The EUR/USD is trading in the mid 1.1600s; slightly higher in the wake of the new week. The pair lost ground on Friday due to several reasons. US Retail Sales enjoyed upwards revisions for July that compensated for weak figures in August. The University of Michigan’s Consumer Sentiment measure beat expectations and topped 100 points, adding some oomph to the dollar.

And then came reports that Trump is keen on imposing trade tariffs on China, ending a week of silence and relative calm. The US Dollar gained across the board late on Friday paring some of the gains it enjoyed earlier.

Trade concerns intensified over the weekend. The Wall Street Journal reported that the US would announce the new duties, on $200 billion worth of Chinese goods as early as today. Moreover, the story from the WSJ also said that China will abandon the planned negotiations and will limit American companies from exporting products from China.

While Asian stock markets are down on Monday, the US Dollar has not capitalized on the news so far. Tension is high towards the US session which could see the announcement on the tariffs or a potential US comment on the topic.

Euro-zone inflation is expected to be confirmed at 2% YoY on the headline and 1% on the core for August. A significant impact is unlikely as the CPI data comes out just days after the ECB decision.

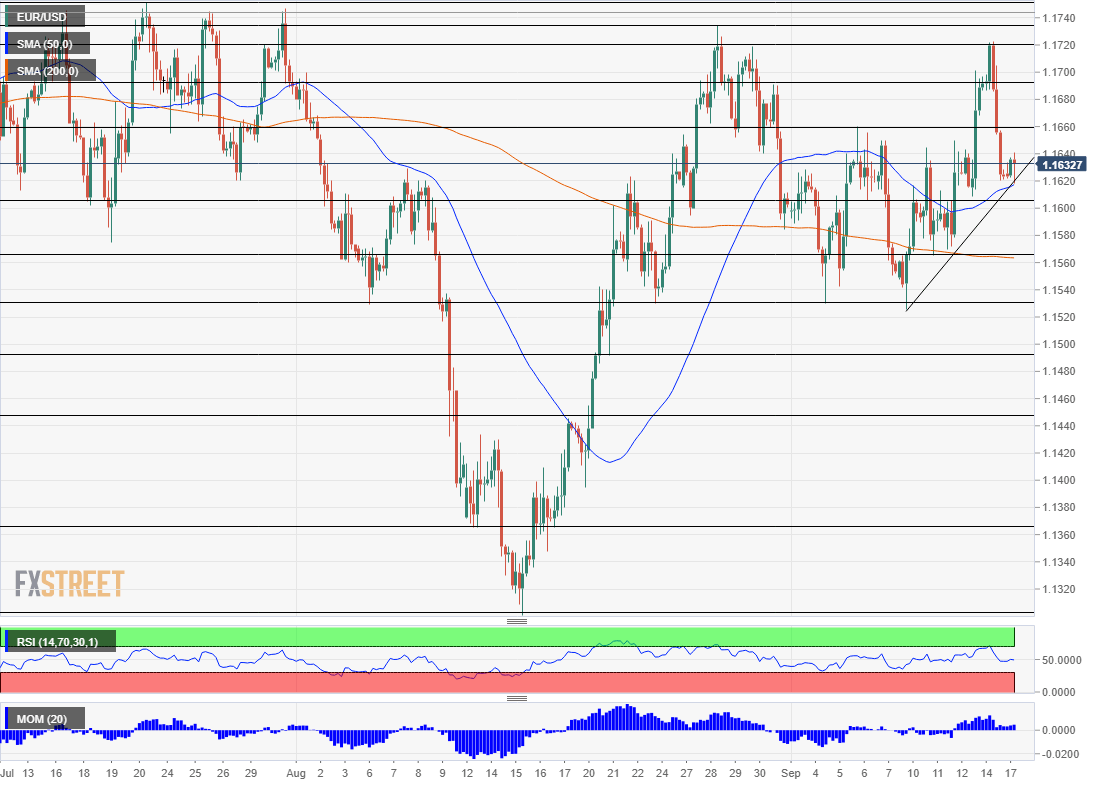

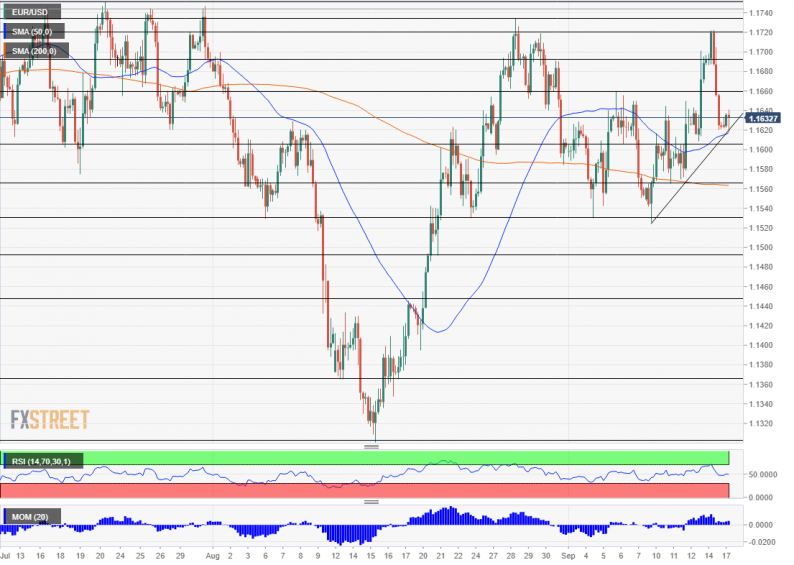

EUR/USD Technical Analysis

The EUR/USD is trading above the 50 and 200 Simple Moving Averages on the four-hour chart. An uptrend channel can also be identified. However, Momentum has faded away, and the Relative Strength Index (RSI) is not going anywhere fast.

1.1660 was a top line two weeks ago and may slow the pair down on its way up. 1.1695 was a swing high a bit earlier. 1.1725 was a peak last week, and it is closely followed by 1.1735 that was the peak in late August and the quadruple top of 1.1750 that kept the EUR/USD down in July.

Leave A Comment