Mario Dragh’s magic is back and the team at ANZ sees it as a big bazooka.

Here is their view, courtesy of eFXnews:

The ECB delivered a bazooka. It extended QE (by €540bn), allowed the purchase of bonds with a minimum one year maturity and the purchase of bonds with yields below the deposit rate (-40bps).

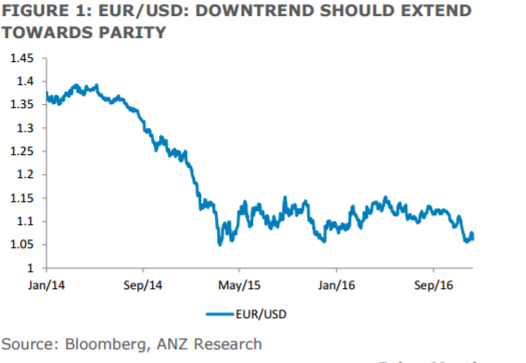

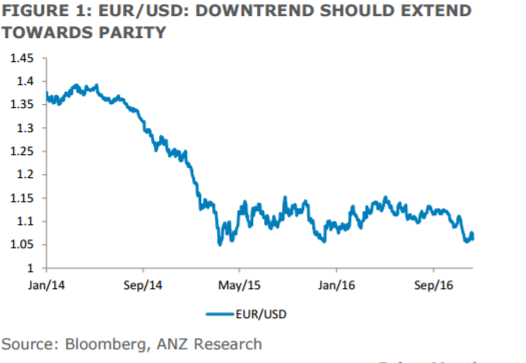

The euro fell and the forthcoming political cycle suggests portfolio outflows from the euro area will continue. Further EUR underperformance vs. USD, AUD, NZD and Asia is expected.

Our forecasts assume that EUR/USD will move towards parity in coming months. If anything, the December ECB policy meeting reinforces that view. And whilst the ECB has mapped out its policy landscape for 2017, there are still material event risks facing the euro area. The elections in the Netherlands in March, elections in France –presidential election in April/May and Assembly election in June – and general election in Germany in September take place against a backdrop of rising support for populist parties. An election in Italy can’t be completely discounted either. There is also the issue of bad debts in the banking system, in particular Italy, which needs to be addressed.

Against a backdrop where the FOMC will be raising interest rates we advise staying short EUR/USD and selling rallies.

Leave A Comment