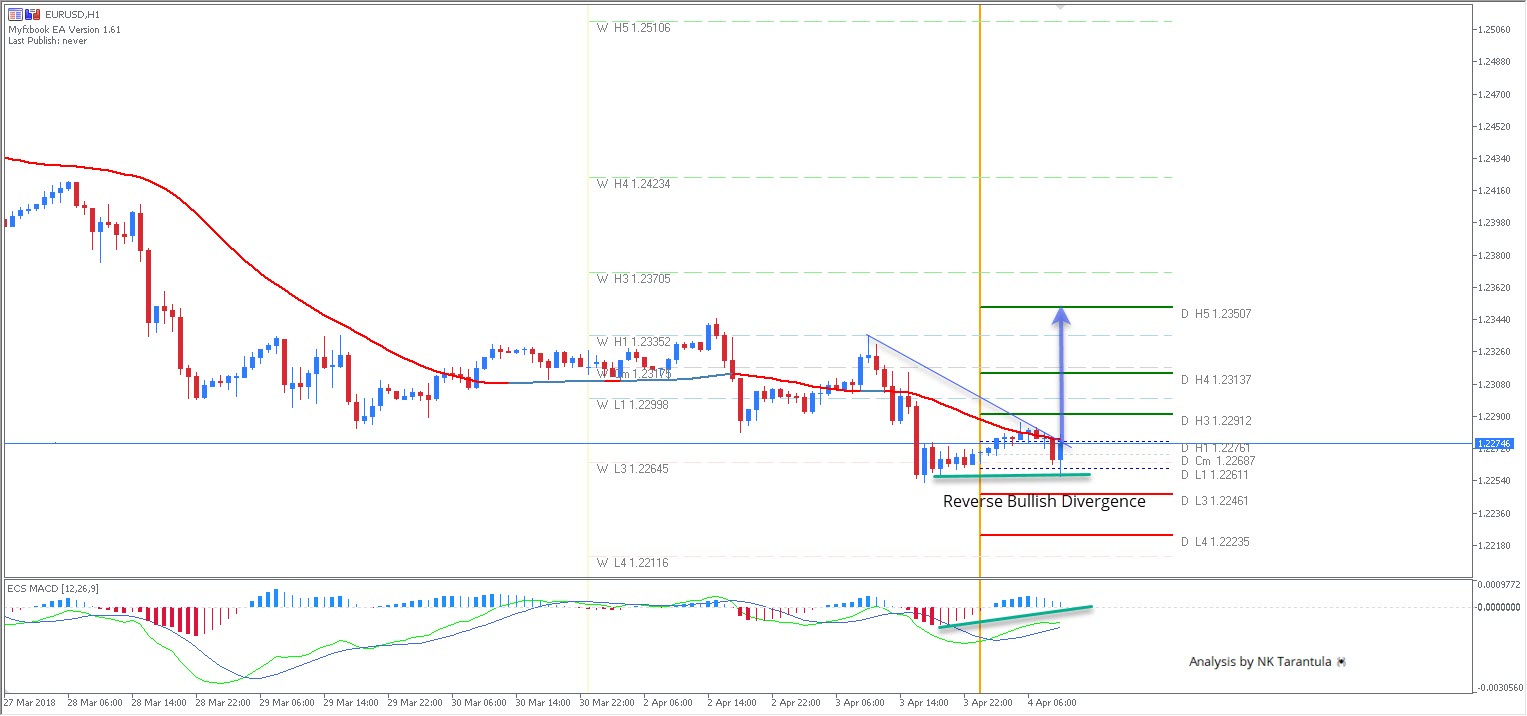

Source: Admiral Markets MT5 with MT5SE Add-on

The EUR/USD has formed a reverse bullish divergence exactly at W L3 Pivot point. Reverse or exaggerated bullish divergence is the type 3 divergence. The price is double bottom-ish while the oscillator makes a higher low. The EUR/USD price might bounce from 1.2255-65 and go straight up. If the 1h candle closes above the blue trend line and above EMA89 we might see 1.2291, 1.2213 and 1.2350. Ideally, for a bullish scenario to work out, the EUR/USD should be kept above W L3

W L3 – Weekly Camarilla Pivot (Weekly Interim Support)

W H3 – Weekly Camarilla Pivot (Weekly Interim Resistance)

W H4 – Weekly Camarilla Pivot (Strong Weekly Resistance)

D H4 – Daily Camarilla Pivot (Very Strong Daily Resistance)

D L3 – Daily Camarilla Pivot (Daily Support)

D L4 – Daily H4 Camarilla (Very Strong Daily Support)

POC – Point Of Confluence (The zone where we expect price to react aka entry zone).

Leave A Comment