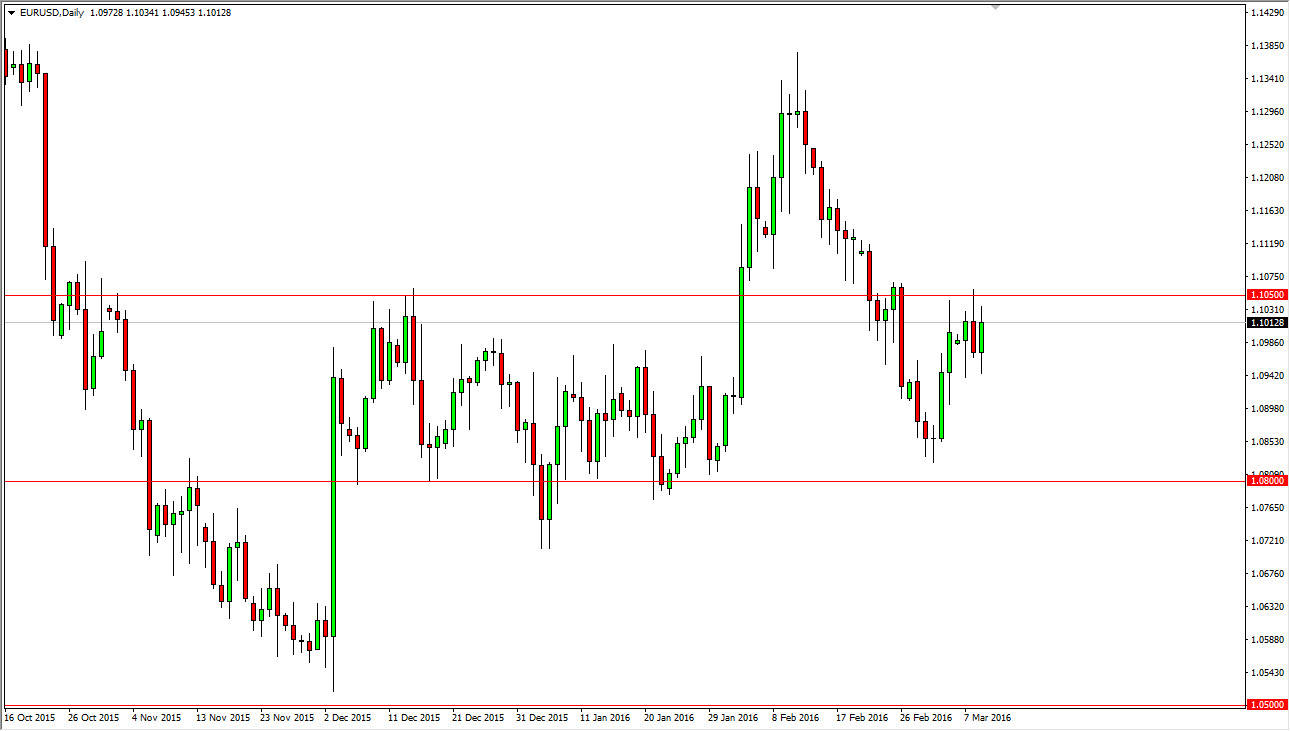

EUR/USD

The EUR/USD pair had a fairly volatile session during the day on Wednesday, but ultimately settled on a slightly positive candle. Thing is though we have a significant announcement coming out today, the ECB has an interest rate decision and more importantly a monetary policy statement. Because of this, you can expect quite a bit of volatility in the Euro overall, and as a result I’m not necessarily looking to trade this market unless it gives me a clear signal. The clear signal I wish to see is a break above the 1.1050 level, which would show a fairly significant amount of strength entering the market. By doing so, that should free the pair to go to the 1.13 handle. On the other hand, if we break down below the bottom of the range for the session on Wednesday, we will more than likely break down and go looking for support closer to the 1.08 level, as we would continue the recent consolidation.

GBP/USD

The GBP/USD pair rose slightly during the course of the day on Wednesday, as we continue to bounce around the 1.42 handle. I’m not necessarily looking for a big move here, but if we do break above the 1.43 level, we will more than likely try to reach towards the 1.45 level given enough time. That will be an easy move, and quite frankly I can think of several other trades out there I would rather be involved in. On the other hand, if we can break down below the bottom of the hammer from the Monday session, I feel that we will probably fall to the 1.40 level fairly quickly.

To be honest, I feel much more comfortable selling this market than buying it, but we need the aforementioned scenario to do so. There is probably going to be a significant amount of volatility in this pair going forward, because of course we have the whole situation about the possibility of the United Kingdom leaving the European Union. Until we have that vote later this year, this pair is probably going to be quite choppy.

Leave A Comment