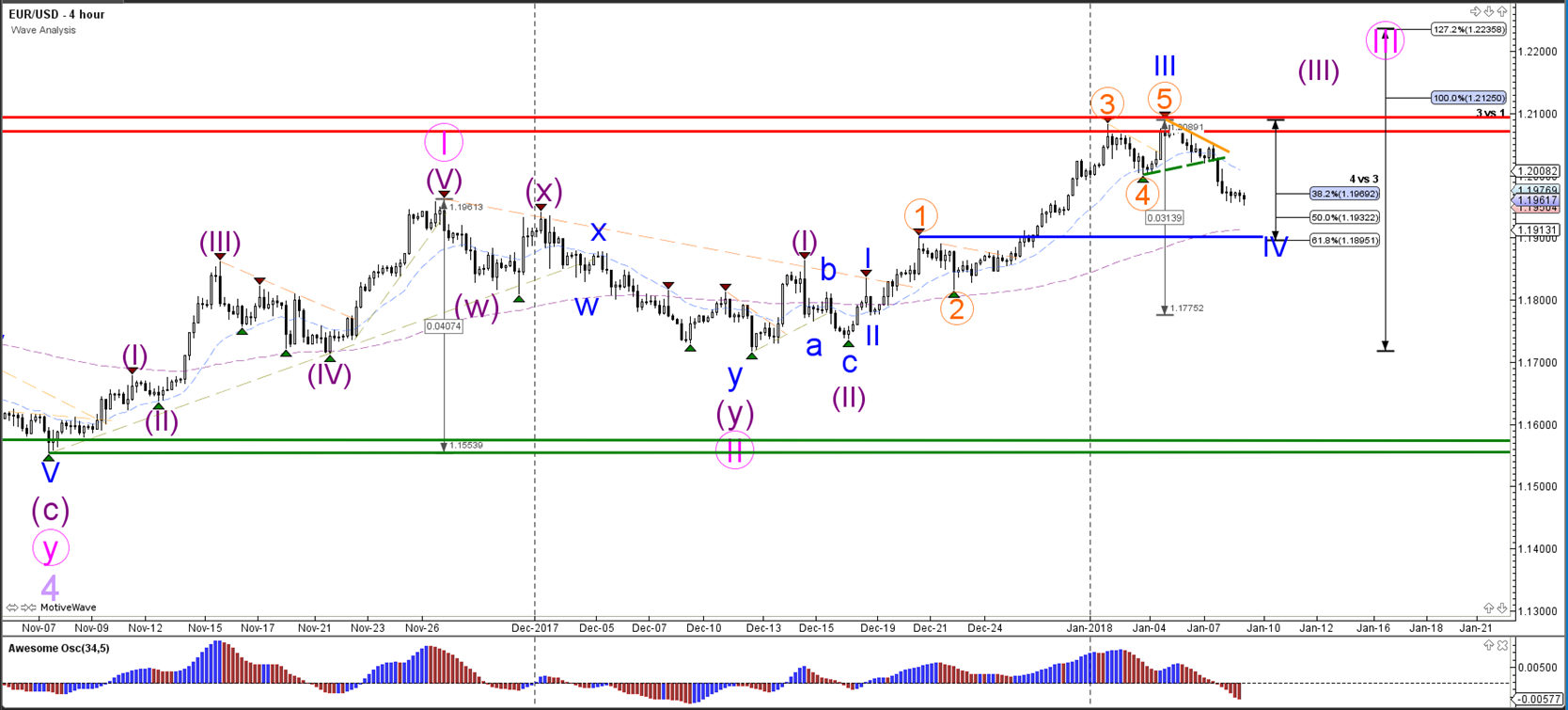

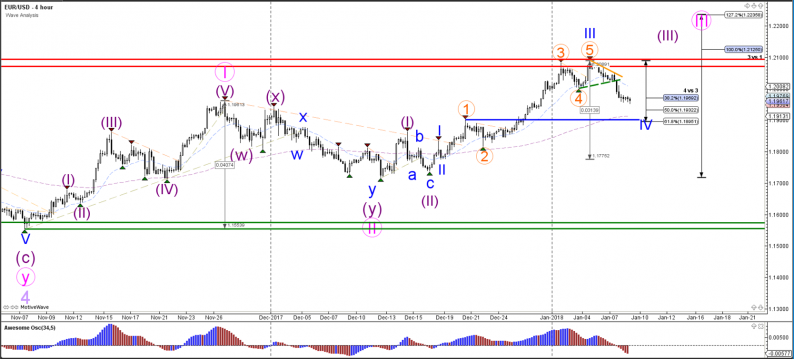

EUR/USD

4 hour

The EUR/USD made a bearish breakout below the support trend line (dotted green) after bouncing at the resistance (red). The bearish retracement could be part of a bearish correction within a larger uptrend continuation where waves 3 prevail. The alternative is that price is not completing a 123 (pink) but a larger ABC correction. A break below the support trend line (blue) and 61.8% Fib of wave 4 makes a bearish scenario more likely.

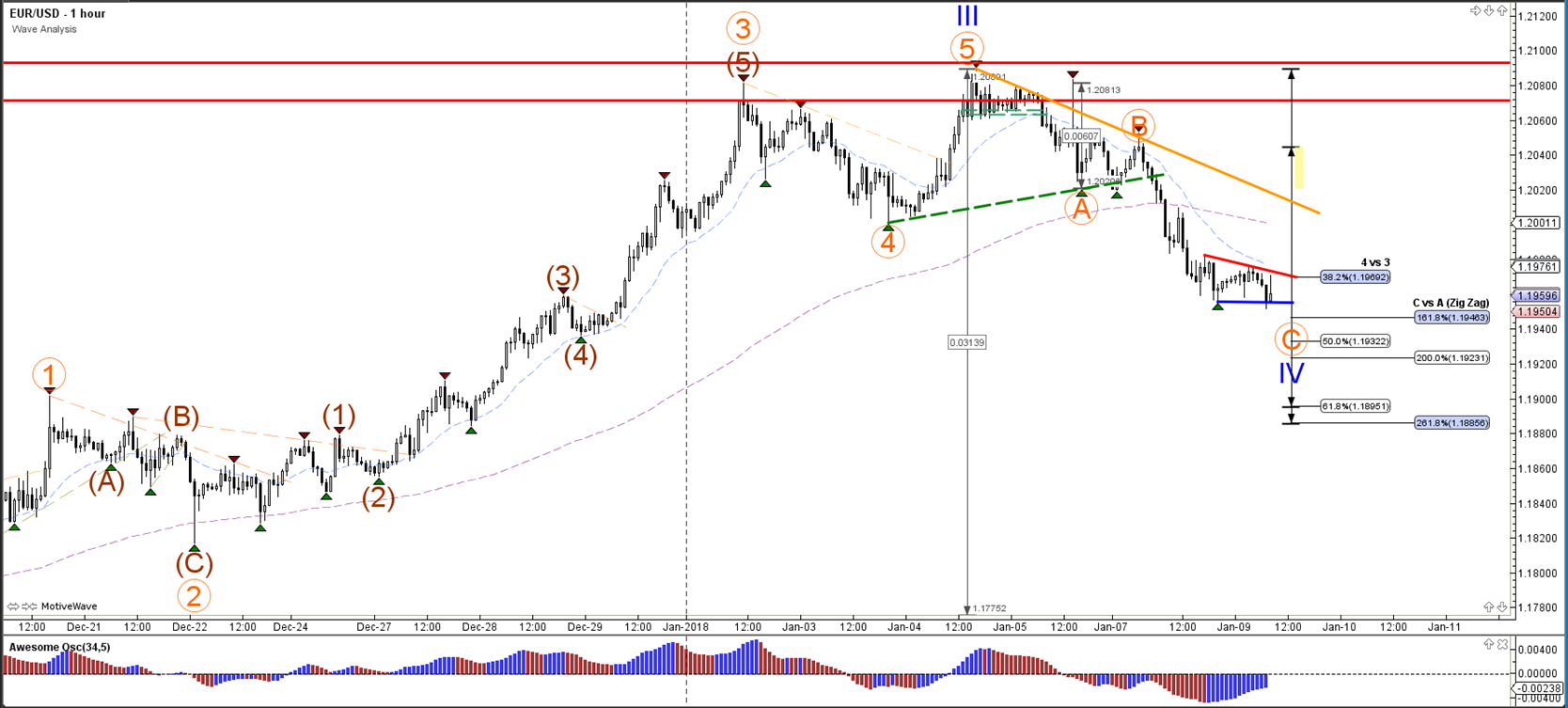

1 hour

The EUR/USD broke the support trend line and could be building a wave C (orange) correction. A break above the resistance trend line (red) could be a first sign that wave C is over whereas a break below support could see price fall further. A push below the 61.8% Fib makes this wave 4 unlikely.

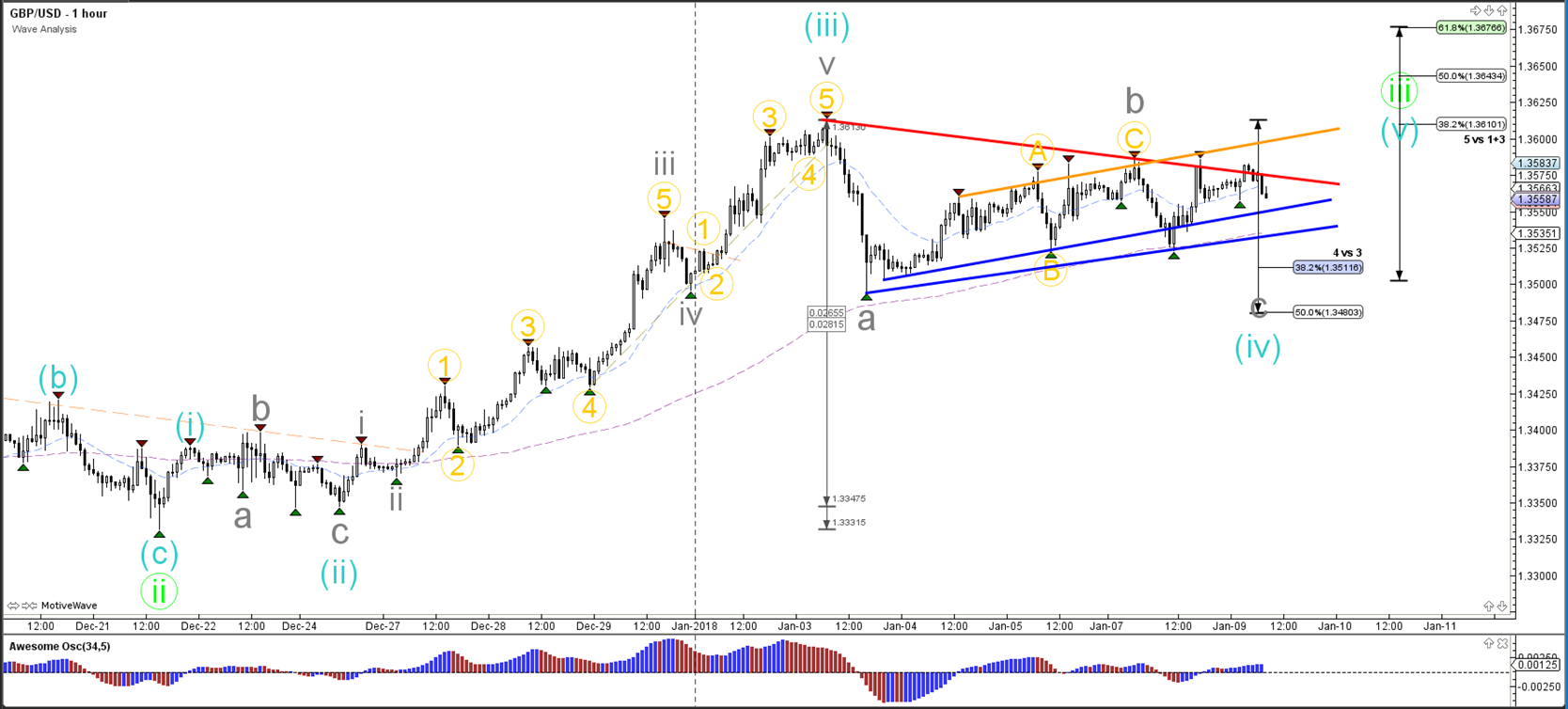

GBP/USD

4 hour

The GBP/USD is building a corrective pattern in the larger uptrend. A break above the resistance trend lines (orange/red) could see price move towards the Fibonacci targets whereas a break below support (blue) could see price make a larger bearish correction.

1 hour

The GBP/USD is building an ABC corrective pattern. The breakout direction depends on the price’s reaction versus the trend lines.

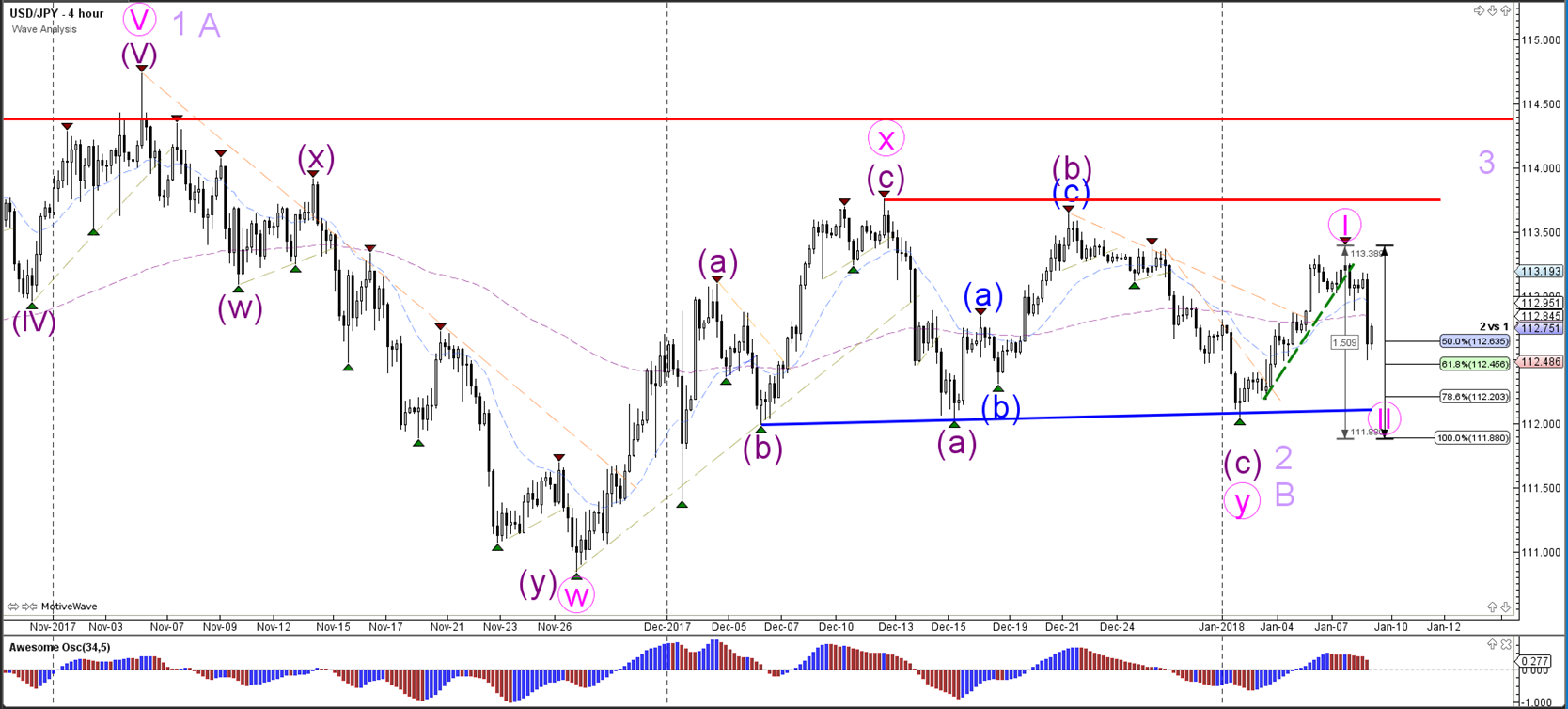

USD/JPY

4 hour

The USD/JPY broke below support (dotted green) and has made a larger bearish correction. This retracement could be a potential wave 1-2 (pink) although price remains in a larger range.

1 hour

The USD//JPY broke the bullish trend channel (green) and could be building an ABC pattern if price stays above the 100% Fib level of wave 2 vs 1.

Leave A Comment