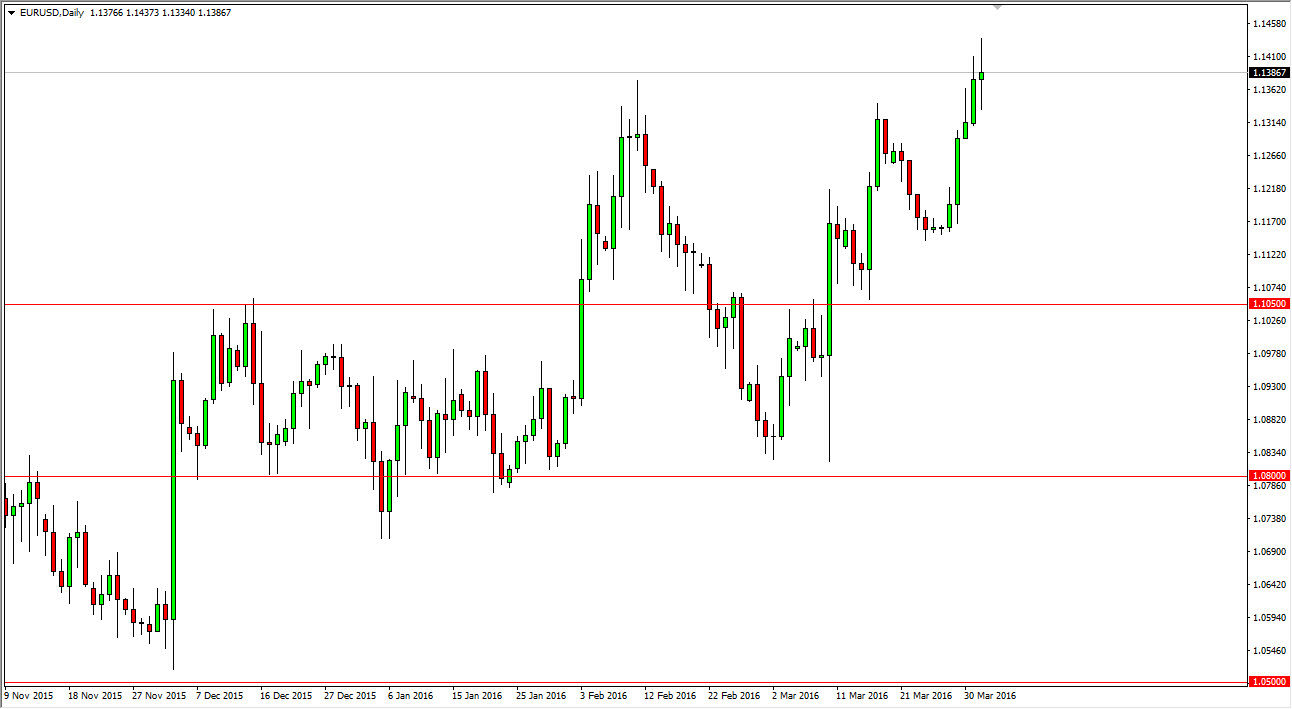

EUR/USD

The EUR/USD pair went back and forth during the course of the day on Friday, in reaction to the nonfarm payroll numbers. This isn’t much of a surprise to me, the jobs number release typically has been pretty much a wash, as it’s quite often a neutral day. However, we are a bit extended at this point and we did break above the 1.14 level, so I think we’re going to see a short-term pullback in order to build up enough momentum to go higher at this point. I believe that eventually the market will try to reach the 1.15 level, which of course has been my longer-term target for some time. However, you’re going to see quite a bit of volatility in a market that features 2 central banks trained to step away from hawkish language.

GBP/USD

The GBP/USD pair fell during the day on Friday, in reaction to the jobs number. Keep in mind that this market has been very range bound for some time, and I essentially look at it as consolidating between the 1.41 level on the bottom, and the 1.44 level on the job. On the chart, I have the 100 day exponential moving average which has been acting as strong dynamic resistance, and we have recently trying to break above it. However, we failed again, so I feel that although we are consolidating, it’s probably easier to short this market on short-term rallies that show signs of exhaustion more than anything else.

We did have a fairly large range for the session, and that tells me that the momentum may be picking up again to the downside. Ultimately, this is a market that has to deal with the Federal Reserve stepping away from a couple of interest-rate hikes this year, which of course is negative for the US dollar. On the other hand, we have to deal with the potential exiting of the United Kingdom from the European Union. That of course will put bearish pressure on the Pound. Because of this, I feel that we just will continue to see massive volatility.

Leave A Comment