– U.S. Durable Goods Orders to Contract for First Time in Three-Months.

– Non-Defense Capital Goods Orders ex Aircrafts to Decline for Fourth Time in Last Eight Months.

Trading the News: U.S. Durable Goods Orders

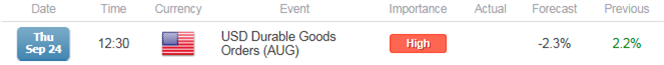

A 2.3% decline in demand for U.S. Durable Goods accompanied by a weakening outlook for business investments may produce near-term headwinds for the greenback as it fuels speculation for a further delay in the Fed liftoff.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

The Federal Open Market Committee (FOMC) may continue to endorse a wait-and-see approach at the October 28 interest rate decision as the central bank adopts a more cautious outlook for the region, and signs of a slower recovery may encourage Chair Janet Yellen to preserve the zero-interest rate policy (ZIRP) throughout 2015 in an effort to further insulate the real economy.

Expectations: Bearish Argument/Scenario

Release

Expected

Actual

Advance Retail Sales (MoM) (AUG)

0.3%

0.2%

U. of Michigan Confidence (SEP P)

91.1

85.7

Wholesale Trade Sales (MoM) (JUL)

0.1%

-0.3%

Waning confidence accompanied by the ongoing weakness in private-sector consumption may drag on orders for large-ticket items, and a dismal development may put increased pressure on the Fed to further delay the normalization cycle especially as the central bank scales back its outlook for growth and inflation.

Risk: Bullish Argument/Scenario

Release

Expected

Actual

Building Permits (MoM) (AUG)

2.5%

3.5%

ISM Non-Manufacturing (AUG)

58.2

59.0

Personal Spending (JUN)

0.2%

0.2%

Leave A Comment