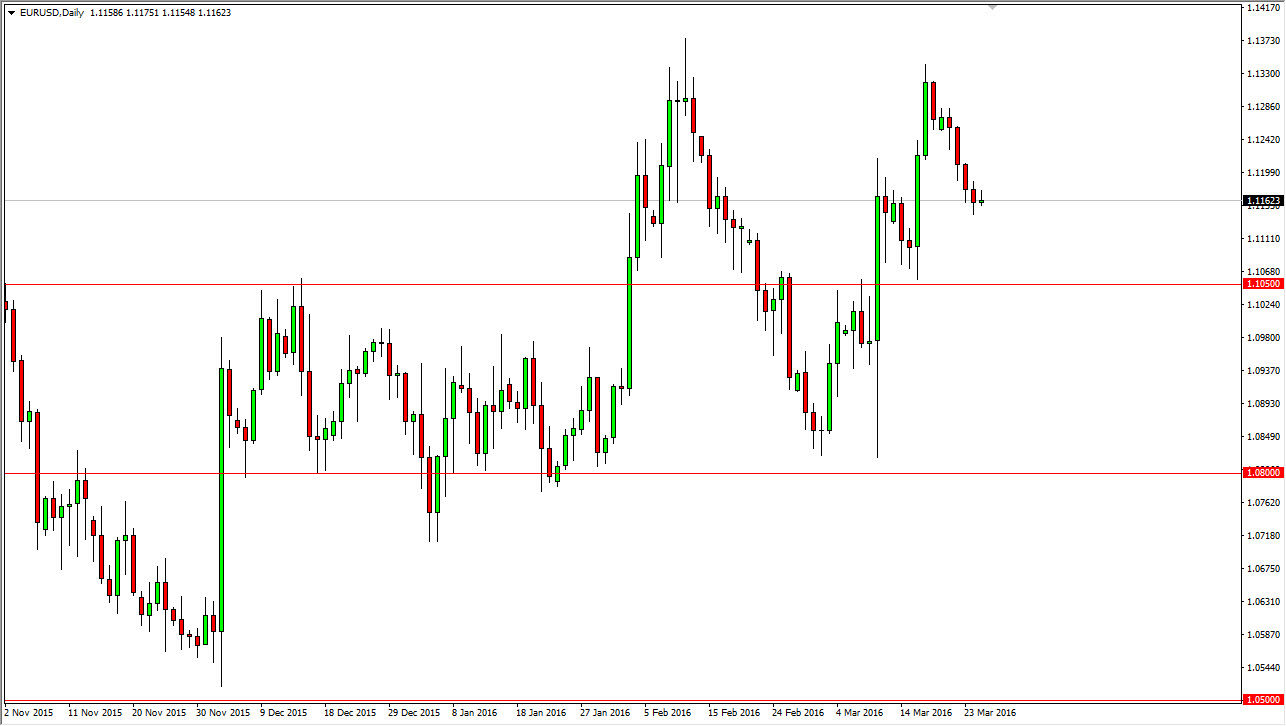

EUR/USD

The EUR/USD pair did very little during the session on Friday, as Christians around the world celebrated Good Friday. This of course meant that there was almost no liquidity. With this, the market didn’t do much but it appears that we are trying to find support somewhere near the 1.1150 level. With this, the market should continue to go higher and break above the top of the range and should send this market looking for the 1.13 level. I don’t have any interest in shorting this market, I believe that there is enough support all the way down to the 1.1050 level that sooner or later we will get a supportive enough looking candle to start buying. I have a longer-term target of 1.15, but it may take a while to get there.

GBP/USD

The GBP/USD pair tried to rally during the course of the session on Friday, but pulled back to form a bit of a shooting star. Ultimately though, if we can break above the top of the range for Thursday I feel that the market will then reach towards the 1.45 level again. If we can break above there, we could go much higher but I feel that we will more than likely stay within this consolidation range as there are a lot of questions out there about the United Kingdom and whether or not it will stay within the European Union when citizens vote this June.

Of course, keep in mind that the Federal Reserve is very dovish all of a sudden, so with this it’s likely that the market will continue to be a very choppy one, as there are a lot of different things pushing these currencies in several different directions. For the foreseeable future, I believe that this market will continue to trade in the range of 1.40 to 1.45 or so.

Leave A Comment