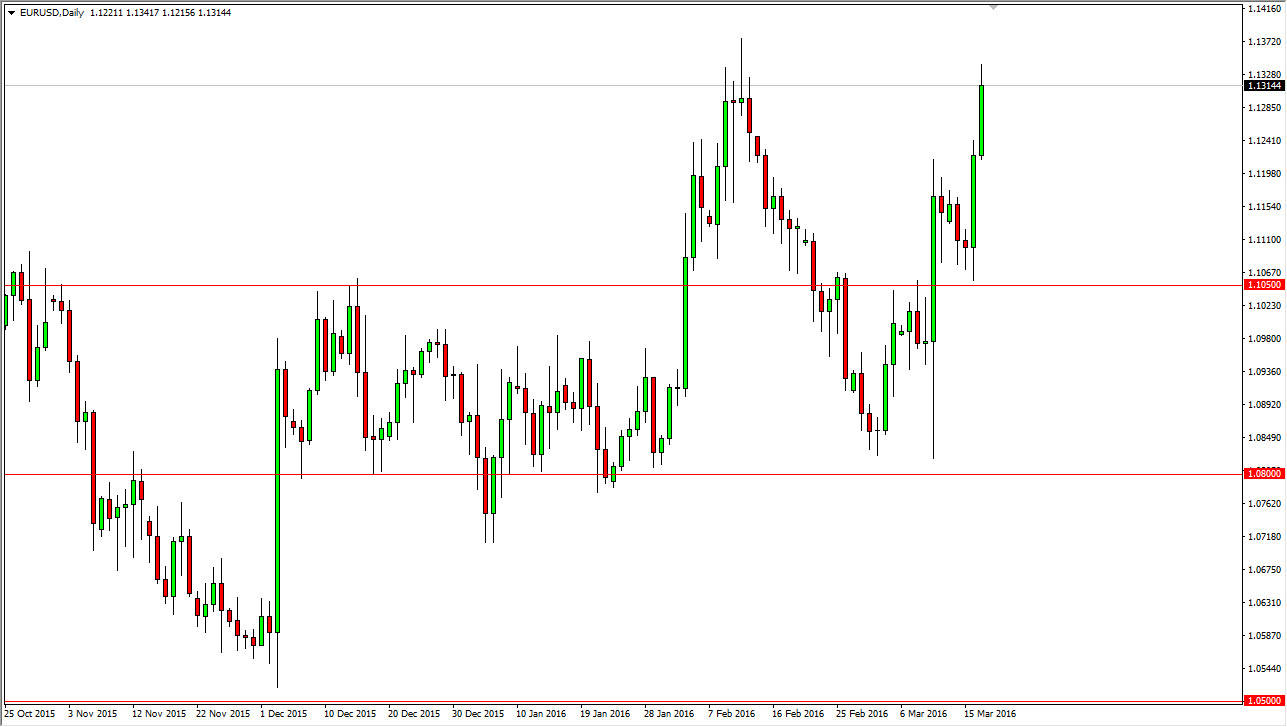

EUR/USD

The EUR/USD pair broke higher during the course of the session on Thursday, as we continue to see quite a bit of bullishness in this pair. We initially pulled back to the 1.1050 level below, and as a result we found buyers step into this market. This is especially true considering that the Federal Reserve has suggested that it is not going to do as many interest-rate hikes this year as it originally anticipated, and as a result it looks as if the US dollar is going to continue to soften in general. That being the case, it makes sense that people will buy the Euro, because it is essentially the “anti-dollar.” With that being said, we should then reach towards the 1.15 level given enough time and we look at pullbacks as potential value that we can take advantage of.

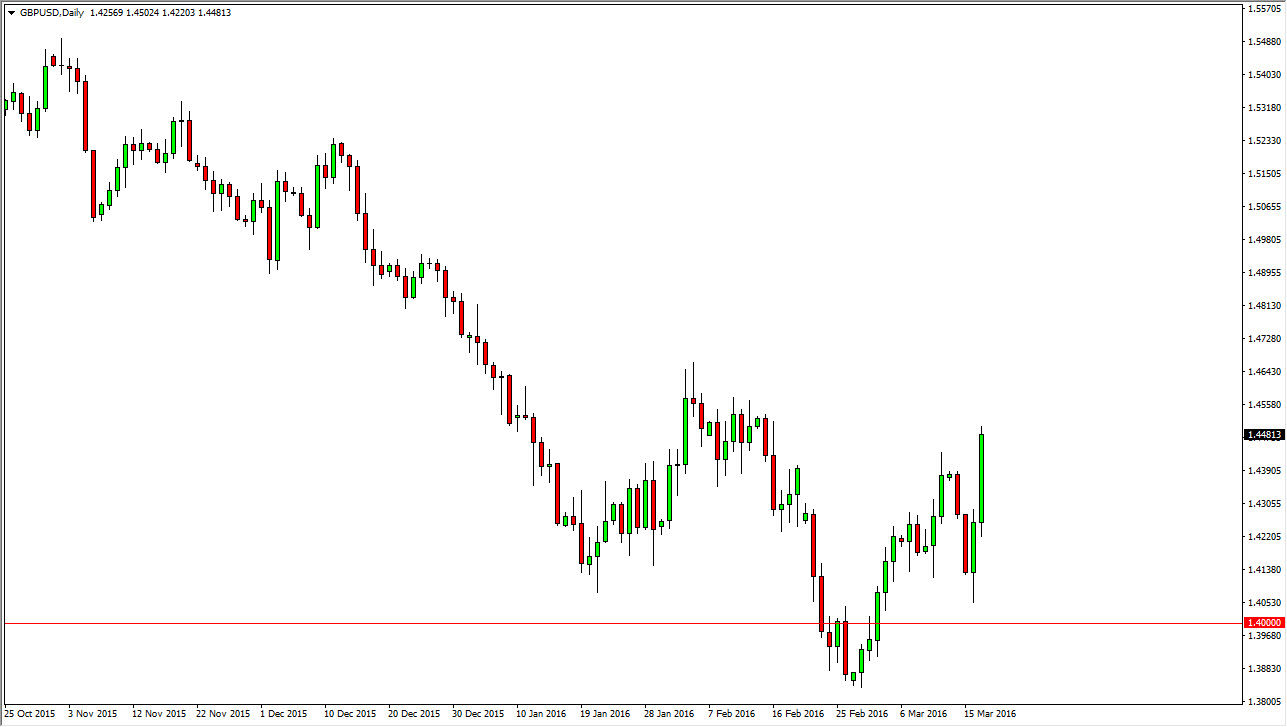

GBP/USD

The GBP/USD pair broke higher during the course of the session on Thursday, testing the 1.45 level. That being the case, the market looks as if it is ready to continue going higher but it’s very likely that we have to pullback to find enough momentum to shoot this market to the upside. Keep in mind though that the United Kingdom may possibly exit the European Union, so there is a little bit of hesitation when it comes to this particular pair. Even though this market should continue to go higher, the reality is that it will probably underperform the EUR/USD pair as an example.

The pair should break out to the upside, but the reality is that we may have a little bit of resistance above that the market needs to deal with. Because of this, we just simply look for short-term pullbacks to take advantage of that answer buying. We have no interest in selling, and believe that it is only a matter of time before we go higher as the market continues to focus on the Federal Reserve and its announcement.

Leave A Comment