Hello Fellow Traders. In this technical blog, we’re going to take a quick look at the Elliott Wave charts of EUR/NZD published in members area of the website. We’re going to explain the forecast and Elliott Wave Pattern. Before we take a look at the real market example of Expanded Flat, let’s explain it in a few word.

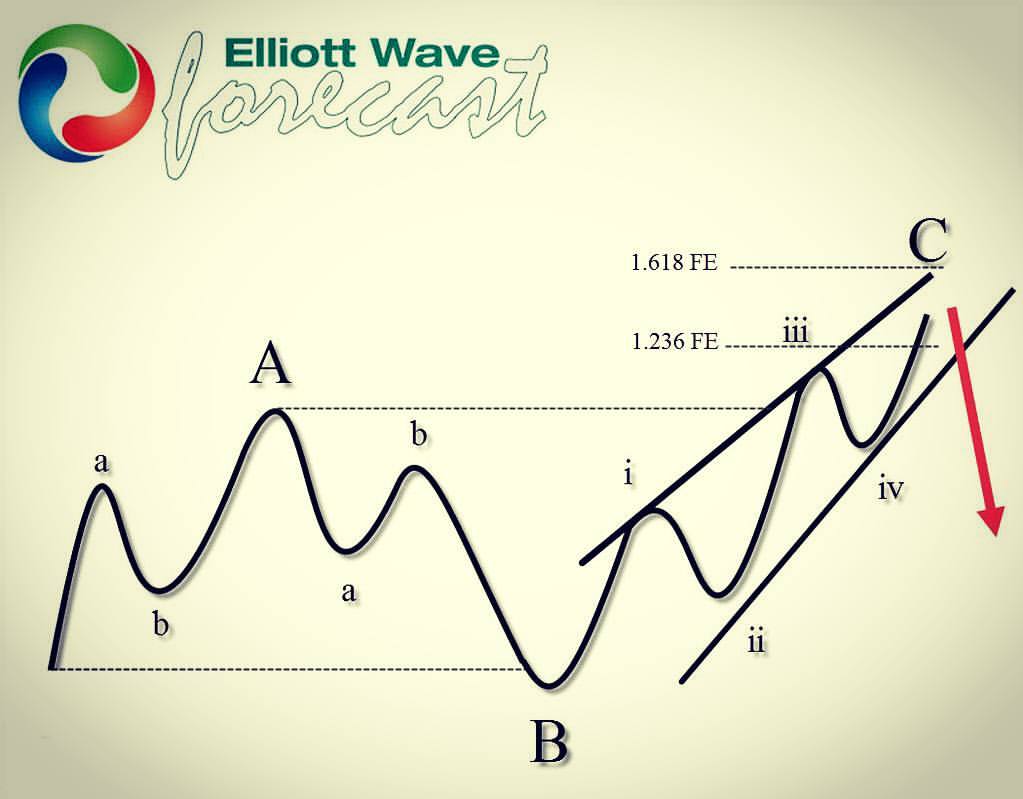

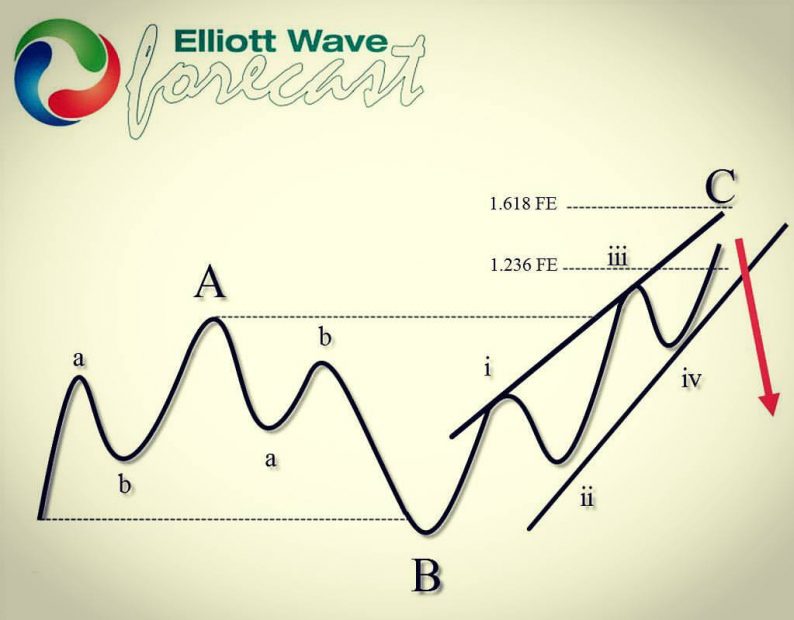

Elliott Wave Expanded Flat is a 3 wave corrective pattern which could often be seen in the market nowadays. Inner subdivision is labeled as A, B, C, with inner 3,3,5 structure. Waves A and B have forms of corrective structures like zigzag, flat, double three or triple three. Third wave C is always 5 waves structure, either motive impulse or ending diagonal pattern. It’s important to notice that in Expanded Flat Pattern wave B completes below the start point of wave A, and wave C ends above the ending point of wave A which makes it Expanded. Wave C of expanded completes usually close to 1.236 Fibonacci extension of A related to B, but sometimes it could go up to 1.618 fibs ext.

At the graphic below, we can see what Expanded Flat structure looks like.

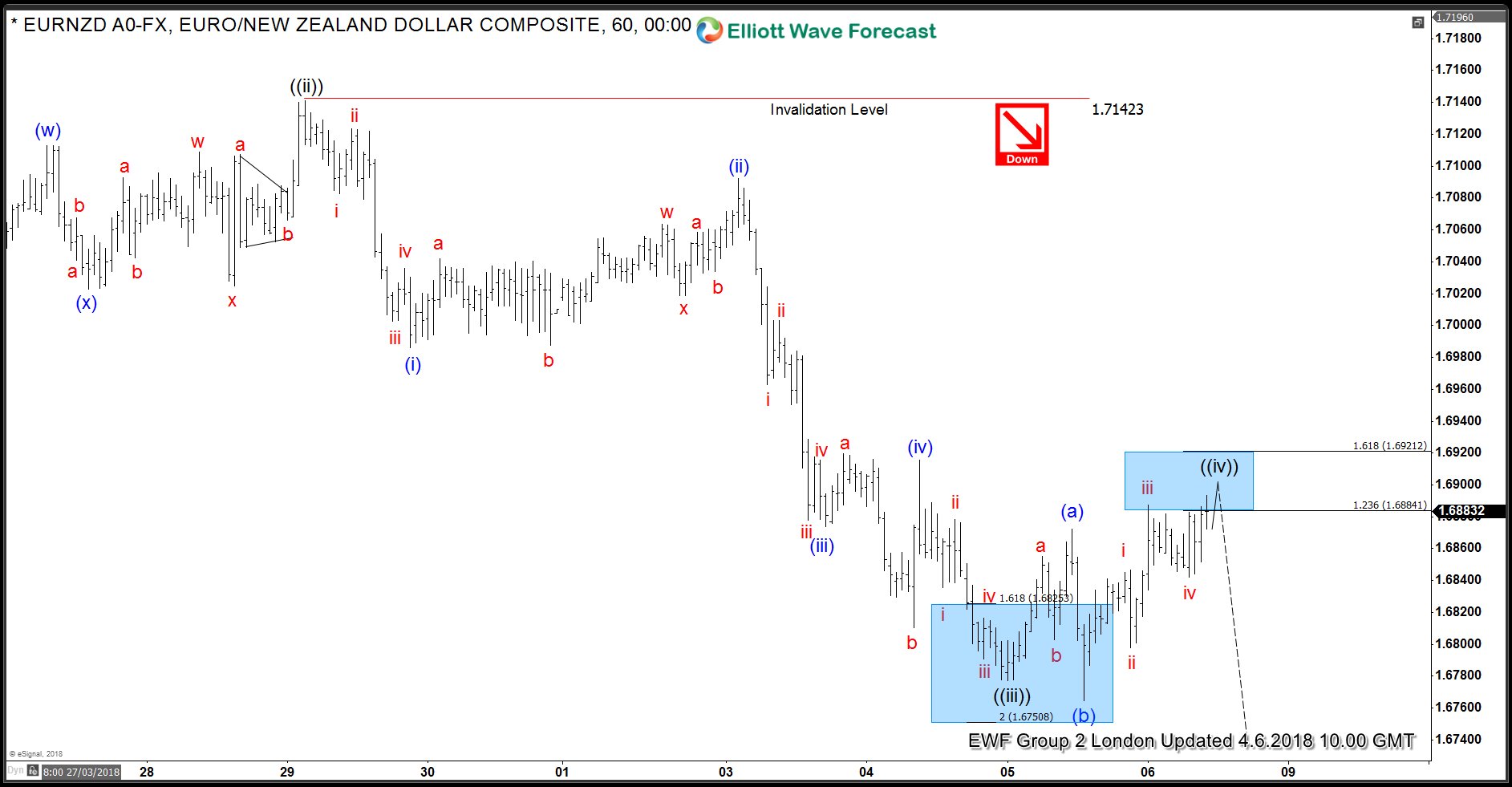

EURNZD Elliott Wave 1 Hour Chart 04.06.2018

As our members know, we’re labeling short-term cycle from the 1.71645 peak as 5 waves structure. Wave ((ii)) ended at 1.71423 high and now the pair remains is correcting short-term cycle against that peak. As far as proposed pivot stays intact we should ideally see another leg lower in wave ((v)). Currently, wave ((iv)) recovery is in progress. It’s unfolding as Elliott Wave Expanded Flat structure, with inner labeling (a)(b)(c) blue. As we can see wave (b) has broken below the start point of wave (a), while wave (c) has broken above ending point of wave (a) which makes this structure Extended. Currently, the pair is ending wave (c) as 5 waves rally from the low. The pair is expected to find sellers at 1.6884-1.6921 area for another leg lower wave ((v)).

Eventually, EURNZD has found sellers at proposed area: 1.6884-1.6921 and gave us decline in wave ((v)). On April 10th, the pair has made the new low as we expected.

Leave A Comment