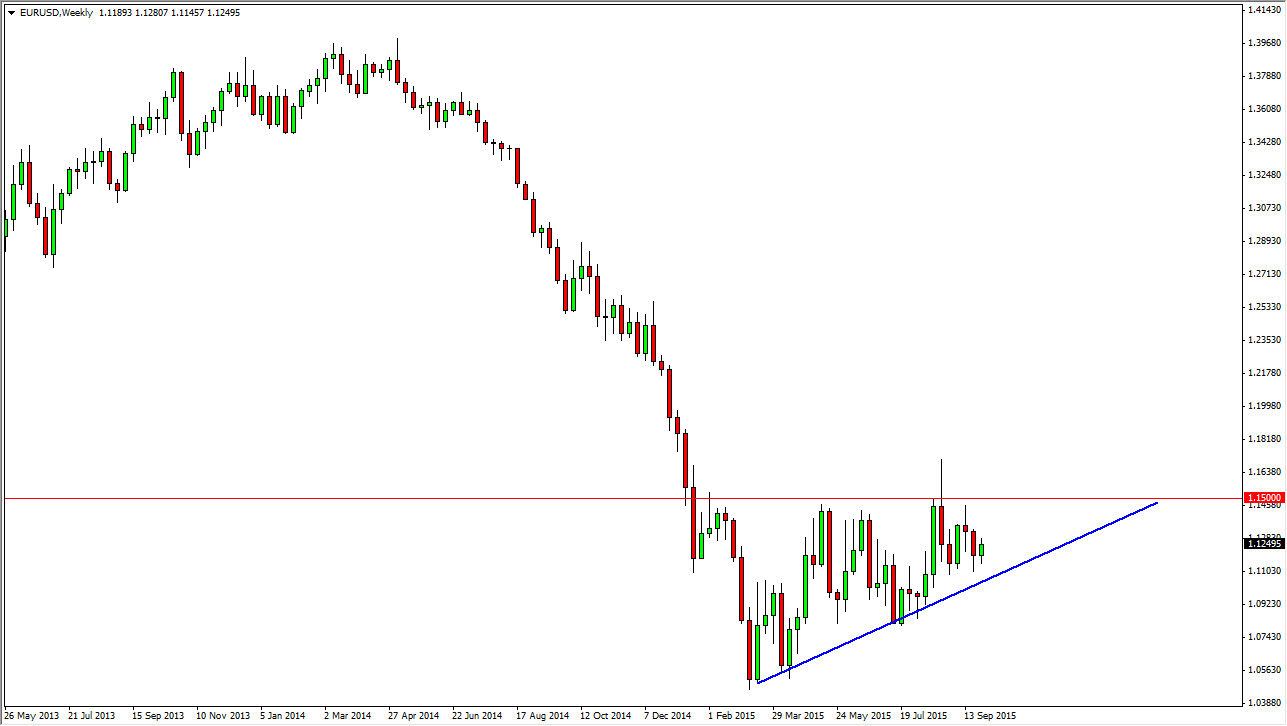

The EUR/USD pair has been a very tight market to deal with recently. After all, the market has been bouncing around below the 1.13 level down to the 1.10 level for the last couple of weeks, with a few sessions here and there that were outside of the range. Ultimately though, as you can see on the weekly chart I have drawn a significant uptrend line. I believe this uptrend line suggests that we are trying to form some type of ascending triangle, and that a break above the top of that ascending triangle is going to be a bit of a trend change. The 1.15 level has been broken previously, but you can see that we could not hang onto the gains. Trend changes tend to be very nasty affairs, and therefore very choppy. This is one of the situations where people will remark that the market is trying to wipeout as many traders as possible.

Going long

At this point in time, as long as we can stay above the uptrend line I am only buying this pair. Truth be known though, this is one of my least favorite currency pairs to trade anymore, as it has been so noisy. After all, the Federal Reserve has confused the market by refusing to go higher with interest rates. But at the same time, they had suggested that perhaps many of the world global markets and global economies were far too soft to do so. In a sense, they said “it’s not us, it’s them.”

That statement of course had a lot of people concerned about world markets, but I also recognize that the European Union is starting to show signs of recovery. With that, it’s very likely that we will eventually break out. I don’t know that it will be this month, but in the meantime I am buying short-term pullbacks for short-term trades. Again, I have no interest whatsoever in selling this market until we get below the uptrend line.

Leave A Comment