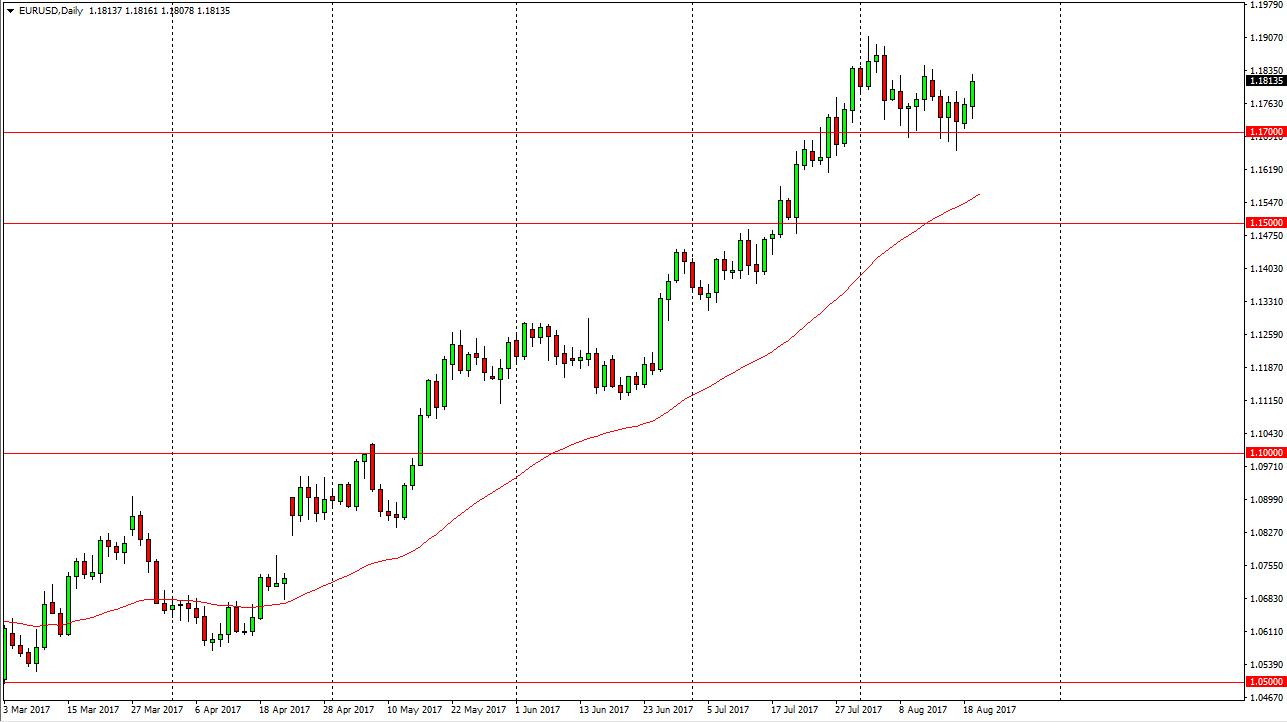

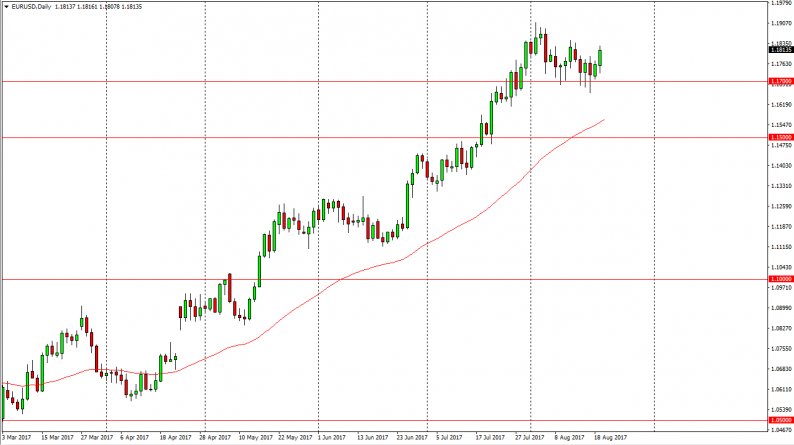

EUR/USD

The EUR/USD pair initially fell on Monday but turned around to rally yet again. We have broken above the 1.18 level, and it now looks as we have formed a bit of a bullish flag. If we can break above the 1.1850 level, I think that this market is ready to go much higher. Because of this, I have no interest in shorting and I believe that a pullback should only offer value. I believe that the 1.17 level underneath is going to continue to offer support, although we do have the Jackson Hole meeting going on this week, so we could see a bit of volatility due to statements coming out after Thursday. Nonetheless, I believe that the market is ready to go much higher, so I am very hesitant to start selling, unless we were to break down below the 1.15 level significantly.

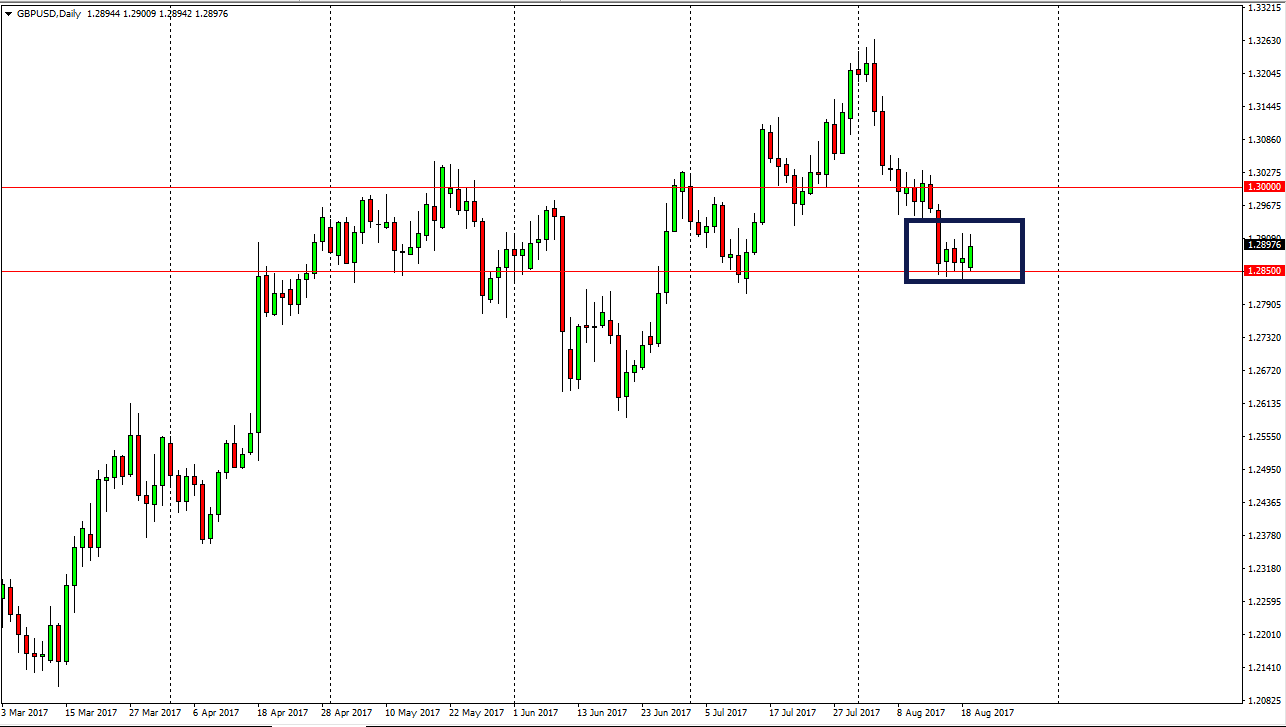

GBP/USD

The British pound had a positive session on Monday, but I think that what is more important to pay attention to is that we are in a consolidation area. I think that the 1.2850 level underneath should continue to offer support, so therefore I’m not expecting much until we break down below that level on a daily close as far as selling is concerned. However, we could bounce from here and go looking for the 1.30 level above, but I also believe that market will have plenty of bearish pressure. Because of this, I do not believe in buying this market until we break above the 1.3050 level, which would show a significant swaying and momentum. Ultimately, I believe that we will continue to see bearish pressure on the British pound, and therefore unless the US dollar melts down, this market will probably continue to be a bit soft.

Leave A Comment