EUR/USD

4 hour

Important numbers are expected to be released today in the US. The Non-Farm Payroll (NFP), average hourly earnings, and unemployment rate will be announced and they typically impact the US Dollar and other financial instruments. The reaction of the USD to the news remains to be seen but from an Elliott wave perspective, price has probably completed a wave 5 (purple/green) within wave 3 (blue).

The EUR/USD strong bearish momentum did not break the support trend line (blue), which makes a bullish extension still possible. However, price needs to break above the previous top of 1.2070 to make the scenario more likely. For the moment, an ABC (red) correction is more probable. The Fibonacci levels of wave B (red) could in that case act as resistance levels for a potential bearish turn.

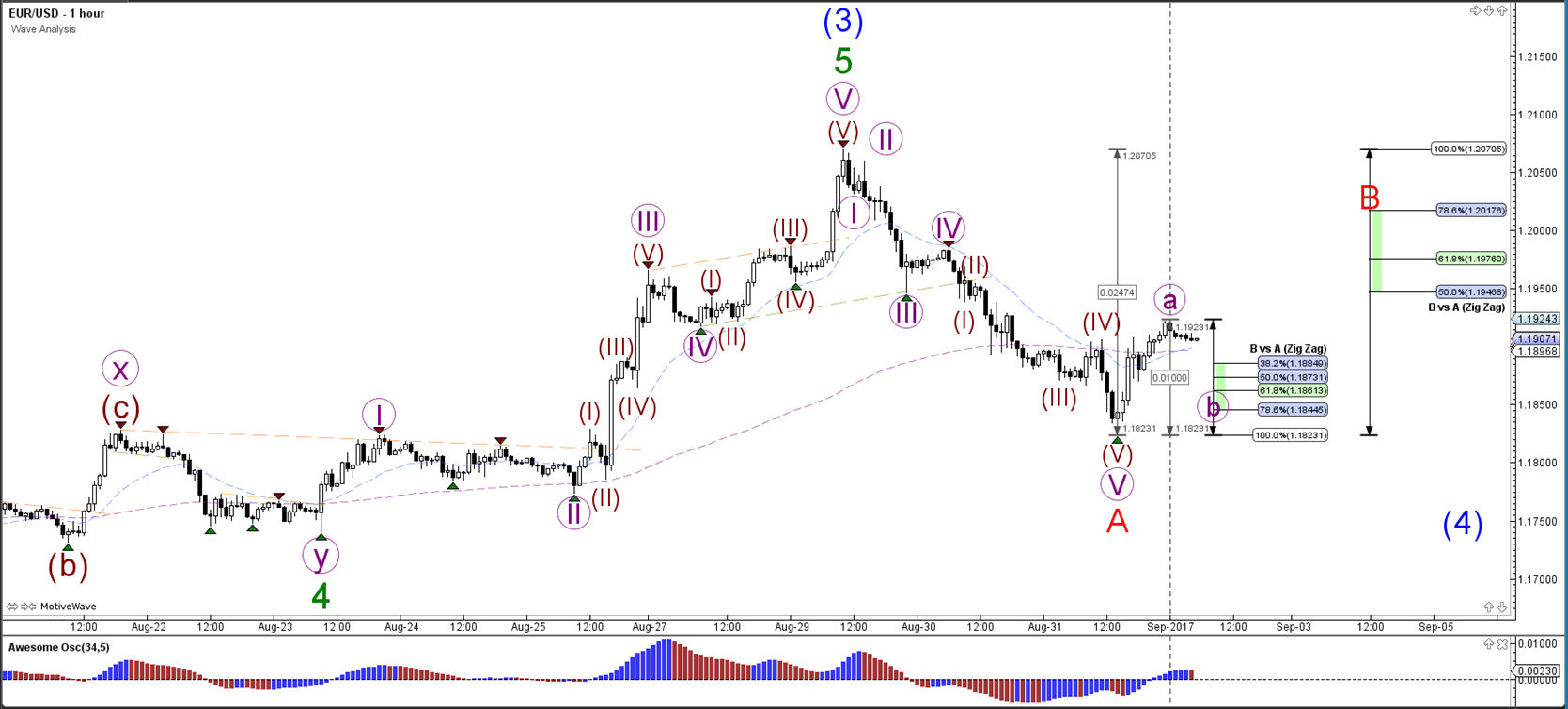

1 hour

The EUR/USD is probably building an ABC (purple) within a B (red). The invalidation level of the bearish correction is a break above the top at 1.2070.

USD/JPY

4 hour

The USD/JPY broke below the bullish channel (dotted blue). The bearish bounce could indicate that wave C (orange) has been completed but price will need to break below the support zone (green) to confirm this. Otherwise a larger bullish correction towards the 38.2% and resistance zone (red) could occur.

1 hour

The USD/JPY is most likely building a wave 12 or AB (purple).

GBP/USD

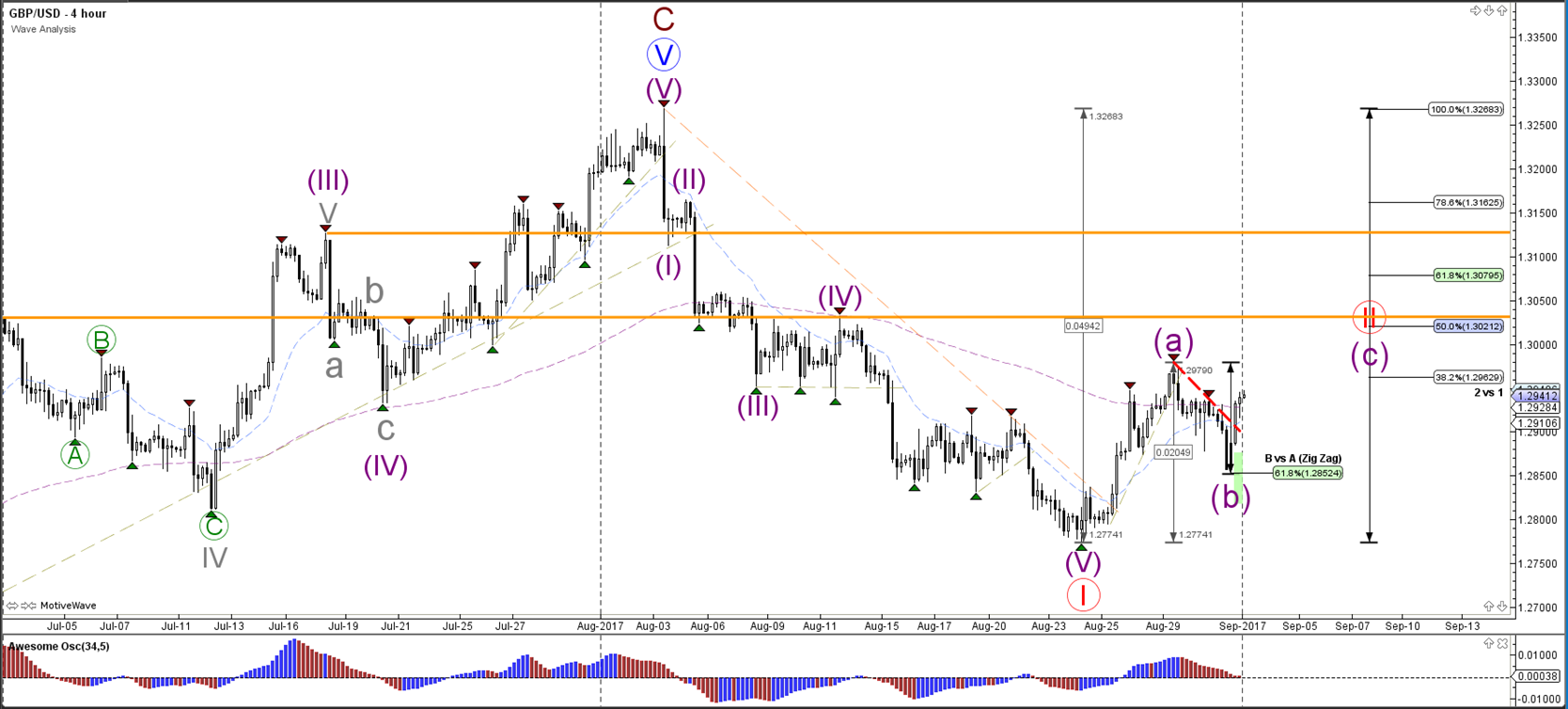

4 hour

The GBP/USD made a deeper retracement and reached the 61.8% Fibonacci level which acted a support. The orange lines indicate a potential resistance zone.

1 hour

The GBP/USD bullish break above resistance (dotted red) is indicating the potential start of wave C purple).

Leave A Comment