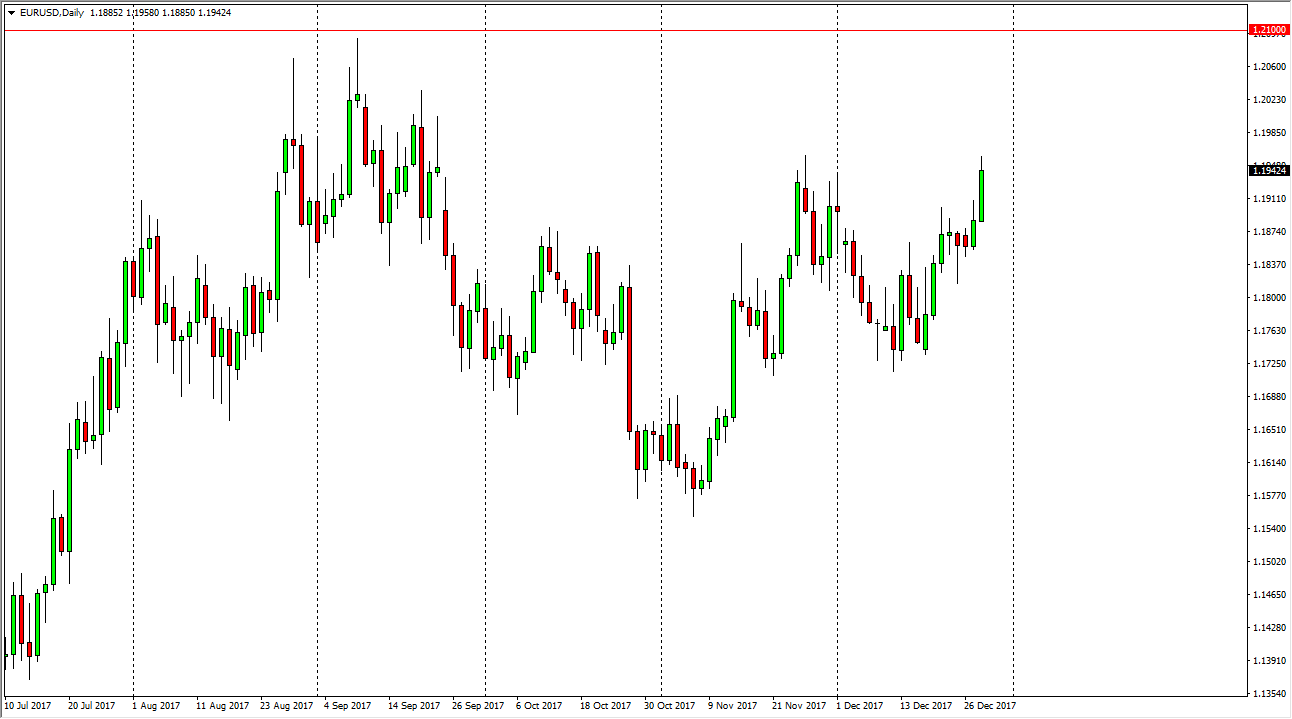

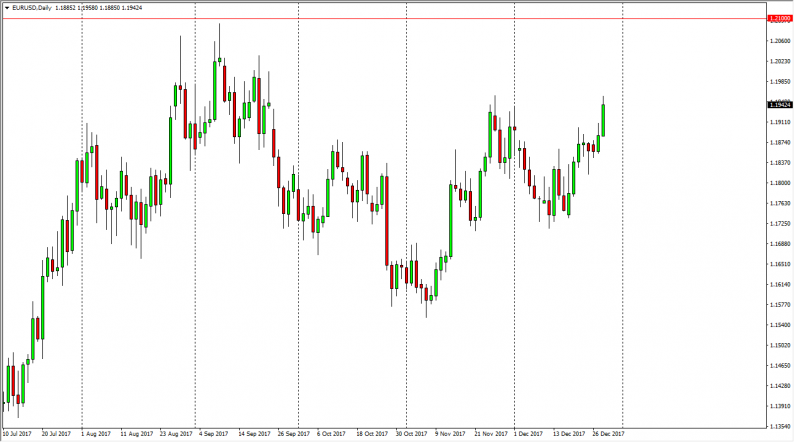

EUR/USD

The EUR/USD pair broke higher during the trading session on Thursday, clearing the 1.19 level. There is a certain amount of resistance near the 1.1950 handle though, so I think we may pull back in the short term. Longer-term, I believe that the market should continue to go higher, perhaps reaching towards the 1.21 level given enough time. I think that every time we pull back, it’s likely that there is a buying opportunity presented itself, but I would be very cautious about jumping in with both feet, and I believe that the thin trading value will continue to make this market difficult, but I do believe that in the end the buyers are getting ready to push this market much higher. I believe 2018 will be a very good year for this pair, but of course headlines and choppiness will return occasionally.

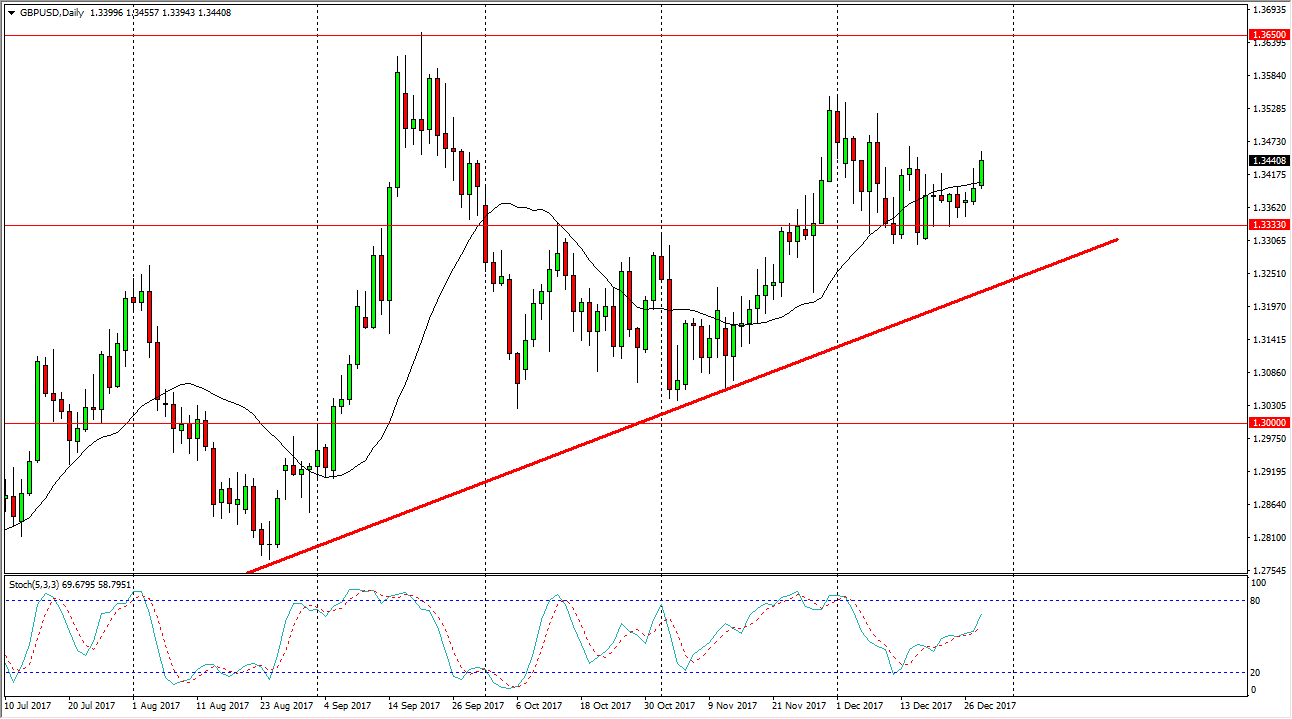

GBP/USD

The British pound rallied during the trading session, breaking above the Wednesday highs during the Thursday bullish session. We have broken above a minor downtrend line, so I think that the market is ready to go higher, but I recognize that the 1.35 level above is resistance, and the short-term target. If we can break above there, the market should then go to the 1.3650 level. A break above that level is a “buy-and-hold” situation just waiting to happen. The uptrend line underneath should offer enough support to keep this market going higher over the longer term, and I do believe that this will be one of the better stories of the year, the rebirth of the British pound as a viable and strong currency. In the meantime, expect a lot of noise and choppiness but I certainly don’t want to sell.

Leave A Comment