The EUR/USD outlook is mildly bullish on Tuesday morning, setting a positive tone ahead of the highly anticipated US inflation report. Adding fuel to the euro’s momentum, Peter Kazimir, Chief of Slovakia’s Central Bank, said the ECB should hold off on rate cuts until they have enough economic data. PixabayThe US inflation report will give more clues on when the Fed might start cutting interest rates. Economists expect a monthly increase of 0.3% in US consumer inflation. However, the focus will be whether the report will beat or miss forecasts. A higher-than-expected reading could mean more delays on Fed rate cuts. Consequently, the dollar would rise, pushing EUR/USD lower. Meanwhile, a lower-than-expected reading would increase rate-cut bets, pressuring the dollar and boosting EUR/USD. Currently, traders are more convinced that the Fed will cut rates in June. This confidence came after Powell’s dovish testimony. Notably, he said there was progress on inflation, making a rate cut more likely.Additionally, data on Friday revealed a softer labor market, with the unemployment rate higher than expected. This will allow the Fed to start lowering interest rates in the second half of the year.Meanwhile, inflation is declining in the Eurozone, and the ECB is gaining confidence in the progress. As a result, markets expect the first cut in June. On Monday, Peter Kazimir noted that the ECB had done a lot to lower inflation. However, he emphasised the need for patience before cutting rates. EUR/USD key events today

PixabayThe US inflation report will give more clues on when the Fed might start cutting interest rates. Economists expect a monthly increase of 0.3% in US consumer inflation. However, the focus will be whether the report will beat or miss forecasts. A higher-than-expected reading could mean more delays on Fed rate cuts. Consequently, the dollar would rise, pushing EUR/USD lower. Meanwhile, a lower-than-expected reading would increase rate-cut bets, pressuring the dollar and boosting EUR/USD. Currently, traders are more convinced that the Fed will cut rates in June. This confidence came after Powell’s dovish testimony. Notably, he said there was progress on inflation, making a rate cut more likely.Additionally, data on Friday revealed a softer labor market, with the unemployment rate higher than expected. This will allow the Fed to start lowering interest rates in the second half of the year.Meanwhile, inflation is declining in the Eurozone, and the ECB is gaining confidence in the progress. As a result, markets expect the first cut in June. On Monday, Peter Kazimir noted that the ECB had done a lot to lower inflation. However, he emphasised the need for patience before cutting rates. EUR/USD key events today

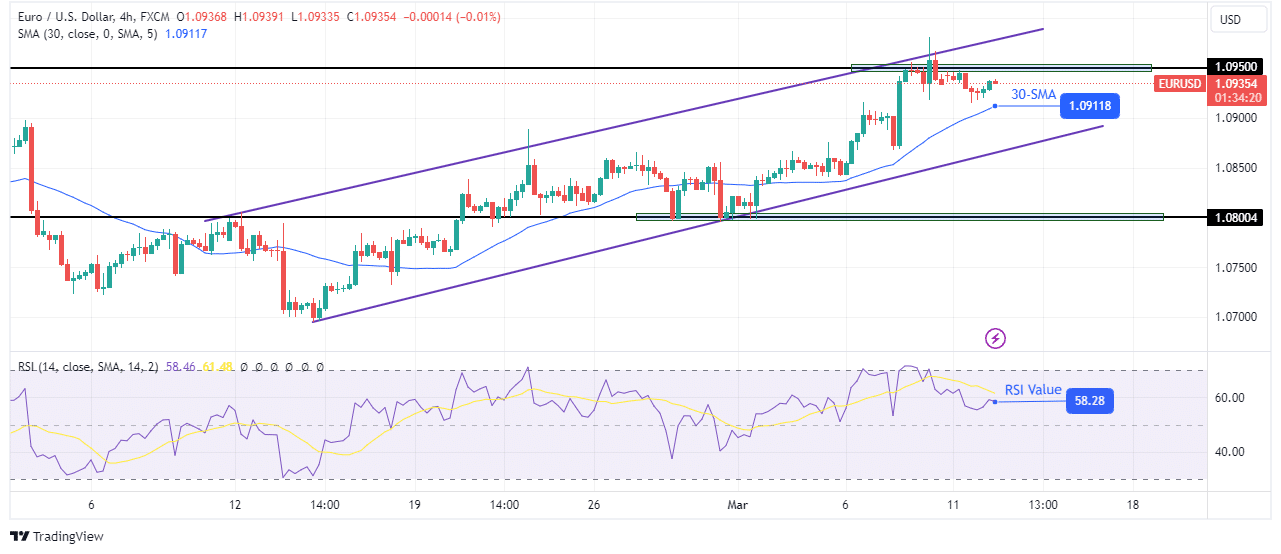

EUR/USD technical outlook: Bulls stalled by 1.0950 EUR/USD 4-hour chartOn the technical side, the bias for EUR/USD is bullish as the price trades above the 30-SMA, and the RSI is above 50 in bullish territory. At the same time, the price is trading in a bullish channel. It bounces higher each time it hits the channel support. However, the bullish move has paused after reaching the channel resistance and the 1.0950 key level. If this resistance zone holds firm, the price will likely fall to retest the channel support before the uptrend continues. However, the price will continue to rise if it breaks above 1.0950.More By This Author:GBP/USD Price Corrects Gains After Mixed US NFP DataUSD/CAD Outlook: Markets Assess Canada’s Upbeat Jobs ReportEUR/USD Outlook: Dollar Declines As US Jobs Data Looms

EUR/USD 4-hour chartOn the technical side, the bias for EUR/USD is bullish as the price trades above the 30-SMA, and the RSI is above 50 in bullish territory. At the same time, the price is trading in a bullish channel. It bounces higher each time it hits the channel support. However, the bullish move has paused after reaching the channel resistance and the 1.0950 key level. If this resistance zone holds firm, the price will likely fall to retest the channel support before the uptrend continues. However, the price will continue to rise if it breaks above 1.0950.More By This Author:GBP/USD Price Corrects Gains After Mixed US NFP DataUSD/CAD Outlook: Markets Assess Canada’s Upbeat Jobs ReportEUR/USD Outlook: Dollar Declines As US Jobs Data Looms

Leave A Comment