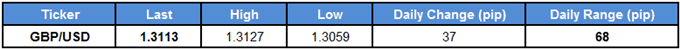

The British Pound pares the sharp decline following the dovish Bank of England (BoE) rate-hike, with GBP/USD at risk of staging a near-term advance following the failed attempt to test the October-low (1.3027).

The BoE appears to be in no rush to further normalize monetary policy after raising the benchmark interest rate for the first time since 2006, and Governor Mark Carney and Co. may endorse a wait-and-see approach at the next meeting on December 13 as officials warn the ‘uncertainties associated with Brexit are weighing on domestic activity, which has slowed even as global growth has risen significantly.’ Limited bets for higher borrowing-costs may undermine the resilience in GBP/USD, with the pound-dollar exchange rate at risk of facing a more bearish fate especially as the Federal Open Market Committee (FOMC) is widely anticipated to developer a 25bp in December.

Nevertheless, a pickup U.K. Manufacturing & Industrial Production may boost the appeal of Sterling as it instills an improved outlook for the real economy, and the Monetary Policy Committee (MPC) may adopt a more hawkish tone over the coming months as‘spare capacity appeared to have eroded, if anything, a little more rapidly than the Committee had anticipated in its August projections.’ With that said, the monthly opening range remains in focus for GBP/USD, with the pair at risk of trading on a firmer footing as both price and the Relative Strength Index (RSI) break out of the bearish trends carried over from September.

GBP/USD Daily Chart

Leave A Comment