Out of all the jobs that I am asked to perform every year, predicting what is going to happen for the following year is one of the most difficult. There are a lot of factors that are unknown currently as the central bank actions can often be less than desirable, or a complete surprise. Currently, we have the Federal Reserve looking very likely to raise interest rates, but the charts in the EUR/USD pair are telling a different story on the monthly timeframe.

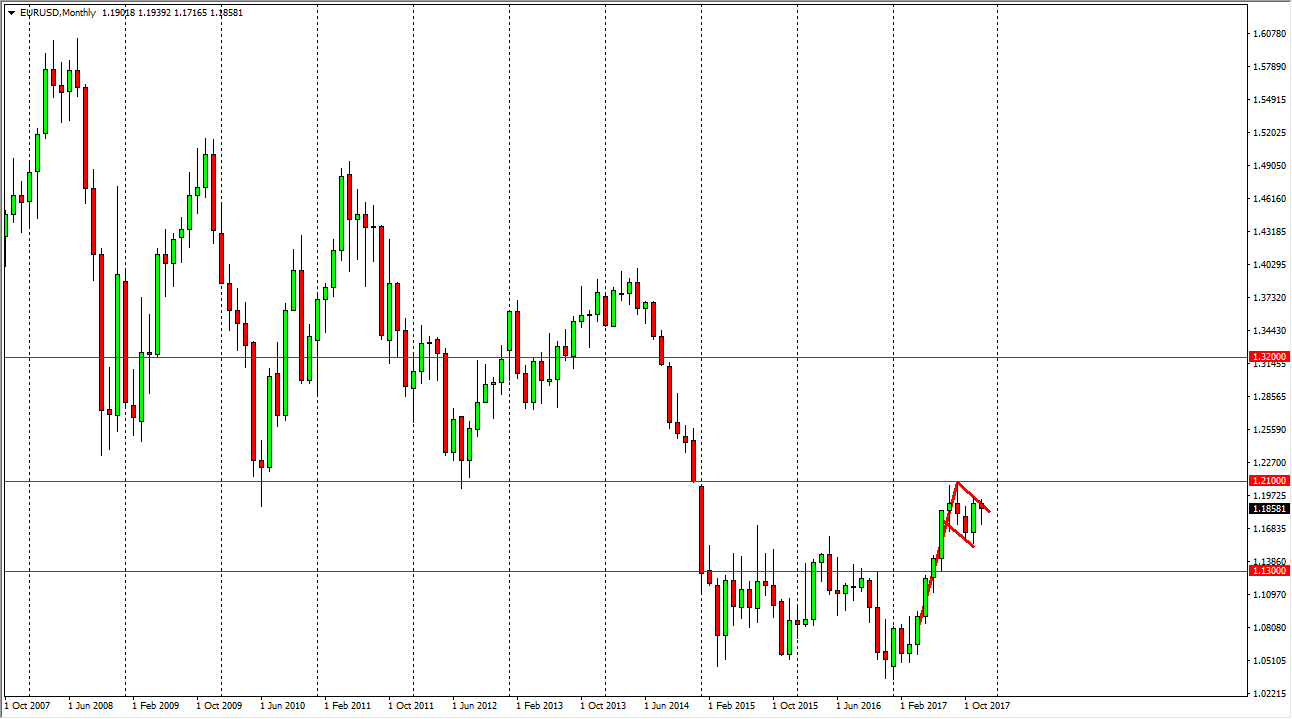

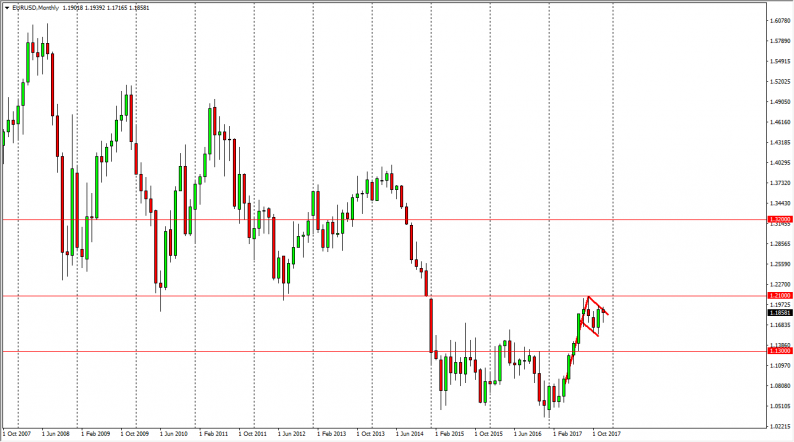

As you can see, I have a bullish flag marked on the monthly chart, and I think this is the tell for 2018. If we break the top of the bullish flag, which we are almost ready to do already, I think that the market continues to go much higher. The flag measures for a move to the 1.32 level that I have marked on the chart, and looking at the overall picture, it does seem to be a reasonable move. I am not sure exactly what will cause this, but clearly if we can break above the 1.21 handle, one would have to think there’s a good chance of the buyers will jump in.

I believe that the 1.15 level is going to continue to offer support, so I suspect that we may have a bit of a grind to break out to the upside, but once we do it’s likely that traders will add to their positions rather rapidly. However, that’s not to say that this is going to be easy. As things stand now, I believe that buying on the dips will probably be the main theme of this pair during the year. Unfortunately, most Forex brokers don’t pay much in the way of swap anymore, or you could get paid to hold currency pairs. That is what has made a short-term trading so much more prevalent these days, as trading for swap is all but nonexistent.

Leave A Comment