germany will release industrial production. UK will release industrial and manufacturing production and trade balance. US will release NFP and Canada will release both employment and building permits.

Trading Quote of the Day:

“In investing, what is comfortable is rarely profitable.” – Robert Arnott

Green lines are resistance, Red lines are support.

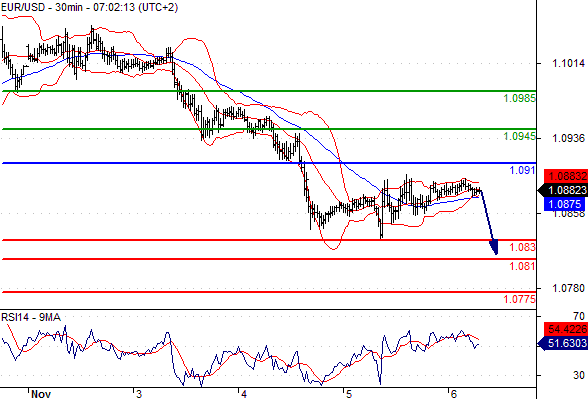

EUR/USD

Pivot: 1.091

Likely scenario: Short positions below 1.091 with targets @ 1.083 & 1.081 in extension.

Alternative scenario: Above 1.091 look for further upside with 1.0945 & 1.0985 as targets.

Comment: As long as the resistance at 1.091 is not surpassed, the risk of the break below 1.083 remains high.

GBP/USD

Pivot: 1.5275

Likely scenario: Short positions below 1.5275 with targets @ 1.518 & 1.514 in extension.

Alternative scenario: Above 1.5275 look for further upside with 1.533 & 1.537 as targets.

Comment: The RSI is mixed to bearish.

AUD/USD

Pivot: 0.7175

Likely scenario: Short positions below 0.7175 with targets @ 0.712 & 0.709 in extension.

Alternative scenario: Above 0.7175 look for further upside with 0.72 & 0.7225 as targets.

Comment: As long as the resistance at 0.7175 is not surpassed, the risk of the break below 0.712 remains high.

Leave A Comment