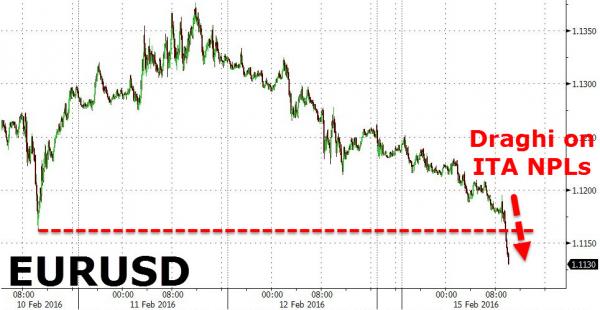

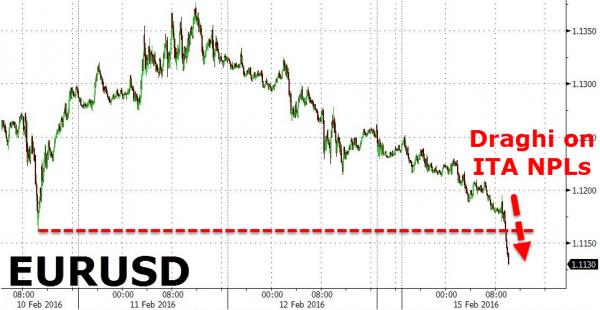

EUR/USD is down over 120 pips this morning and accelerating as Mario Draghi drops all kinds of tapebombs in his Q&A with his Brussels overlords. Most crucially, slamming EUR/USD 70 pips and breaking Wednesday lows, was his admission that while The ECB would “not buy” non-performing Italian bank loans, it would (confirmed by Italy’s Treasury) allow the busted deals as repo collateral (how close to par?) allowing Italian banks to kick the can just a little further.

So to clarify…

But, as Italy’s Treasury confirms, will allow Italian banks to post them as repo collateral (who knows what haircut)

So – to translate – we’ll burden the European taxpayer with all these busted loans, give you cash (probably with no haircut) because all it needs is some time and these loans will all be money good?

Oh and what we are doing with Italy’s NPLs, we will do for all EU nations.

No wonder EUR is dropping…

Is EUR/USD tumbling from this apparent “easing” or from the incredulity of Draghi’s hubris in destroying any semblance of ECB balance sheet strength? Or both?

In other words, we will buy whatever is falling?

Leave A Comment