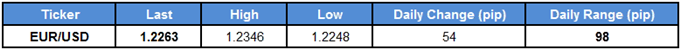

EUR/USD slips to fresh weekly lows following the semi-annual testimony with Fed Chairman Jerome Powell, and fresh developments coming out of the euro-area may spark a further decline in the exchange rate as the core rate of inflation is expected to slow to an annualized 1.2% from 1.3% in January.

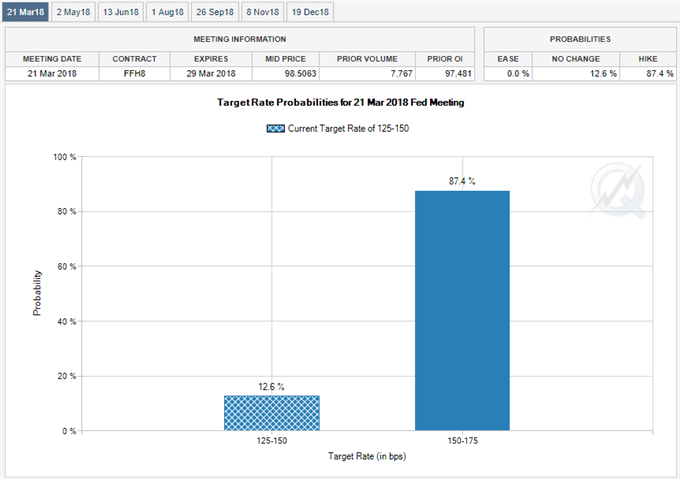

It seems as though the Federal Open Market Committee (FOMC) is on course to deliver three rate-hikes in 2018 as Chairman Powell notes that ‘further gradual increases in the federal funds rate will best promote attainment of both of our objectives,’ and the hawkish rhetoric may keep the dollar afloat over the coming days as the central bank is widely expected to deliver a 25bp rate-hike in March.

At the same time, signs of subdued price growth may dampen the appeal of the single-currency as it encourages the European Central Bank (ECB) to further expand its balance sheet, and President Mario Draghi and Co. may stick to the sidelines at the next meeting on March 8 as inflation continues to run below the central bank’s target.

However, recent comments from Bundesbank President Jens Weidmann suggests the Governing Council will continue to alter the monetary policy outlook over the coming months, which would include‘a bit more specificity with respect to the interest-rate guidance,’ and the broader shift in EUR/USD man continue to unfold in 2018 as the ECB appears to be on track to conclude its quantitative easing (QE) program in September.

Nevertheless, recent price action raises the risk for a further decline in EUR/USD as it snaps the narrow range from earlier this week, with the pair at risk for a more meaningful correction especially as the Relative Strength Index (RSI) fails to preserve the bullish formation carried over from the previous year.

EUR/USD Daily Chart

Leave A Comment