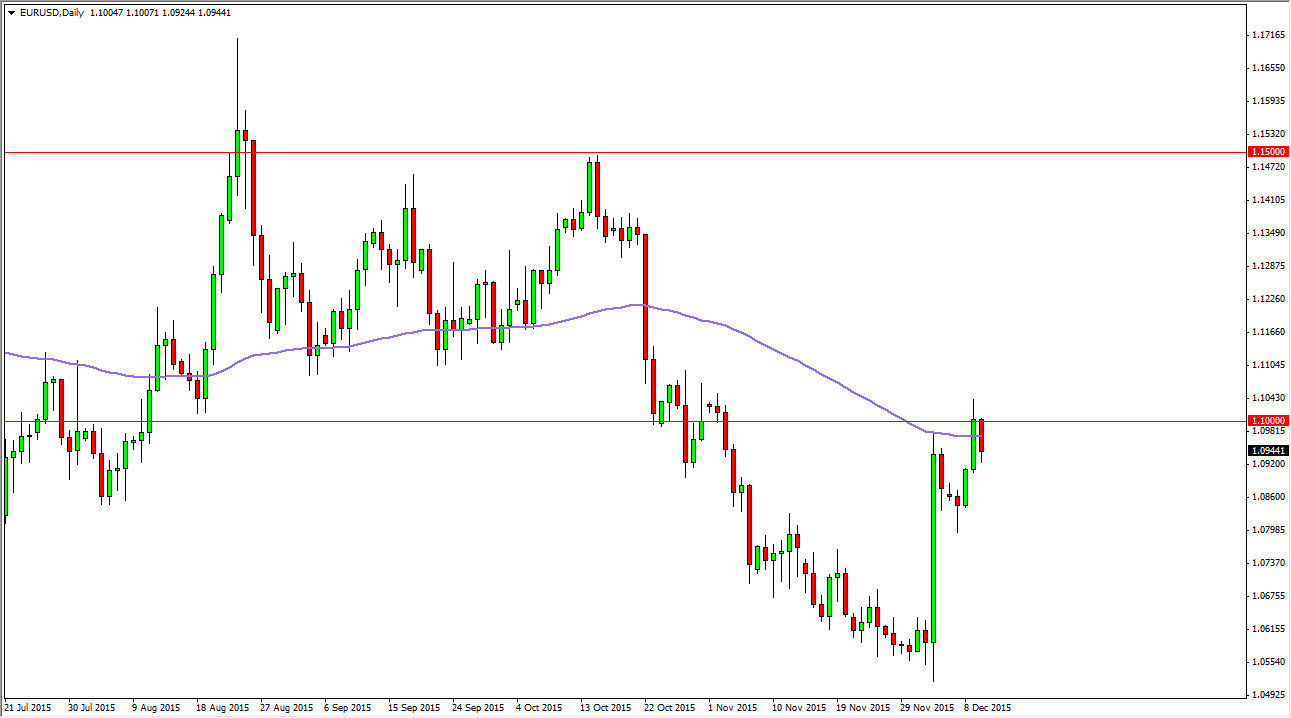

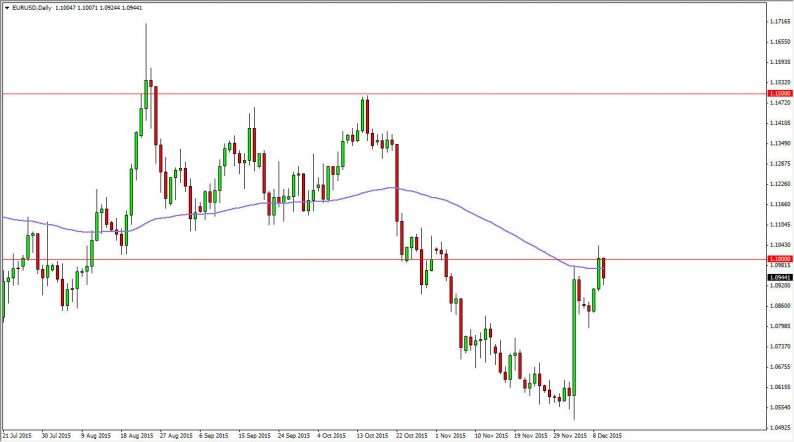

The EUR/USD pair fell during the course of the session on Thursday, as we reached towards the 1.10 level. Because of this, I feel that we might have a little bit of a pullback coming. On top of that, you can see that I have a purple line on the chart that represents the 100 day exponential moving average which of course longer-term traders tend to pay quite a bit of attention to. I think at this point in time, a pullback makes sense, but we also have a massive amount of support below in the form of the hammer from Monday. That suggests to me that the 1.08 level below is going to be the bottom of the consolidation area is still, while the 1.10 level above is the top.

Adding more confusion is the fact that we have quite a bit of noise above the 1.10 level, and extending to the 1.11 level. It is because of this I feel it’s probably best to wait until we get above the 1.11 handle in order to start buying. I recognize that short-term traders may continue to bounce around in this market, but you have to be very careful as hanging onto a position for any real length of time could be dangerous.

Volatility

One thing that you can count on in this market is going to be volatility. After all, this is an area that continues to attract quite a bit of noise. Also, we are entering a time of year which tends to have quite a bit of volatility anyway, due to the fact that liquidity disappears. Because of this, I feel it’s probably best to simply wait into we break out of this little consolidation area before placing any serious trades. However, once we get close to the 1.08 level initial signs of support, a small position to the upside could be taken, just as a small selling opportunity could be taken somewhere near the 1.10 level. But as far as larger positions, I’ll be waiting for an impulsive candle.

Leave A Comment