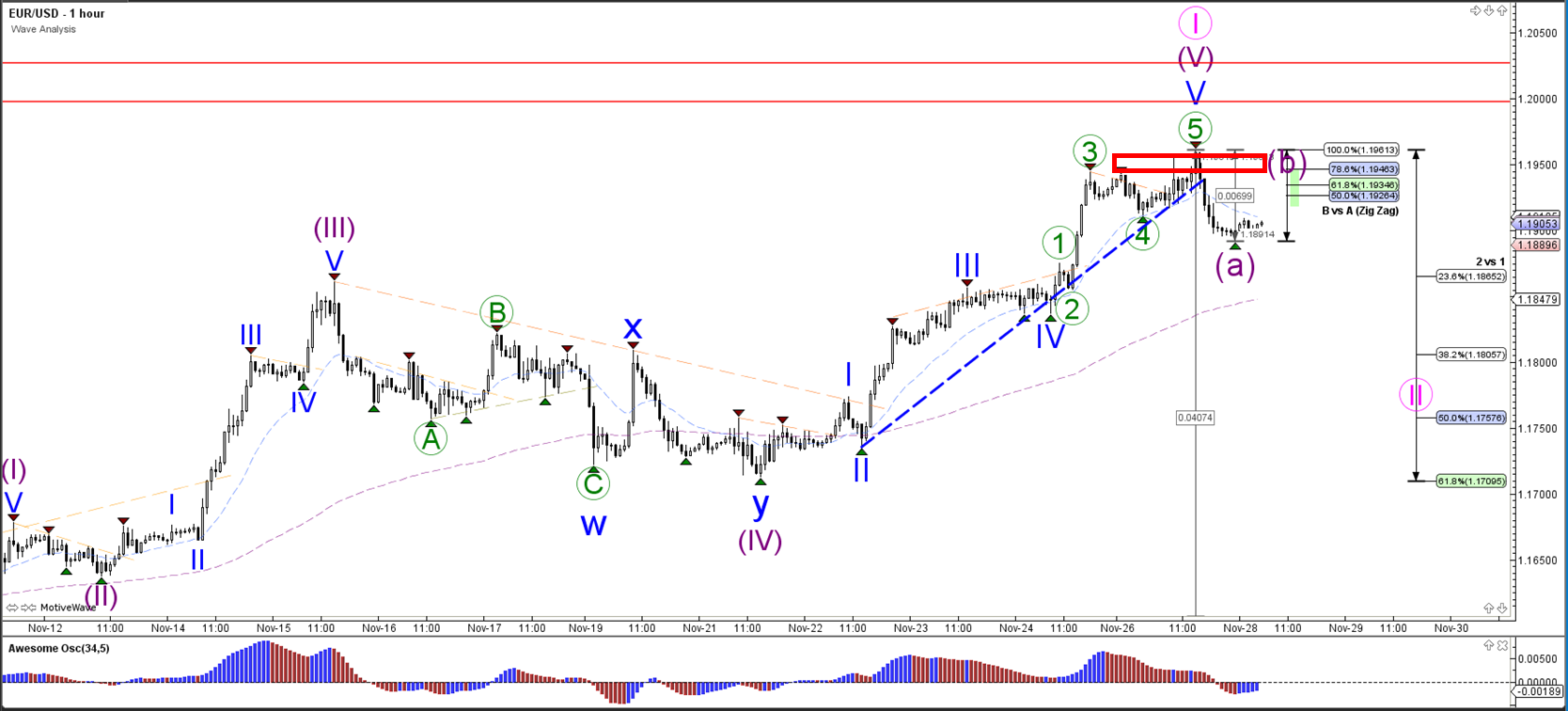

EUR/USD

4 hour

The EUR/USD uptrend is probably in a wave 5 (purple) of a larger wave 1 (pink). The 5th wave managed to reach 1.1960 but missed the 1.20 round level by a little bit. Price could still reach this resistance level later this week by extending wave 1 but eventually a correction within wave 2 (pink) is likely.

1 hour

The EUR/USD uptrend could become extended if price manages to break above the resistance zone (red). In that case price could make it towards the resistance zone around 1.20. A failure to break could indicate a larger ABC (purple) correction within wave 2 (pink).

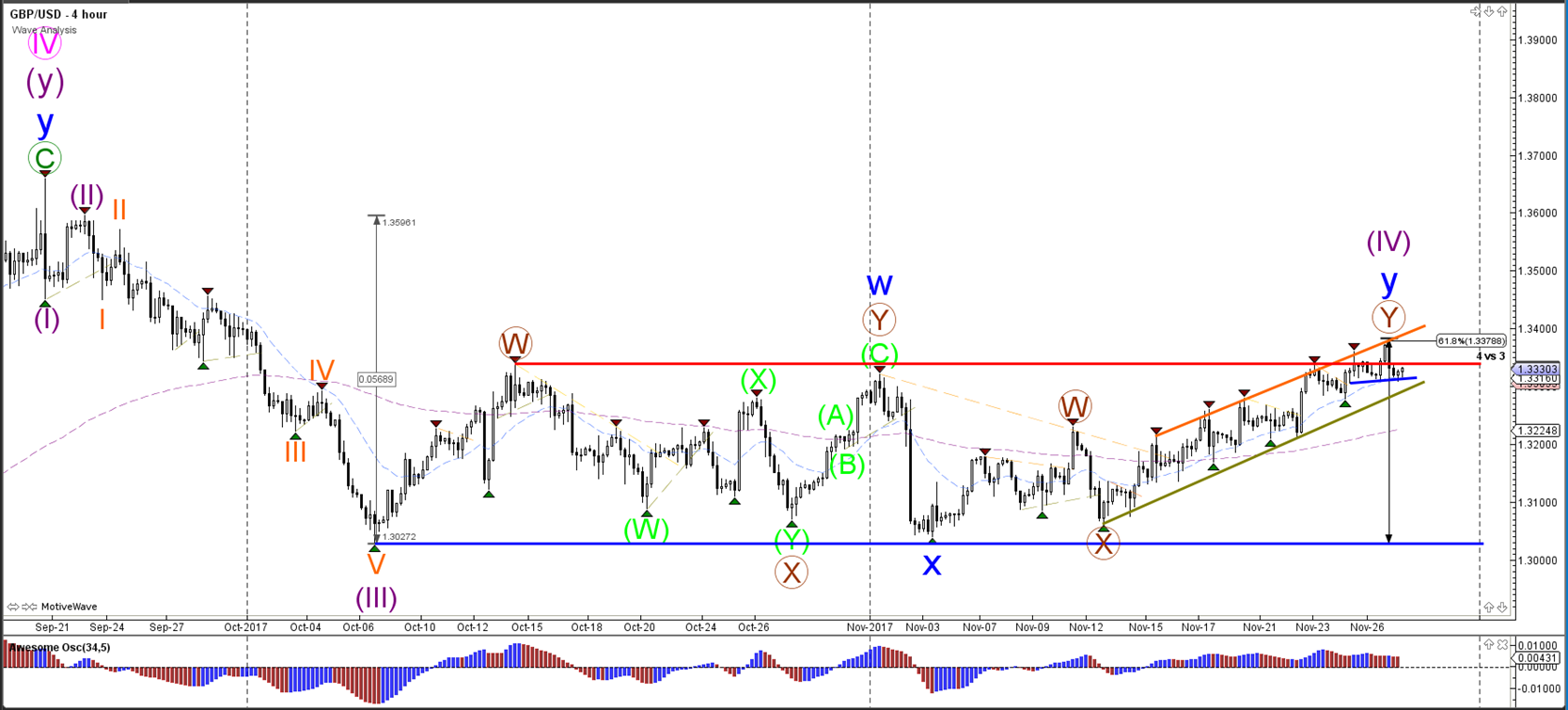

GBP/USD

4 hour

The GBP/USD channel has reached a key decision zone: the resistance of the sideways range (red). A new bullish breakout above the resistance (red) could indicate an uptrend whereas a bearish breakout could see price fall back to the bottom of the range (blue).

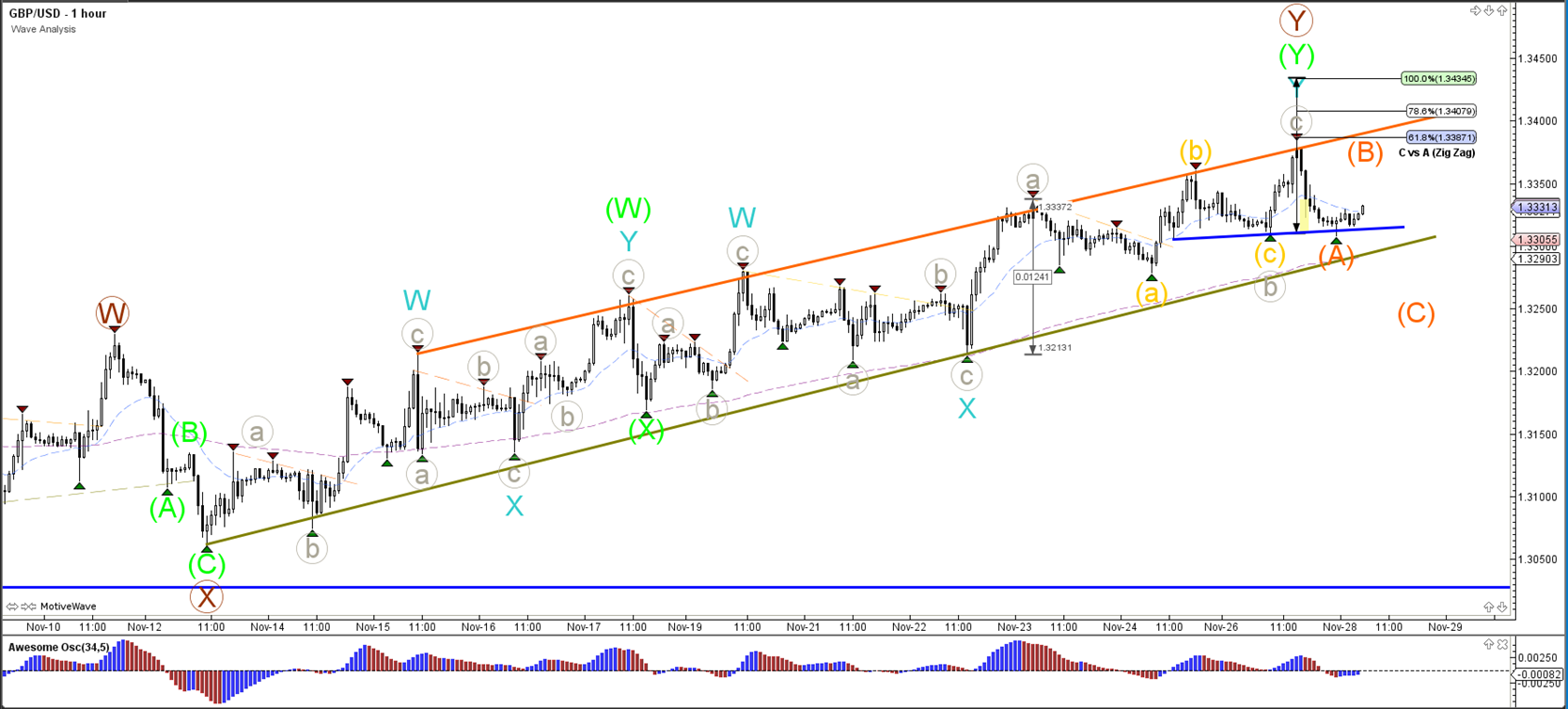

1 hour

The GBP/USD bounced at the top and bottom of the channel and remains choppy in its movement. Now price is also showing double divergence between the two most recent tops, which could spark a potential ABC (orange) correction. A break above resistance could indicate a larger bullish momentum.

USD/JPY

4 hour

The USD/JPY bounced a second time at the 50% Fibonacci support level. Price could be expanding the bearish correction via a larger WXY (pink) pattern. A new bearish break below the 50% would most likely indicate a bearish continuation towards the 61.8% Fib.

1 hour

The USD/JPY could be building a bear flag chart pattern within a larger bearish wave C (blue). A bearish breakout could see price fall towards the Fibonacci targets whereas a bullish break could see price retest the trend channel (red).

Leave A Comment