EUR/USD intra-day analysis

EUR/USD (1.0646): EUR/USD is likely to resume the downside following the past few days of consolidating below 1.0700 price level which is likely to turn into resistance in the near term. The bias to the downside will see EUR/USD testing the previous support near 1.0600 which could see a further extension to the downside towards 1.0550. However, a test of support near 1.0600 will mean an upside bounce in prices. The untested resistance level near 1.0800 could, therefore, be the upside target, following the initial test of resistance of 1.0700.

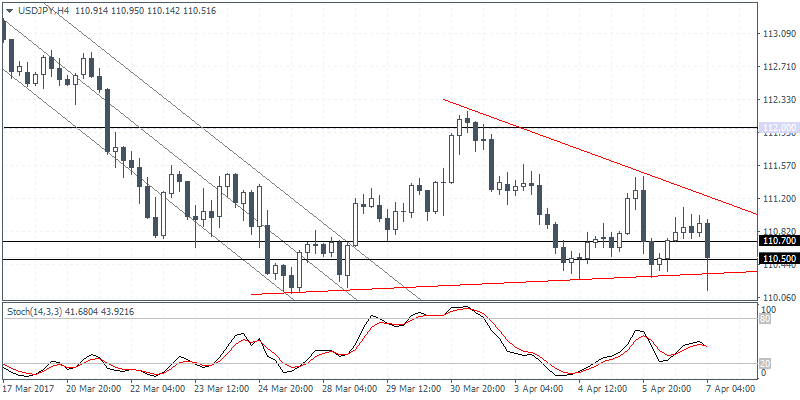

USD/JPY intra-day analysis

USD/JPY (110.51): USD/JPY continues to consolidate near the 110.70 – 110.50 levels and this strong consolidation indicating a potential breakout in the near term. To the upside, a break down below the support level will signal a downside move towards 110.00, but the bias is to the upside, where a breakout from the falling trend line will signal a move towards 112.00.

Price action is also showing the consolidating shaping up within the triangle pattern. Thus, as prices continue to test the support level at 110.50 – 110.70, the bias is to the upside suggesting a breakout towards 112.00 initially followed by a test of resistance at 114.00

XAU/USD intra-day analysis

XAU/USD (1263.06): Gold prices rallied in today’s session posting an intraday high of 1269.38 after price broke past the resistance at 1257.60. The gains came as investors rush to safety as the U.S. air strikes on Syria is likely to stoke tensions.

We can expect to see further upside continuation in prices as a result following the bullish upside breakout from the ascending triangle. Any pullbacks in gold could be tested near 1257.60 which could turn to support while to the upside, the minimum target is towards 1274.00 – 1275.00 levels.

The bullish outlook would be invalidated only on a firm close below 1257.60, in which case we can anticipate strong declines towards 1250.00 support initially.

Leave A Comment