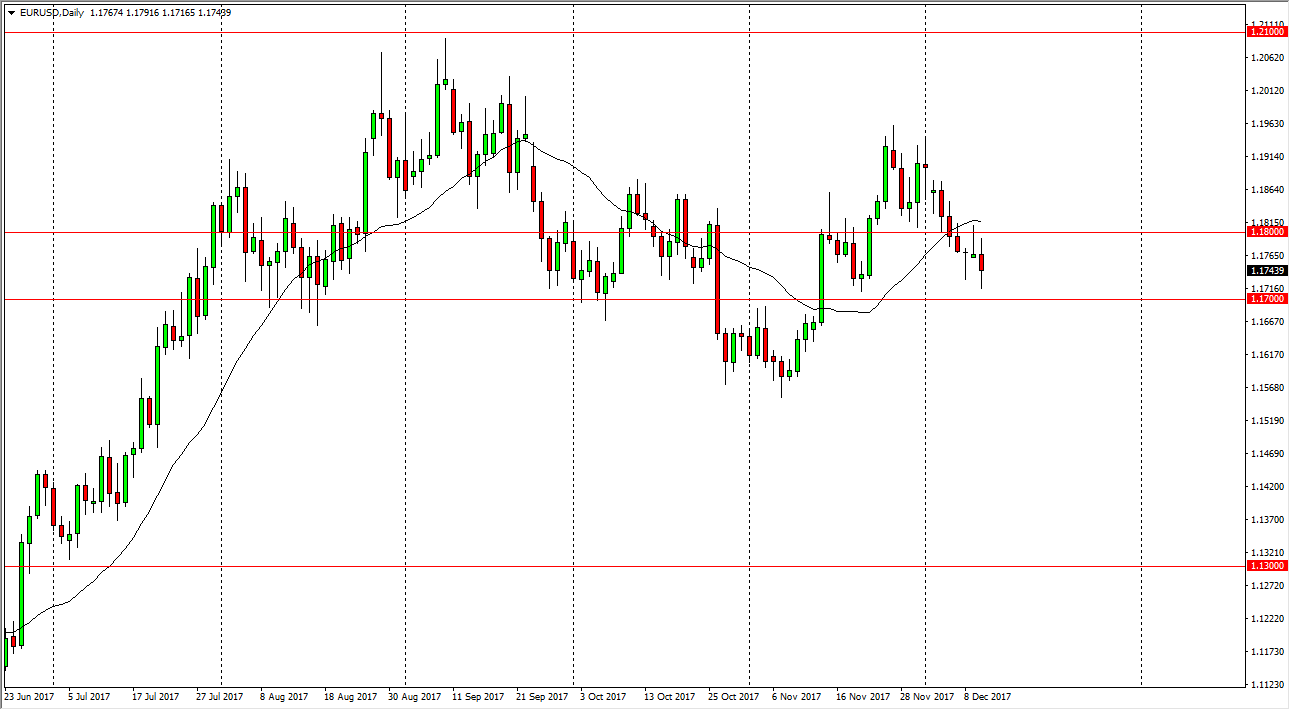

EUR/USD

The EUR/USD pair has been very noisy over the last several sessions, and it looks as if we are settling down between the 1.17 level on the bottom, and the 1.18 level on the top. We have the Federal Reserve releasing an interest rate decision today, and of course a statement that follows, and this will be followed with great interest as people will be looking to see if the Federal Reserve is looking hawkish, or dovish. This will greatly influence where this market goes next. On a daily close above the 1.18 level, I am a buyer of this market, just as I would be a seller below the 1.17 handle. The market will present a clear trading signal after today from what I expect, so I am going to be very cautious, but I’m going to follow whatever direction we break out.

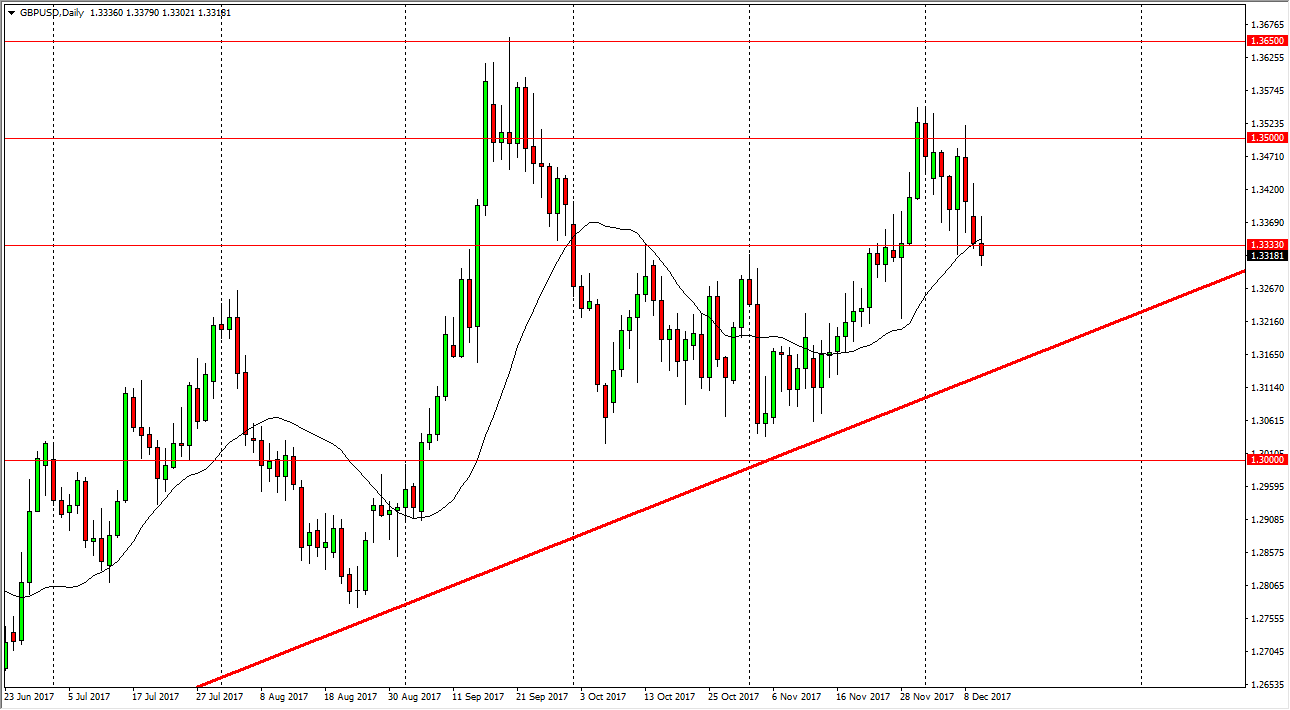

GBP/USD

The British pound tried to rally during the session on Tuesday but found the area above the 1.3333 handle to be very resistive. We ended up forming a shooting star like a candle, sitting in an area that is supposed to be very supportive. I think today is going to be very interesting for the long-term outlook of the British pound, as the Federal Reserve will have its influence. A break above the top of the candle for the session on Tuesday would be a very bullish sign, and then send this market to the 1.35 handle. Alternately, if we break down below the 1.33 handle, then I think that the market will probably go looking towards 1.32 handle. The markets will react either in favor or against the value of the US dollar today, because of the perceived attitude of the Federal Reserve.

Leave A Comment