The worst performing currency today was the euro, which fell sharply against all of the major currencies. Chancellor Merkel failed to secure a coalition after weeks of contentious negotiations and the talks collapsed over the weekend when the Free Democrats walked out. Investors interpreted the political uncertainty as euro negative and rightfully so because Merkel could lose power after serving as Chancellor for the past 12 years. As the largest country in the Eurozone however its troubles will have a direct impact on the currency.

The Chancellor has said she would prefer to hold new elections than form a minority government that could face its own set of troubles. Unfortunately calling new elections is a complicated process that will take months. Forming a minority government or convincing the FDP to return the negotiation table won’t be easy either, which is why we believe that Germany’s political troubles could send EUR/USD below 1.17. Meanwhile the only currency that outperformed the greenback today was sterling, which traded purely on the hope that there will be progress on Brexit talks this week. Prime Minister May is expected to officially increase Britain’s divorce payment. There’s been talk that they could double the initially proposed amount in an effort to unlock the talks but nothing official has been announced. The latest reports suggest that May would receive approval to increase her offer to about EUR40 billion. Although this falls short of the EUR60 billion bill and may not end up satisfying the European Union, the announcement could provide another boost to sterling.

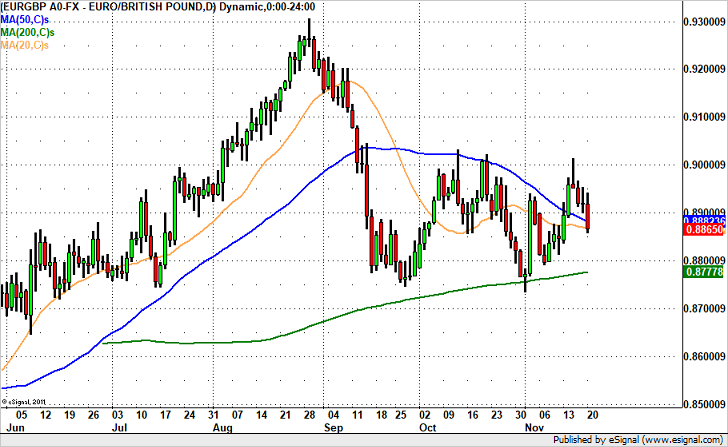

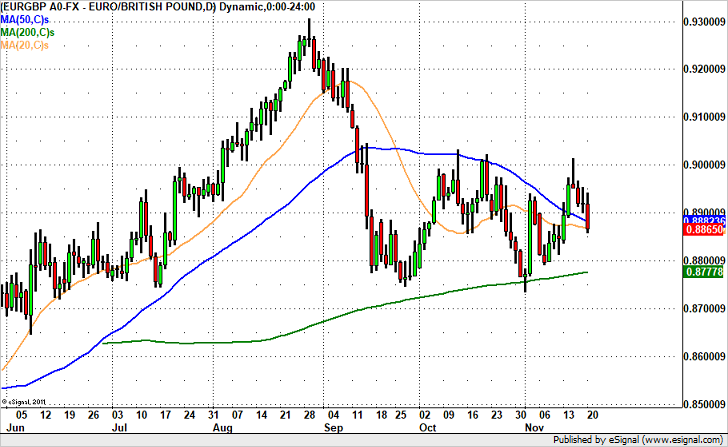

Technically, EUR/GBP broke below the 50-day SMA but has found some temporary support at the 20-daySSMA. We don’t think this will last as the pair is likely to extend its losses down to the 200-day SMA at .8780.

Leave A Comment