THURSDAY TURN-AROUND IN THE US DOLLAR

It’s been a big week across global markets already as we had the first appearance of note from new Fed Chair Jerome Powell. The net result of Mr. Powell’s two-day testimony has been a pullback in US stocks along with some rather interesting price action in the US Dollar. The Dollar put in strength in the hours before Mr. Powell was to begin on Tuesday, and that strength largely continued into yesterday. Prices pulled back to higher-low support as Mr. Powell began his second day of testimony; but a surprising announcement from President Donald Trump of tariffs on Chinese steel helped to provoke an aggressive sell-off in the Greenback. That weakness has largely remained since, and prices are now attempting to cauterize some support around the previously-key level of 90.00 on DXY.

USD VIA ‘DXY’ BACK TO 90.00: TARIFF TALK (IN RED) REVERSES POWELL-PROVOKED USD STRENGTH

Chart prepared by James Stanley

NEXT WEEK IS BIG

First and foremost – there is weekend risk around the Euro. Italian elections can keep the Euro volatile, particularly around the Sunday open, and holding weekend risk is even riskier than usual. So, if holding anything Euro related going into the weekend, be careful.

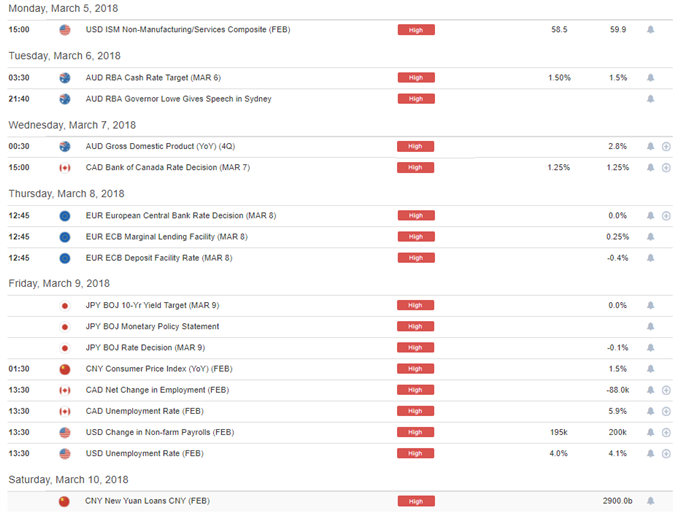

While this week had a heavy US-focus next week spreads out around-the-globe, as we get major Central Bank rate decisions out of Australia, Europe, Japan and Canada. There are some rather interesting themes that’ll come into question around these prints, with heavy emphasis on what the Bank of Japan might say after an aggressively strong-Yen has started to show after a rise in Japanese inflation. Below, we’re looking at the high-impact events on next week’s economic calendar.

DAILYFX ECONOMIC CALENDAR: HIGH-IMPACT EVENTS FOR WEEK OF MARCH 5, 2018

USD STRENGTH FLARES OUT AFTER TARIFF ANNOUNCEMENT

The US Dollar is back-below the 90.00 level a big week across global markets.Dollar strength had largely remained through the testimony of new Fed Chair Jerome Powell. But, it was around 12:50 Eastern Time that President Donald Trump announced tariffs on Chinese Steel imports, at which point a change-of-pace began to show and that’s largely continued since that announcement. One of the more visible moves has taken place in the US Dollar, as the Greenback was making a hard-charge towards the 91.00 level before this announcement came-out. Now, we’re testing the 90.00 level after falling back below the bearish trend-line on the chart below.

Leave A Comment