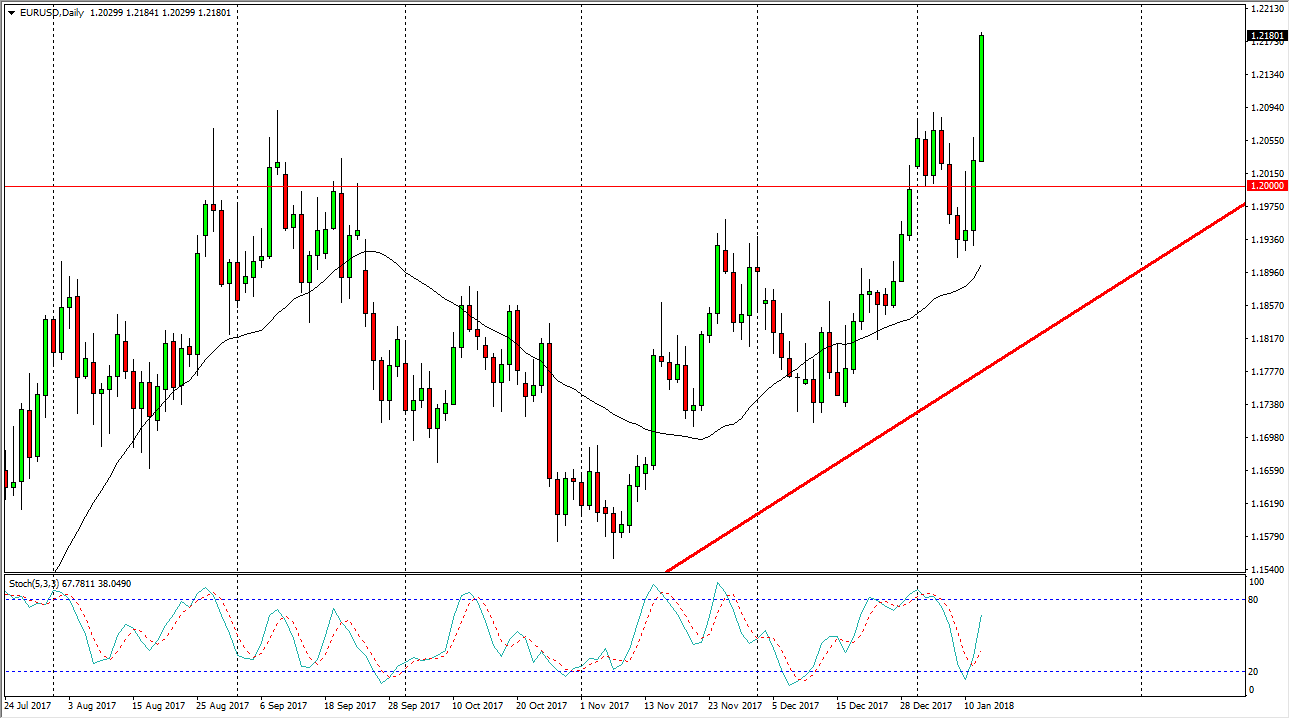

EUR/USD

The EUR/USD pair broke out to the upside significantly, slicing through the 1.21 level, an area that has been vital as of late, offering a significant amount of resistance. This is essentially a “higher high”, signifying that the market is ready to continue the climb. When we pull back from here, I think the 1.20 level underneath is massive support, and based upon the shape of the candle and the fact that we are closing towards the very top of the range, I think that this pair has much further to go. This is a longer-term signal, and I think that the market goes looking towards the 1.25 level given enough time. Dips offer value, and you need to look at those dips as an opportunity to get the Euro “on the cheap.” I have no interest whatsoever in selling this market as it is so bullish.

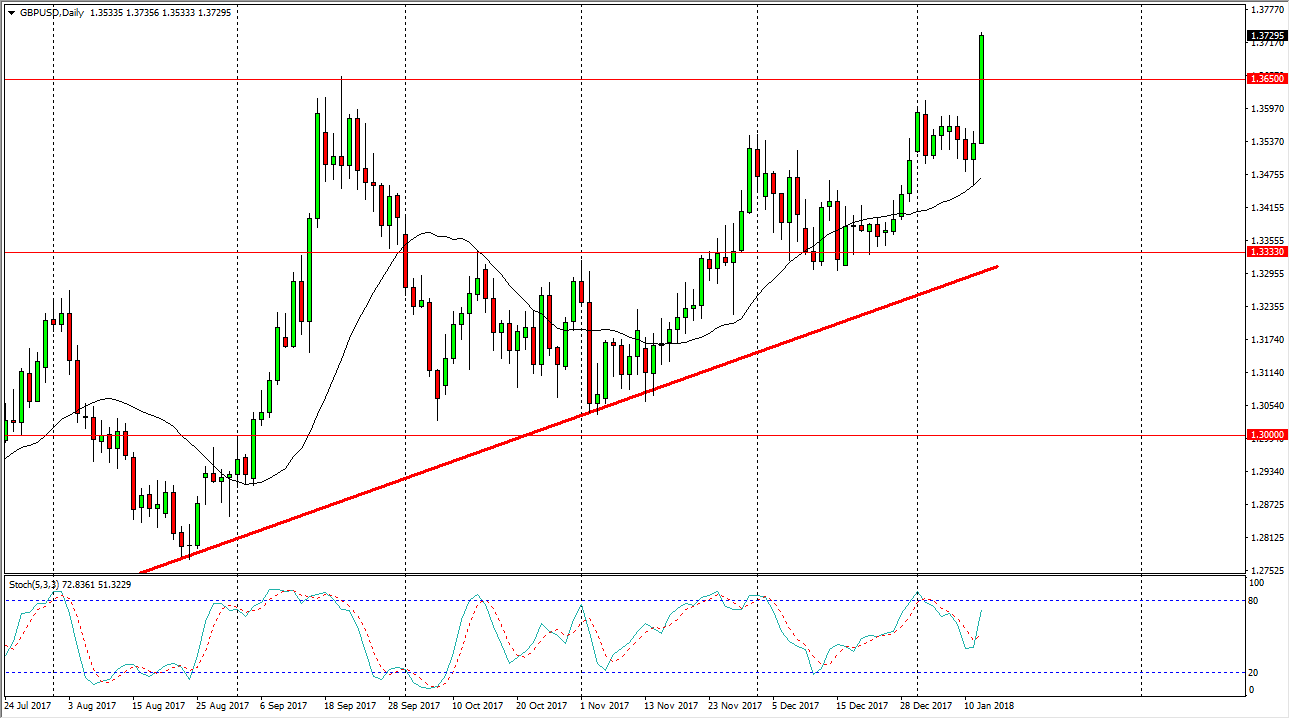

GBP/USD

The British pound broke out to the upside during the day on Friday, slicing through the 1.3650 level, an area that has been vital for a long time, as it was the scene of the gap lower after the vote to leave the European Union. That of course is a very strong sign, and now I think that we are going to continue to go higher, perhaps reaching towards the 1.40 level, and now I think that it becomes a “buy on the dips” scenario, and not only for the short term. I believe that this signifies that we are going to go much higher, but the initial target will probably be the 1.40 level. It’s a large, round, psychologically significant number so a lot of traders will be looking to take profits at that point. Expect volatility, but shorting is all but impossible now.

Leave A Comment