The US dollar is strengthening in the past week, partially on higher expectations for a rate hike. Is there room for further greenback advance against the euro?

Here is their view, courtesy of eFXnews:

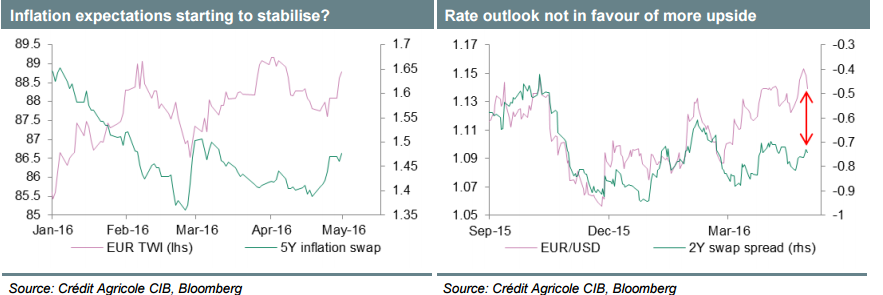

The EUR has been broadly range-bound as of late. It appears that limited room of changing monetary policy expectations leaves the currency driven by external factors.

Even if additional policy measures cannot be excluded the Eurozone recovery is expected to remain on track. It must be noted too that medium-term inflation expectations appear to have stabilized, irrespective of the more supported single currency. Nevertheless, in order to make a case of rising rate expectations, which would be needed to trigger fresh demand, considerably stronger growth and price prospects may be needed.

When it comes to EUR/USD it should remain about the Fed to make a case of diverging monetary policy expectations to the detriment of the pair. We are still of the view that the Fed will tighten monetary policy in June, a view that is currently not priced in.

Leave A Comment