One of the biggest stories this past week was European Central Bank President Mario Draghi’s post monetary policy meeting comments. They sent the euro tumbling against the U.S. dollar because Draghi was not nearly as optimistic as the changes in the policy statement suggests. The central bank head emphasized the need for policy accommodation, the downside risks related to global factors, the strong euro and protectionist threats.

The ECB lowered their 2019 inflation forecast as Draghi warned that underlying inflation remains subdued, “victory hasn’t been declared” and therefore “ECB policy will continue to be reactive.” Taking all of this into consideration, the ECB is telling us that while they are more confident in the economy, they don’t plan to taper quickly. For this reason, we believe that euro will underperform other major currencies in the coming week and we expect further losses against sterling. There’s absolutely nothing on the UK calendar and data hasn’t been that terrible — service sector activity accelerated and while the trade deficit expanded slightly, industrial production rebounded at the start of the year. If ris appetite improves we should see sterling outperform the euro.

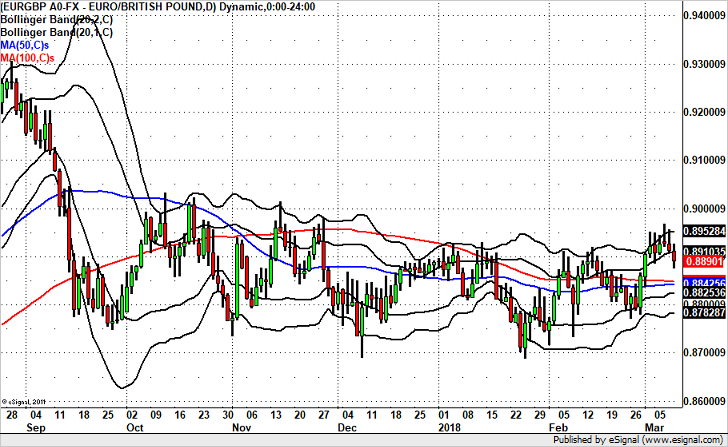

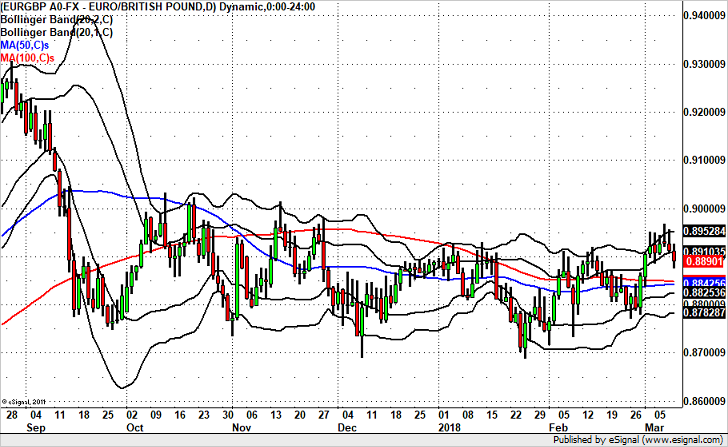

Technically, we’ve seen 3 days of lower highs and lower lows in EUR/GBP. This move took the currency pair below the first standard deviation Bollinger Band. There’s a lot of support near .8845, but we believe that the sell-off could extend to .8800.

Leave A Comment