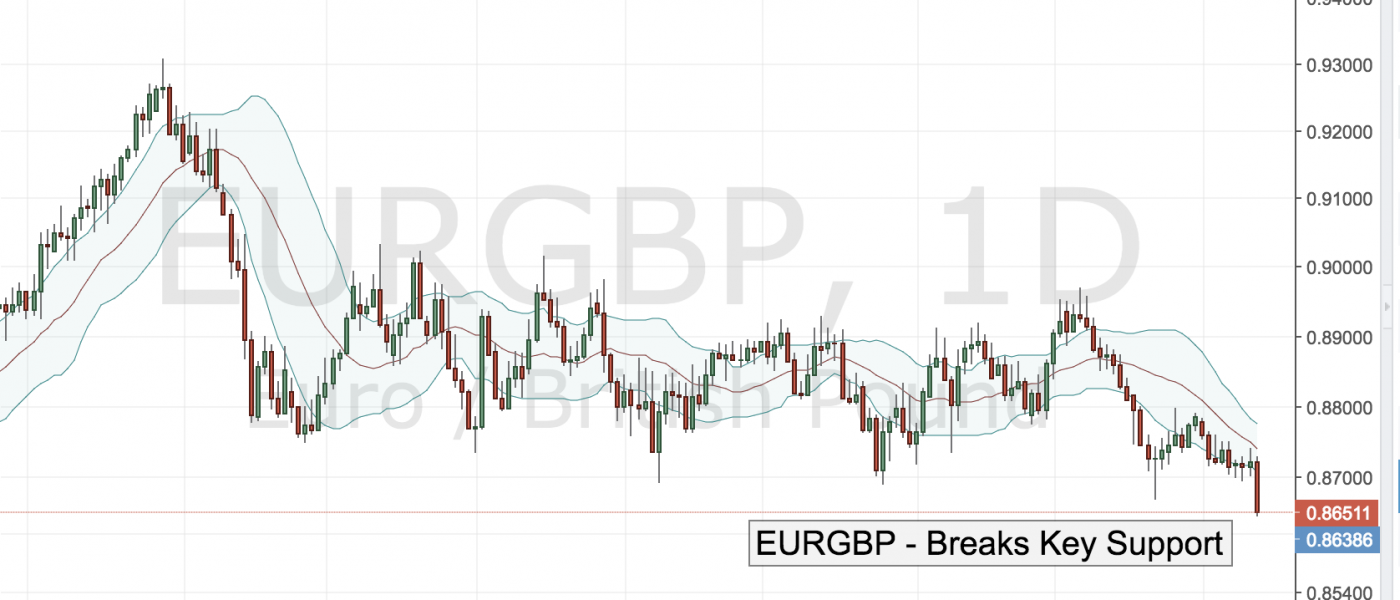

After more than a year EUR/GBP broke below the key.8600 support level which more of an indication of market’s disappointment in the ECB policy than its an overall bullish call on cable. Recent data from the region has consistently hinted that economic growth may have peaked and as we noted today, “EZ IP contracted by -0.8% versus 0.1% eyed in further evidence that growth in the region may have peaked. This puts the ECB in a precarious position as the central bank prepares for a taper of QE just as economic conditions may have deteriorated. This is likely to prevent the ECB from considering any normalization process for the foreseeable future regardless of how much the hawks on the council press for it.”

This view was borne out by the dovish ECB minutes which suggested that the council intends to keep rates at zero for the foreseeable future even as it proceeds with the taper. All of this dovish news helped push EUR/GBP to its lowest level in more than a year, but whether the pair remains below .8700 will be contingent on UK politics and monetary policy. If anything UK economy is in worse shape the EU’s and any rate hike by the BoE could only exacerbate the slowdown. Combine that with the fact that Brexit negotiations are still stuck on the Irish border issue and the EUR/GBP break could well be a fakeout that traps eager shorts trying to ride the momentum.

Leave A Comment