EUR/JPY Daily

Chart Created Using TradingView

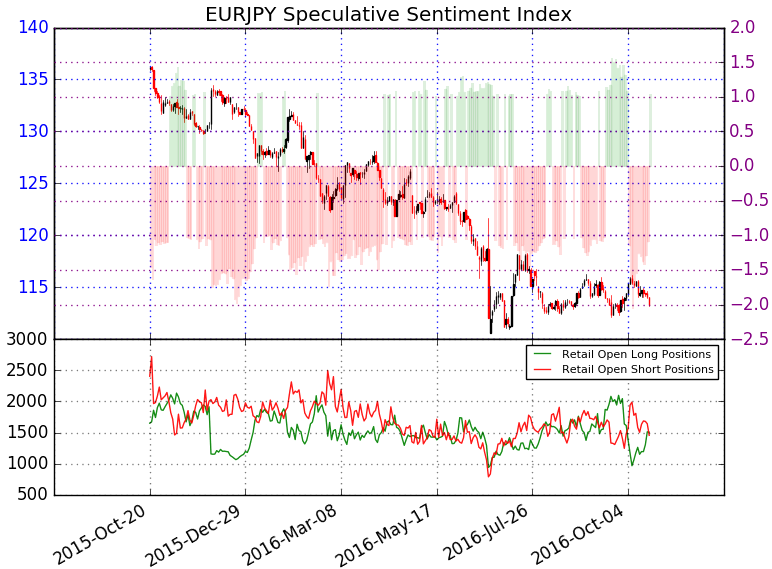

Technical Outlook: EURJPY has been in consolidation since the June 24th Brexit sell-off with the pair now eyeing key confluence support after reversing off yearly trendline resistance earlier in the month. The support zone extends into the September low-day close at 112.26– a break below this key region shifts the focus to the July low at 110.82 and 2016 low at 109.21.

Heading into tomorrow’s highly anticipated European Central Bank (ECB) rate decision, the short-bias is at risk as the pair approaches this support zone with key resistance eyed back at the 2016 trendline which converges on the 100-day moving average around 115.05/10. A close above 116.03 would be needed to shift the broader focus back to the long-side.

EUR/JPY 120min

Notes: The pair has been following this embedded slope off the monthly high with the lower parallels highlighting near-term support at 112.98 and 112.60– both areas of interest for exhaustion / possible long-entries. A break below 112.26 keeps the short-bias in focus.

Interim resistance now stands at the monthly open / 61.8% retracement at 113.63/68backed by 114.18 and the upper parallels which converge on the weekly open at 114.46 (near-term bearish invalidation). From a trading standpoint, I would be looking for a reaction down at structural support with a breach of this near-term formation targeting subsequent topside objectives at 115.05 & trendline resistance extending off the July high currently ~115.75. For the complete setup and to continue tracking this trade & more throughout the week- Subscribe to SB Trade Desk.

Relevant Data Releases This Week

Leave A Comment