The euro maintained a bid throughout the North American session leading some traders to wonder if we’ve finally seen a bottom. Its difficult to say as ECB President Draghi could easily talk the currency down on Tuesday by highlighting all of the reasons why policy needs to remain extremely accommodative but if there weren’t a speech on the horizon, we would say that euro is poised for a move to 1.1700 and higher. Aside from Draghi’s speech, Q3 GDP reports are scheduled for release from Germany and the Eurozone along with the latest ZEW surveys and slightly firmer euro supportive numbers are expected all around. The loonie, on the other hand appears poised for further losses as NAFTA concerns grow. The 5th round of talks are being held in Mexico City this week and if you recall, the talks were very contentious during the fourth round. On a fundamental and technical basis, we believe the Canadian dollar will trade lower this week.

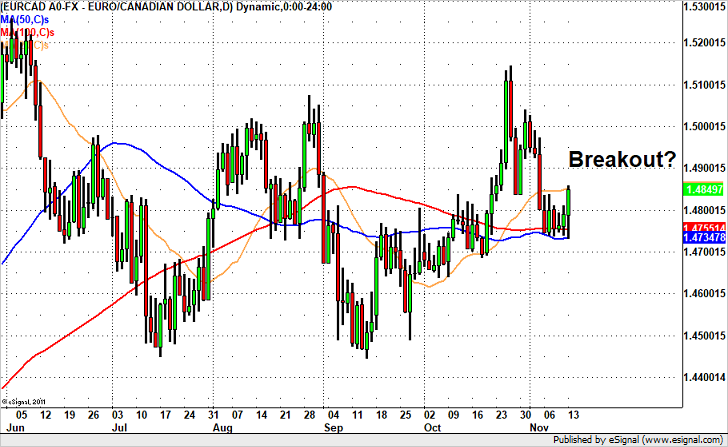

Technically, after consolidating for 5 straight days, Monday’s rally in EURCAD has taken the pair right to the 20-day SMA. While this may be a potential area of resistance, EUR/CAD breakouts tend to have strong continuation. If the pair breaks above 1.4875, taking out today’s high, we could see the rally extend as high as 1.50. There’s firm support near 1.4730, as that’s where recent lows and the 100/200-day SMAs hover.

Leave A Comment