|

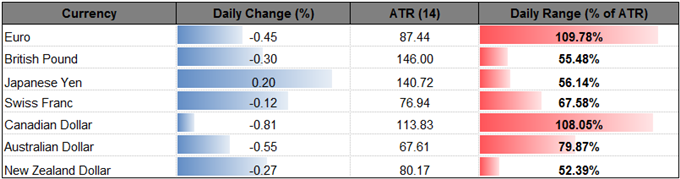

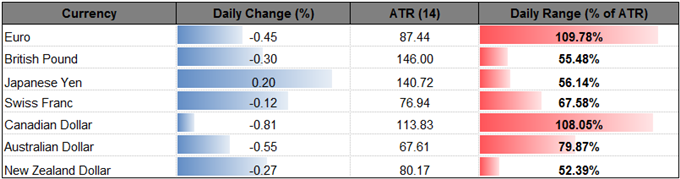

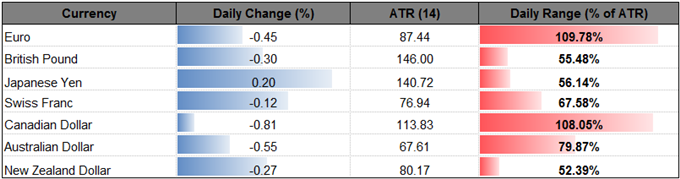

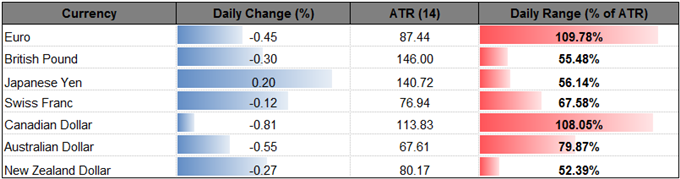

Currency

|

Last

|

High

|

Low

|

Daily Change (pip)

|

Daily Range (pip)

|

|

USD/JPY

|

112.38

|

112.78

|

111.99

|

6

|

79

|

USD/JPY Daily

Chart – Created Using Trading View

The Japanese Yen outperforms against its major counterparts as risk sentiment wanes, with a closing price below the Fibonacci overlap around 112.40 (61.8% retracement) to 112.50 (38.2% retracement) raising the risk for a further decline in the exchange rate especially as the Relative Strength Index (RSI) preserves the bearish trend carried over from December; nevertheless, the dollar-yen may hold channel support as the pair continues to operate within a broader bull-flag formation, and the longer-term outlook for USD/JPY remains constructive as Fed Fund Futures highlight a greater than 60% probability for a June rate-hike.

However, the greenback remains at risk of facing near-term headwinds as market participants scale back bets for a March rate-hike following the Federal Open Market Committee’s (FOMC) first interest rate decision for 2017, and risk sentiment may continue to influence the exchange rate over the remainder of the month as Chair Janet Yellen and Co. appear to be in no rush to implement higher borrowing-costs; may see Fed officials try to buy more time at the next rate decision on March 15 as the central bank argues ‘market-based measures of inflation compensation remain low; most survey-based measures of longer-term inflation expectations are little changed, on balance.’

After making numerous failed attempts to break below 112.40 (61.8% retracement) to 112.50 (38.2% retracement), a closing price below the Fibonacci overlap may open up the next downside target around 111.60 (38.2% retracement) followed by 110.20 (50% retracement).

|

Currency

|

Last

|

High

|

Low

|

Daily Change (pip)

|

Daily Range (pip)

|

|

EUR/USD

|

1.0734

|

1.0802

|

1.0706

|

49

|

96

|

Leave A Comment