EUR/USD DAILY PRICE CHART

Technical Outlook: Euro turned just ahead of the key 61.8% retracement of the 2014 decline at 1.2598 with the pullback now eyeing near-term confluence support around the 1.23-handle. Note that daily momentum has broken back from overbought territory and is now testing a basic support trigger- a break below this threshold alongside a move sub-1.23 would suggest that a more significant near-term high is in place.

That said, look for interim resistance at the yearly high-day close at 1.2393-1.2409 with a break there needed to shift the near-term focus back toward the yearly highs at 1.2538 and the 1.2598 resistance target.

EUR/USD 240MIN PRICE CHART

Notes: A closer look at price action sees prices trading within the confines of a descending pitchfork formation extending off the yearly highs with the median-line converging on up-slope support around the 1.2297-1.2310 – Look for a reaction there.

Bottom line: Euro is heading into up-trend support near the 1.23-handle with our broader bullish invalidation level set to the 38.2% retracement which converges on a slope confluence around 1.2225. While the immediate risk is lower, from a trading standpoint, I’llfavor buying a dip into structural support or a breakout & retest of the upper parallel / 1.2409 resistance level.

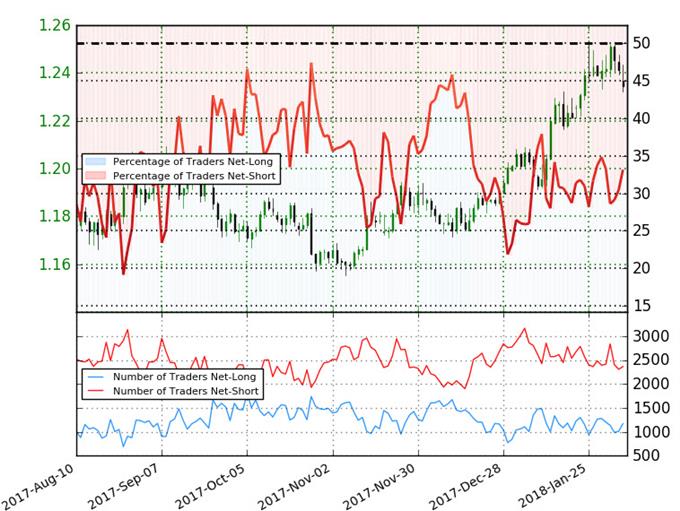

EUR/USD IG CLIENT SENTIMENT

Leave A Comment