The worst performing currency today was the euro, which dropped well below 1.20. The single currency had been under pressure throughout the NY trading session and ended the day near its lows. This suggests that we could see a deeper slide down to 1.19.

The sell-off was driven by the recovery in the U.S. dollar and the slide in German yields. Data was mixed with the decline in German factory orders offset by a pick in Eurozone retail sales and confidence. These reports tell us that while the recent improvements in the economy have boosted confidence, the momentum is beginning to slow as the gains in the euro pose a risk to growth. Looking ahead, we anticipate additional near term losses for the euro and the scope of the move will hinge on tomorrow’s German industrial production and trade balance reports. Economists are looking for stronger numbers all around given the improvement in the manufacturing PMI index but the drop in factory orders raises the risk of a downside surprise.

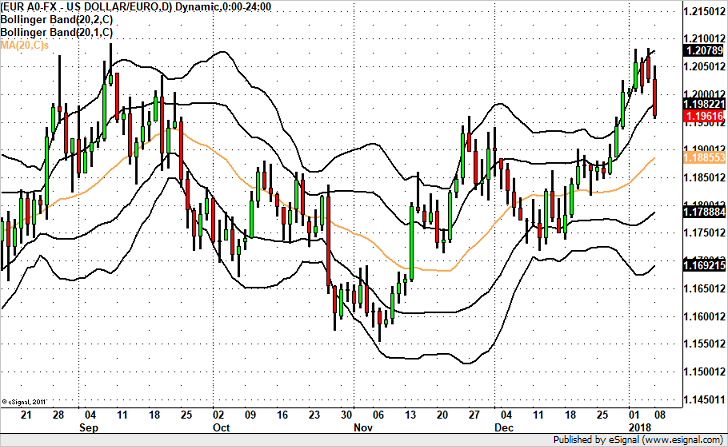

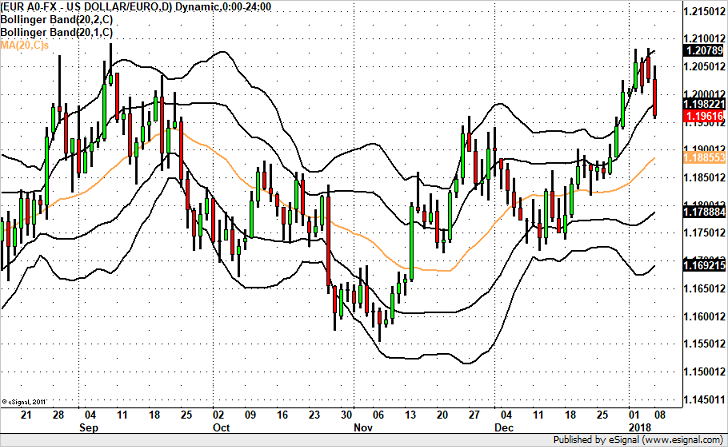

Technically, EUR/USD has fallen below the first standard deviation Bollinger Band. This puts the pair on course to test the 20-day SMA at 1.1885 but the round number (1.19) should be natural support.

Leave A Comment