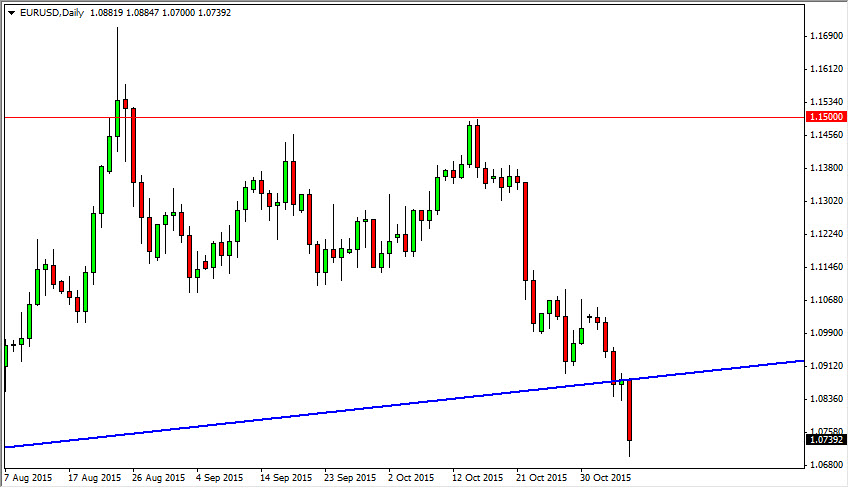

The EUR/USD pair broke down during the course of the session on Friday, clearing the bottom of the hammer on Thursday. Because of this, it shows a significant amount of support been broken through, and that means that the floodgates may have opened. On top of that, we have closed towards the bottom of this candlestick, and that shows that we could very well continue the downward pressure during the day today. I believe that’s the case, as the Euro suddenly finds itself in serious trouble.

This of course had a lot to do with the US jobs number being so strong, which leads me to believe that perhaps the Federal Reserve might have to raise interest rates quicker than people had anticipated. On top of that, you have the European Central Bank suggesting that further stimulus could be added to the mix as well, and that should drive down the value the Euro overall. With that, we have a bit of a “one-way trade.”

Several bearish indicators

The uptrend line has been broken, and that of course is very bearish. The bottom of the hammer being broken from Thursday of course is very bearish as well. Also, we have the 1.08 level which should have been supportive and instead only got sliced through. Because of this, it’s only a matter of time before the selling pressure overwhelms the market and we go to the next significant supportive level which I see as the 1.08 handle. I also believe that selling rallies from time to time might be the way to go as well, as long as we get some type of exhaustive candle above. The bottom of the uptrend line should be resistive as well, so having said that it’s very likely that the sellers will continue to push this in market around. Ultimately, I believe that there are far too many bearish indicators right now to consider buying this particular market. Downward we go.

Leave A Comment