Mario Draghi destroyed the euro today but essentially telling the market that despite the best economic growth in years, he wasn’t ready to pull the plug on QE just yet. By extending QE to 9 months into 2018 Mr. Draghi dashed any hopes of an early taper and broke the hearts of euro bulls.

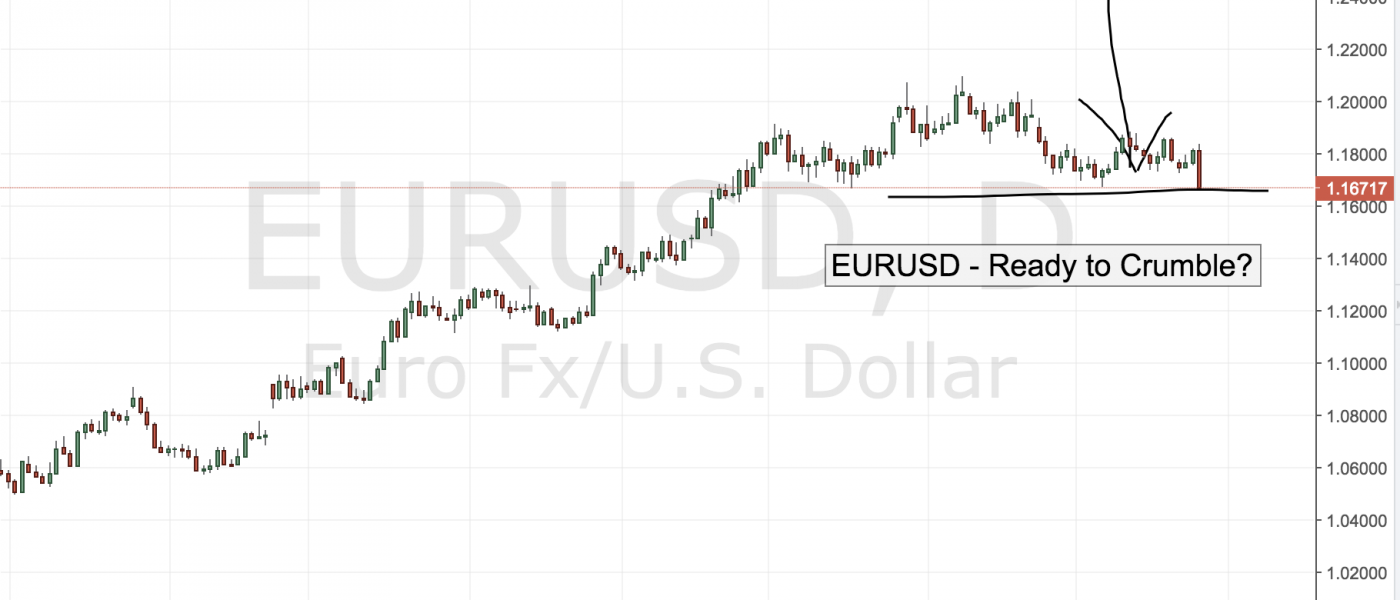

The damage done to the currency today wasn’t just fundamental but technicals as well as it broke the 1.1700 figure and now rests just ahead of the key 1.1650 support. With Fed clearly on a path to more rate hikes, while the ECB remains a non-player for all of 2018, the prospect of further interest rate differential between the two currencies will only expand and could push the EUR/USD quickly towards the key support at 1.1500 level.

Today’s policy courses suggests that the euro is strict sell on rallies trade for now, unless US policy suddenly turns dovish as well.

Leave A Comment