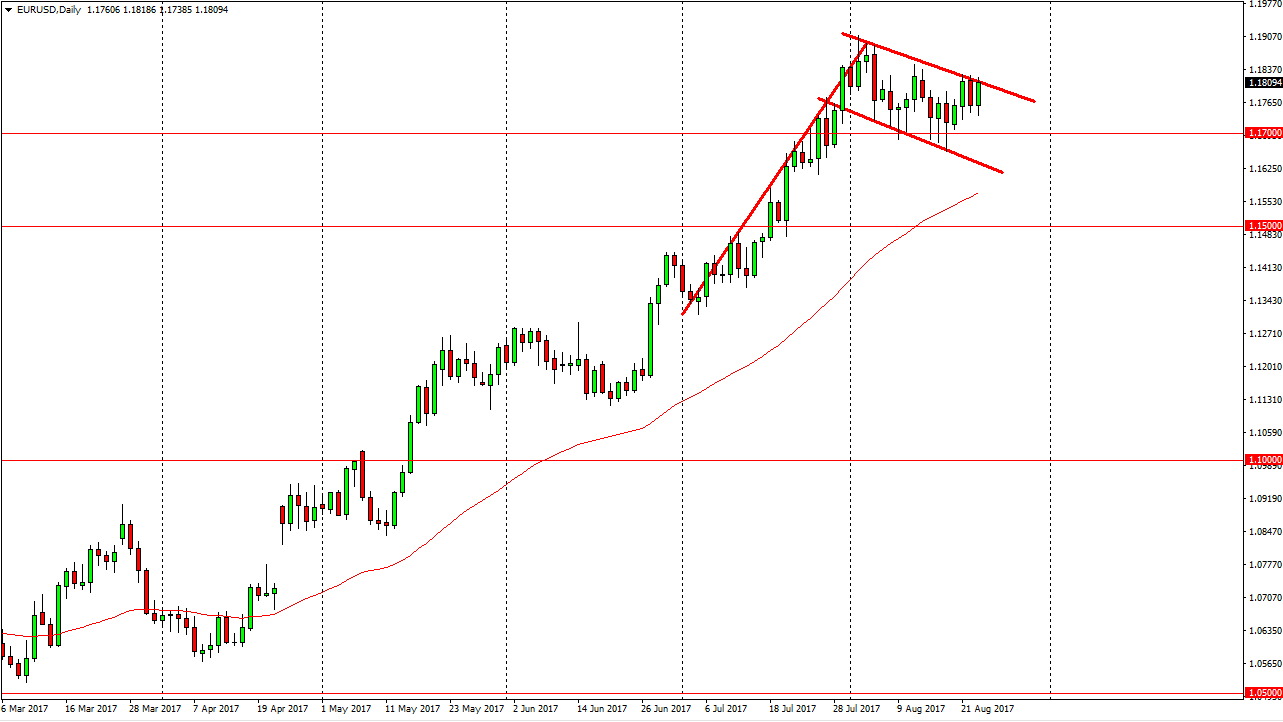

EUR/USD

The EUR/USD pair rallied on Wednesday, as the 1.17 level looks to be supportive yet again. Also, we got decent industrial production numbers coming out of the EU, so that of course helps the value of the currency as well. Ultimately, Mario Draghi didn’t say much about the currency itself, so that gave traders a little bit of relief. With this, I believe that short-term pullbacks continue to be buying opportunities, but most importantly, you can see that I have a bullish flag drawn out on the chart as well. I think that if we can break above the top of the range for the day, this pair should continue to go much higher, with a move that measures to roughly 1.24 above. Ultimately, I think that this market is in an uptrend, so buying short-term pullbacks should continue to be the way forward.

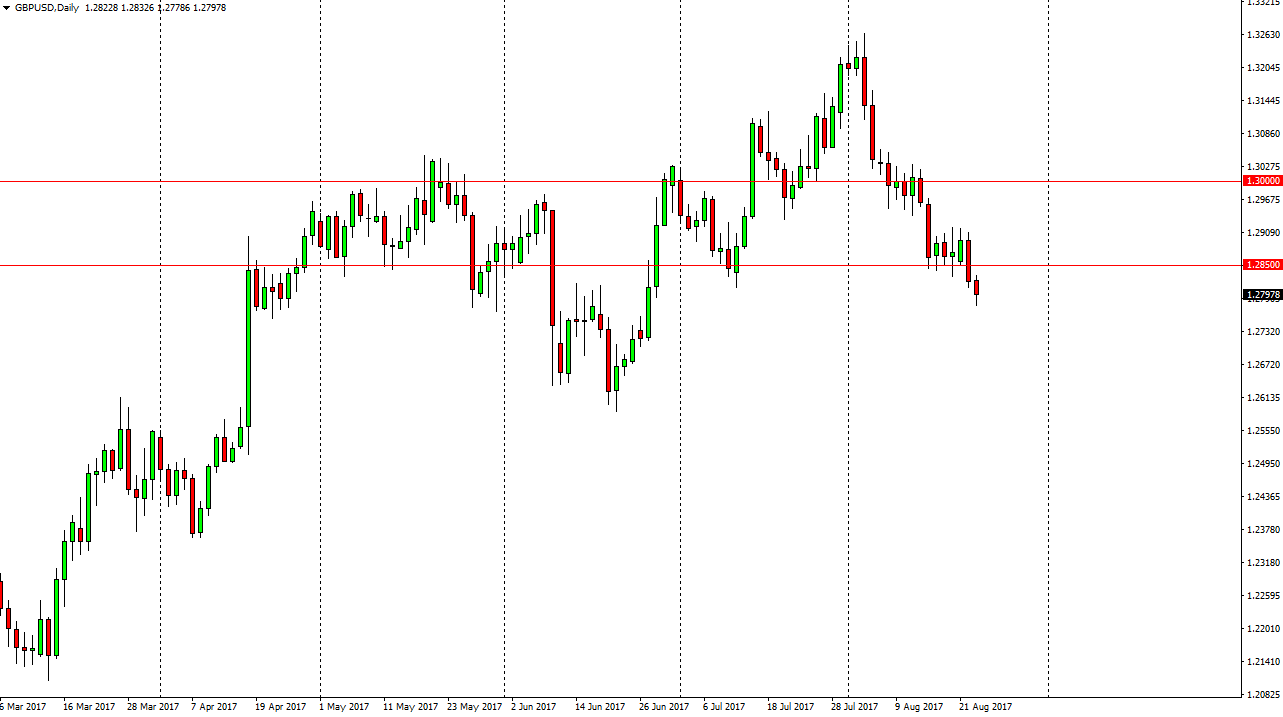

GBP/USD

The British pound fell slightly during the day but found a bit of support towards the end of the session. Because of this, looks as if the market may try to retest the 1.2850 level above, and I think that the market will continue to be attracted to rallies for selling opportunities. If we break down below the bottom of the candle, it’s likely that the market will probably go down to the 1.26 level underneath, as it was support previously. The British pound is getting sold off against most currencies in general, so I think that the market continues to struggle. I look at rallies as an opportunity to pick up “value” in the US dollar, as the British pound has fallen out of favor yet again. GDP numbers come out today from the United Kingdom, so that of course could cause a bit of noise. Unless they are explosive to the upside, I imagine that the British pound is a “cell the rallies” type of market.

Leave A Comment