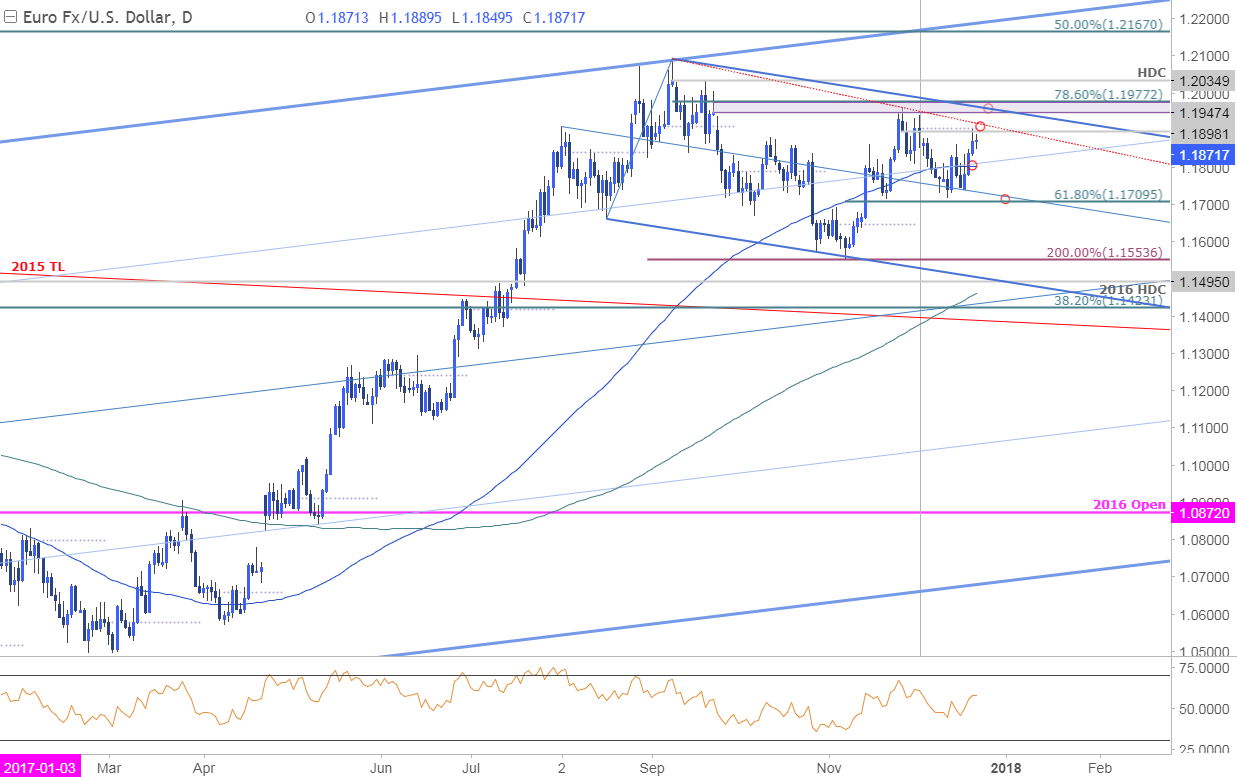

EUR/USD Daily Chart

Technical Outlook: Euro has been trading within the confines of a well-defined descending pitchfork formation extending off the yearly high. Price established the monthly opening range lows along the median-line with the recovery now targeting confluence resistance at 1.1898-1.1903 – a region defined by the monthly open and the November high-day reversal close. A breach above this region targets key topside resistance objectives at 1.1947/72 and the high-day close at 1.2035.

Interim support rests at 1.1803/09 where the 100-day moving average converges on the 50-line of the broader ascending pitchfork formation highlighted in my Weekly Technical Perspective. Broader bullish invalidation rests at 1.1709– keep in mind this level also defines the objective monthly opening-range lows and if broken would suggest a larger correction is underway.

EUR/USD 240min Chart

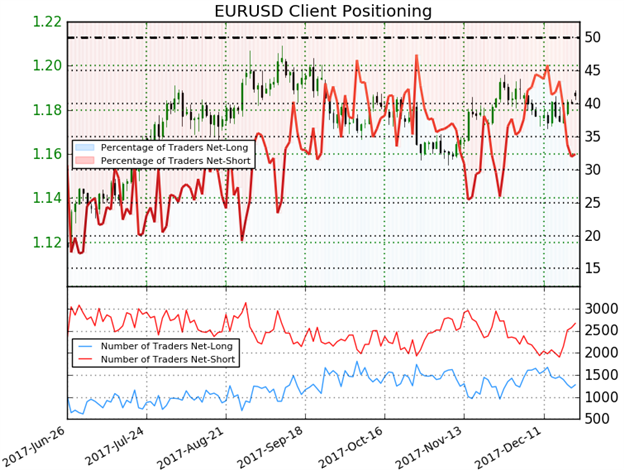

Notes: A closer look at price action sees the pair trading within the confines of an embedded descending median-line formation extending off the November highs with the advance reversing off the upper parallel yesterday in U.S. trade. Note that the pair has carved out a well-defined monthly opening-range just below resistance at 1.1947/65– and a breach above this threshold is needed to mark resumption of the broader uptrend.

Bottom line: could get some kickback from this level but the focus remains higher while above 1.18 with a breakout of this near-term formation needed to suggest a more significant low is in place. A break sub-1.1741 would shift the focus back towards the monthly lows and key support ~1.17.

Leave A Comment