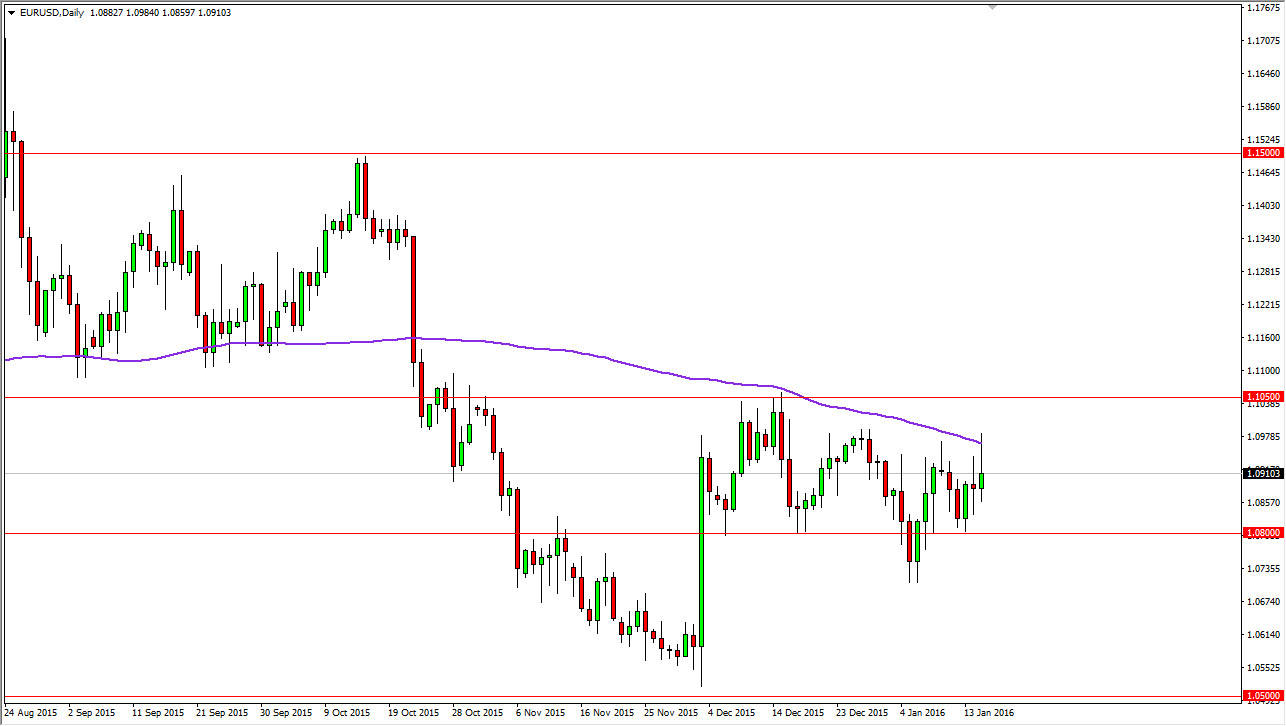

EUR/USD

The EUR/USD pair tried to break out to the upside during the course of the day on Friday, but was turned back around near the 1.10 level. By doing this, we ended up forming a shooting star, which of course is a fairly negative candle. I believe that this market is going to continue to face bearish pressure, as the 100 day exponential moving average has offered quite a bit of resistance and of course the market has been drifting lower overall.

Having said that though, the biggest problem I have with shorting this market at this point in time is the fact that the hammer on the weekly chart was preceded by yet another hammer. With that being the case, I believe that the buyers may make a bit of a stand just below. It’s going to be difficult to trade because of this, so at this point in time I am choosing to stand on the sidelines.

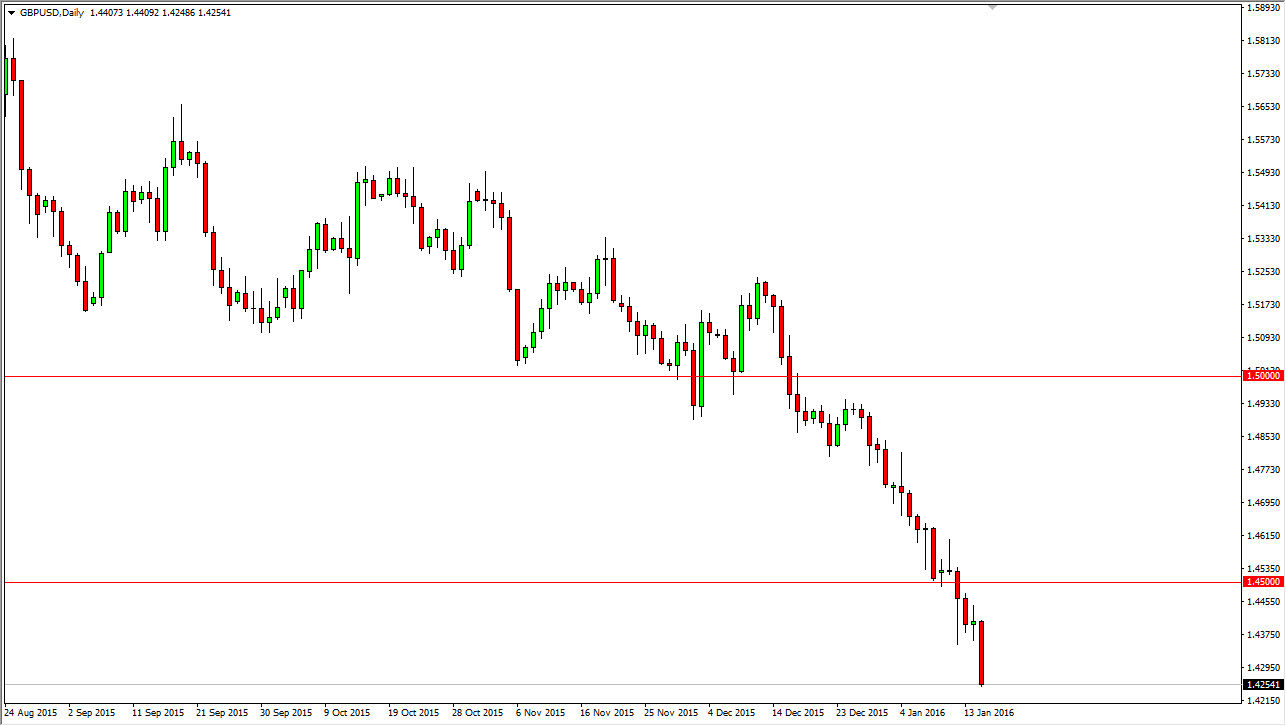

GBP/USD

The GBP/USD pair is a completely different animal though. After all, we broke down rather significantly during the course of the day on Friday, and it looks as if the British pound will continue to go lower as we closed towards the very bottom of the range for the session. That of course normally is a very bearish sign, because not only is it a negative candle, but it also suggests that perhaps we will see continuation of the bearish pressure overall.

Any rally at this point in time should see a bit of selling pressure above, and I believe at this point in time that the 1.45 level is essentially the beginning of the ceiling in this market. I would love to see some type of rally to start selling, but we may not get it right away based upon the fact that we did close the very bottom of the range. I of course am willing to sell a break down below the bottom of the session on Friday as well, so you the way I get this feeling that I will be short of this market today.

Leave A Comment