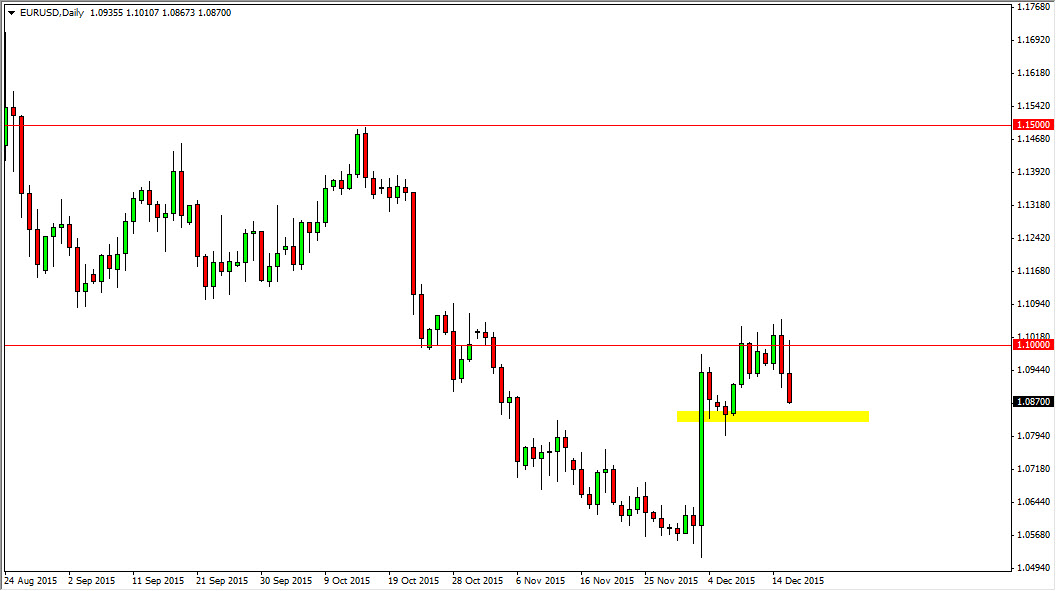

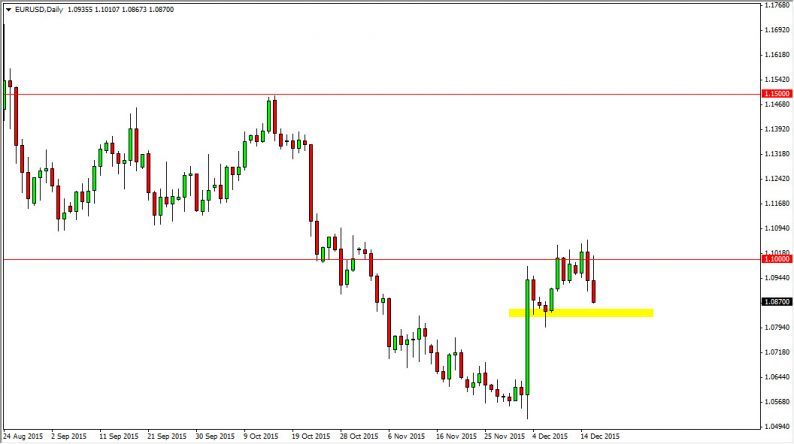

During the session on Wednesday, the EUR/USD pair initially tried to rally but found more than enough resistance of the 1.10 level to turn things around and fall. That being said, we are still within the previous consolidation area, which have the buyers entering the market at the 1.08 level, and the sellers enter the market at the 1.11 handle. Because of this, the market looks as if it is still stuck in this area, but if we can break down below the 1.08 level I would be more than willing to start selling. Until then, I believe that we are just simply going to bounce around in short-term trading opportunities as we have over the last couple of weeks.

Even though there was an interest-rate hike during the session on Wednesday, there wasn’t necessarily a massive reaction that we have seen in the chart. Yes, we have fallen a little bit in favor the US dollar, but quite frankly we are still well within the tolerances of what I would consider to be a relatively normal day, albeit negative.

Waiting for Impulsivity

I need to see some type of impulsive candle in order to get involved in this market, and will not be trading the short-term back and forth type of action that we see right now. If you are a short-term scalper, you may find this market to your liking, but ultimately I feel that it’s only a matter of time before we get an impulsive candle either to the upside or the downside, which could be a nice buying or selling opportunity.

At this point in time, I believe that this market still has to be looked at from the short-term perspective, but I am always aware the fact that there are bigger forces at play. Right now, I still believe in the downside in general, but recognize that any type of significant trade is probably a little while away.

Leave A Comment