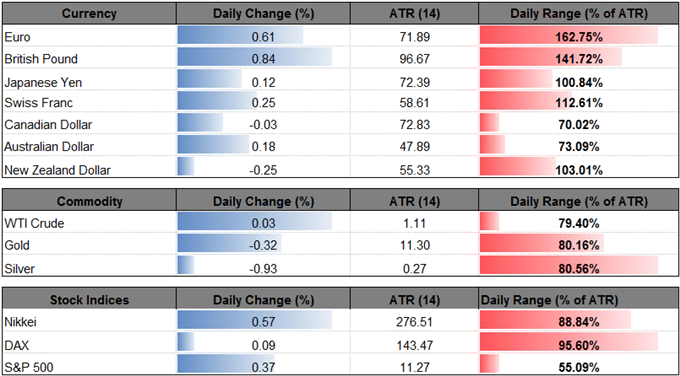

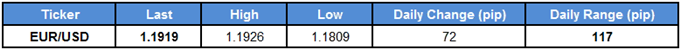

EUR/USD snaps the series of lower highs & lows from earlier this week, with the pair at risk for a more meaningful recovery as the European Central Bank (ECB) adopts an improved outlook for the monetary union.

Even though the ECB is on course to carry the quantitative easing (QE) program into 2018, Governing Council member Peter Praet asserted that the ‘the breadth of the expansion is notable,’ and went on to say that the recent data coming out of the euro-area is ‘reassuring for the growth outlook because recoveries tend to be firmer and more robust when they are broad-based.’ The recent comments suggest the ECB will continue to change its tune over the coming months as ‘reforms have generally been stepped up in the euro area,’ and the bullish EUR/USD behavior may persist going into the end of the year as President Mario Draghi and Co. gradually move away from the easing-cycle.

With that said, EUR/USD stands at risk of extending the advance from the November-low (1.1554), with the topside targets on the radar especially as both price and the Relative Strength Index (RSI) break out of the bearish formations from September.

EUR/USD Daily Chart

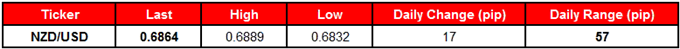

NZD/USD struggles to retain the advance from earlier this year even as the Reserve Bank of New Zealand (RBNZ) pledges to ease the loan-to-value ratio (LVR) restrictions from October 2016, and the pair may continue to give back the rebound from the 2017-low (0.6780) as the central bank appears to be in no rush to lift the cash rate off of the record-low.

Leave A Comment