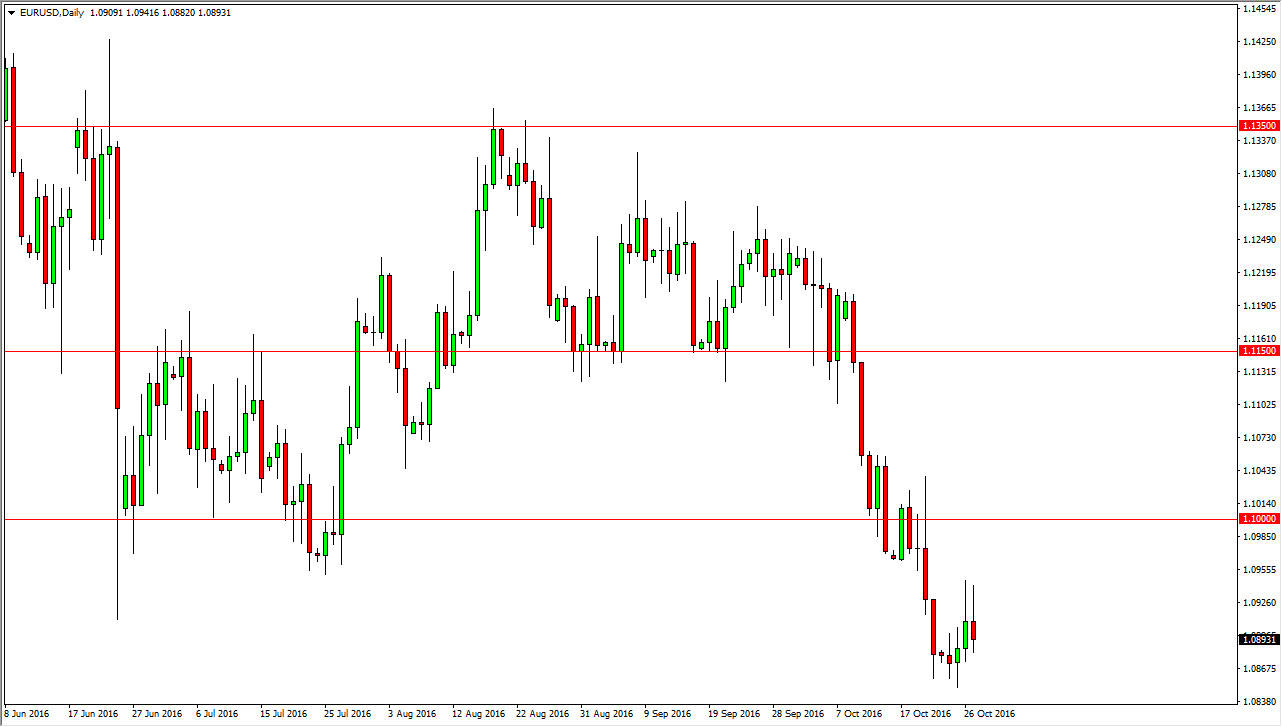

EUR/USD

The EUR/USD pair initially tried to rally during the course of the day on Thursday but turned around to form a bit of a shooting star. Because of this, the market looks as if it is ready to continue to go lower. The 1.0850 level below should continue to be rather supportive, but I do believe that we will break below there given enough time. Any rally at this point in time will more than likely offer selling opportunities based upon the exhaustion above, that we have seen time and time again. I think that the 1.10 level above is massively resistive, and I do think that we eventually go down to the 1.05 level given enough time. With this, I sell rallies again and again, but I do recognize that we will probably have quite a bit of volatility.

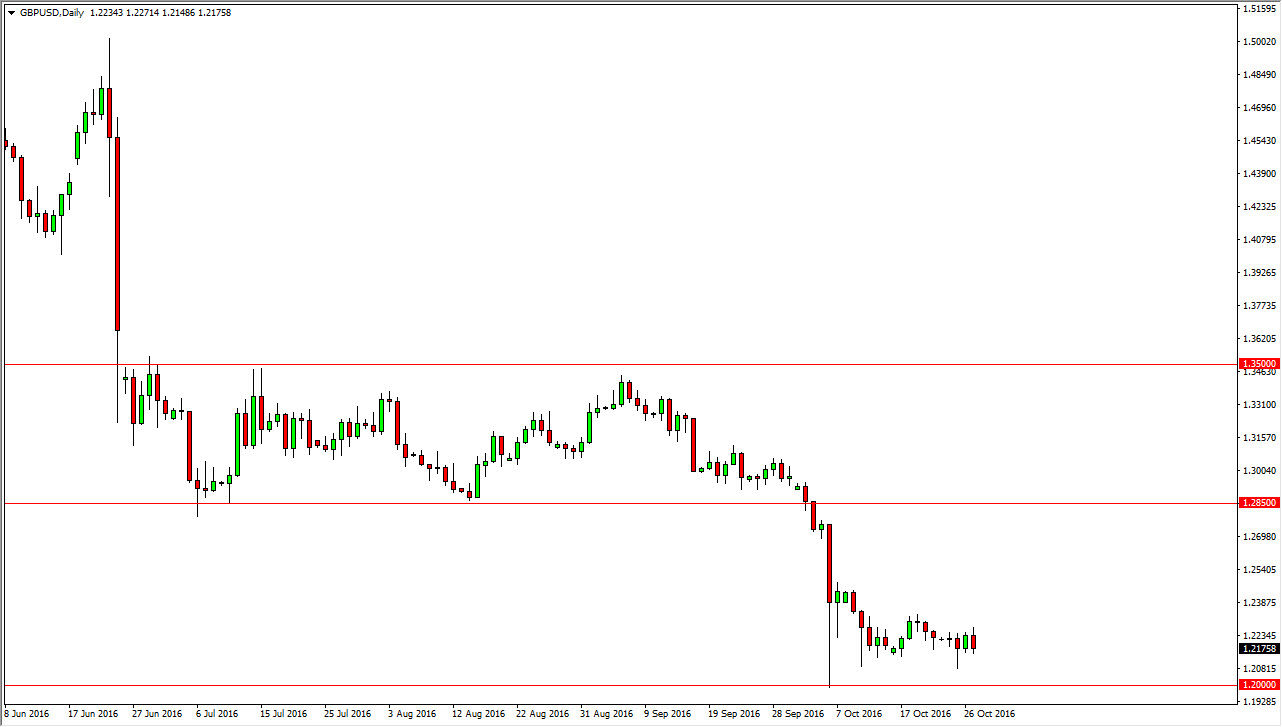

GBP/USD

The British pound tried to rally during the course of the session on Thursday but then turned around to fall initially. That fall was relatively small, though, so having said that I think that we still have to bounce around in order to break down below the 1.20 level underneath. That is the “floor” in this market going forward, and if we can break below there I feel that the market will then reach towards the 1.15 level over the longer term as it was so supportive on the monthly chart. Rally should continue to offer selling opportunities as the currency markets will of course, favor the US dollar but the British pound, especially considering that we have voted to exit the European Union recently, and that of course, works against the value of the British pound as well.

Even if we do rally significantly from here, I feel that the 1.2850 level above is essentially the ceiling and that we will not be able to go above there anytime soon.

Leave A Comment