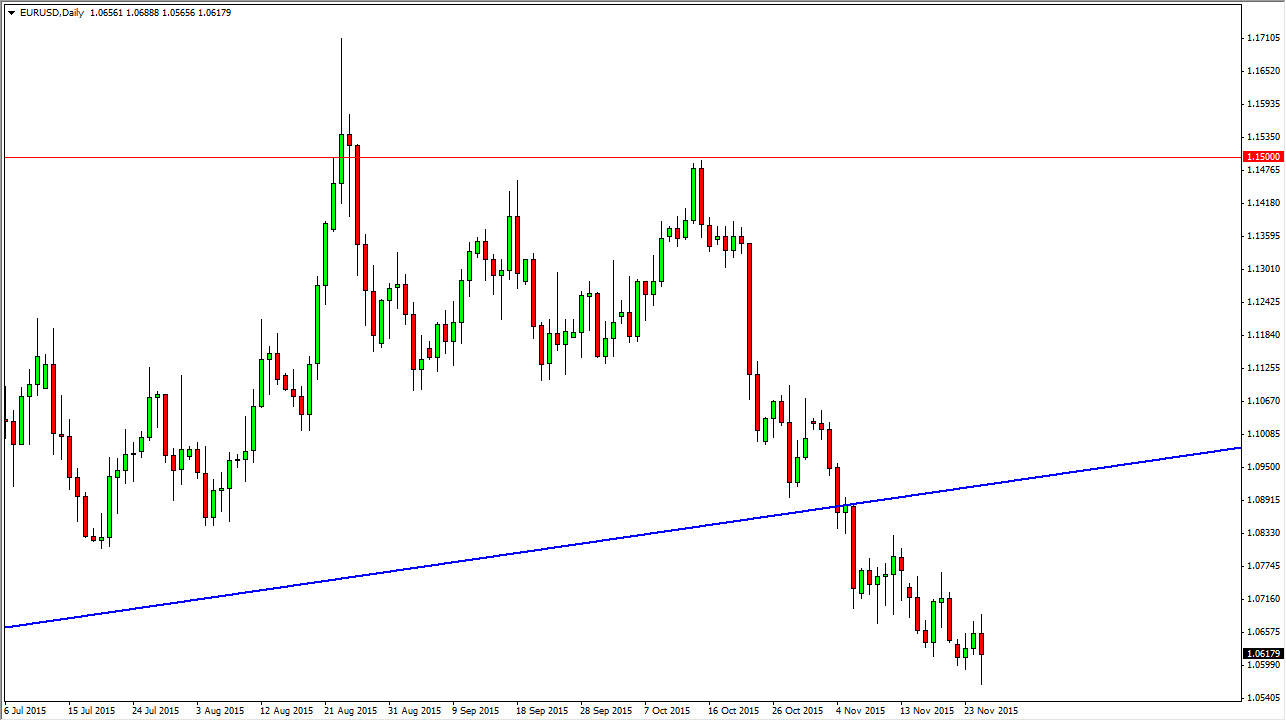

The EUR/USD pair initially fell during the day on Wednesday, but found enough support near the 1.0550 level to turn things around and form a bit of a hammer. This of course is a very positive sign, but quite frankly I think that this is tantamount to a “relief rally” at best. After all, this market has been very negative lately and I don’t see any abatement when it comes to the selling pressure. I believe that this would more or less have been in reaction to the Thanksgiving Day holiday today, which of course keeps the Americans on the sidelines. Several of the larger positions that most traders would have on would be short EUR/USD, and most American traders would have probably been collecting profits during the day.

Selling Rallies

I think that selling rallies going forward is the way to go, as I have been saying for some time. I believe that there are various resistance levels above that could cause a bit of trouble for the Euro bilayers, with special attention being paid to the 1.08 level, and the 1.10 level. On top of that, so we near the 1.10 level, we would have the bottom of the uptrend line from the previous ascending triangle that had been pushing this market higher over the longer term. I think that should now offer quite a bit of resistance, so quite frankly I look at this potential “buying opportunity” as the market simply giving us a better price at which to start purchasing US dollars. I will wait for resistive candle above in order to start selling, and will more than likely look to the daily charts as I believe we may have a little way to go before we get the selling pressure that is necessary.

It is not uncommon for a market to have to make several attempts to break through a major level such as the 1.05 handle, so quite frankly this could be a bit of a momentum building exercise. Ultimately, this pair should continue to drift lower.

Leave A Comment